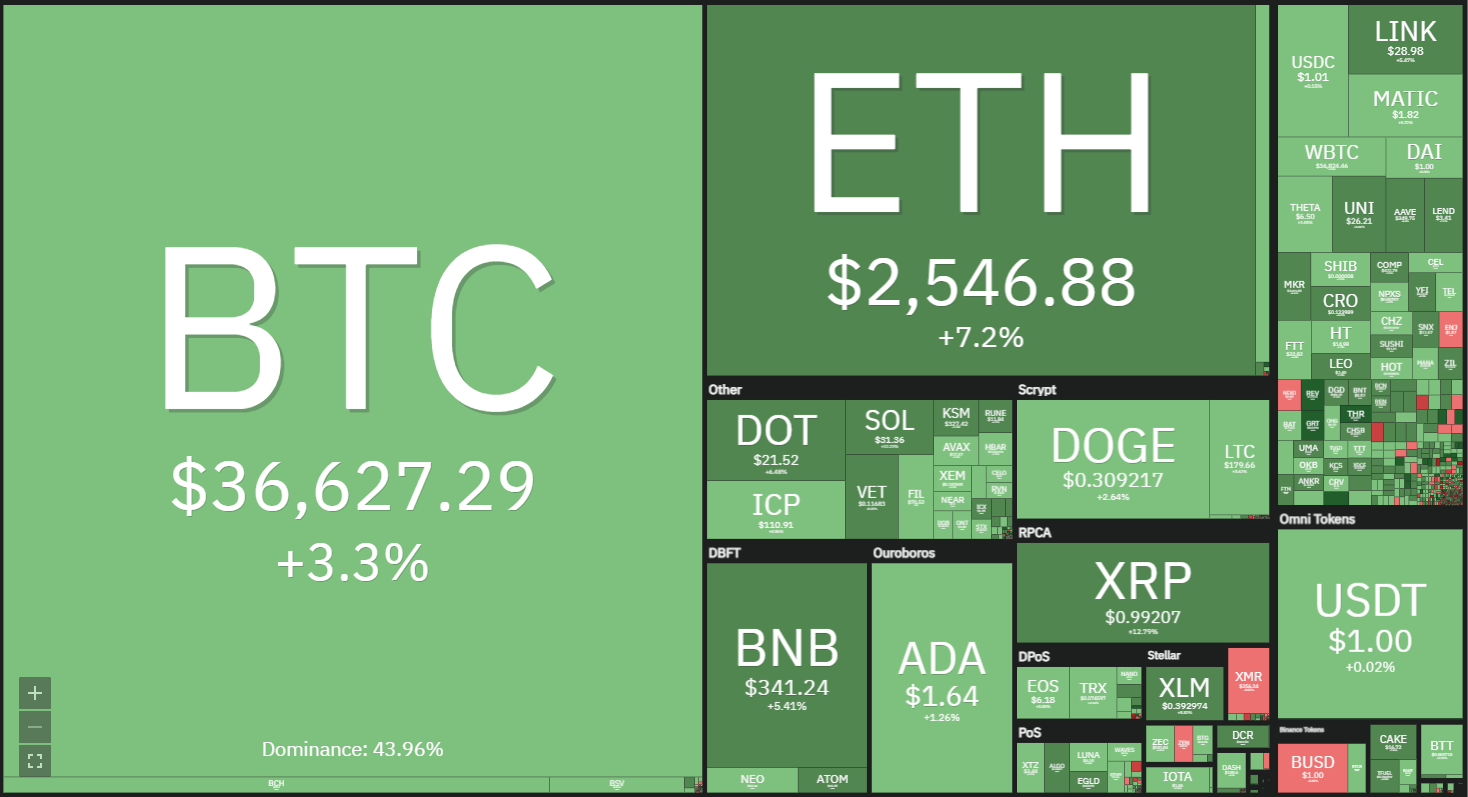

Bitcoin’s (BTC) massive drop in May 2021 is among its worst yearly performances, according to data in Bybt. The reduction has divided into crypto community, with long-term investors considering that the fall as a buying opportunity while short term dealers are ditching their positions out of fear.

Glassnode data indicates that long-term HODLers and miners are using the present weakness to collect BTC. This transfer of BTC from weaker hands to stronger hands is a positive sign because long-term investors will probably not panic and dump their holdings on every bear market correction.

In April, the U.S. personal consumption expenditures price index soared by 3.1% compared to a year before, the biggest rise over 12 months since July 1992. Several institutional investors may utilize the present correction to include BTC to their portfolios as it is an uncorrelated advantage and several consider it as a good hedge against inflation.

Therefore, a sharp plunge under $30,000 looks unlikely. But, that doesn’t indicate a brand new bull market will start in a rush. The cost is very likely to remain volatile and range-bound before the beginning of a sustained uptrend.

Let us analyze the charts of this top-10 cryptocurrencies to spot the critical support and resistance levels.

BTC/USDT

BTC is in a downtrend. Even the downsloping moving averages and also the relative strength index in negative territory suggest the bears have the upper hand. On the other hand, the bulls have other programs since they are trying to start a relief rally.

Resource: TradingView

If the bulls push and maintain the price above the resistance line of the triangle, the pair could start a transfer to the 50% Fibonacci retracement level at $44,750 then to the 50-day simple moving average ($50,161). Such a move will imply that the downtrend could be finished.

Contrary to the assumption, in case the price turns down in the resistance line of the triangle, the pair could extend its stay within the triangle to get a couple more days. A breakdown and close below the support line of the triangle will signify that the resumption of the downtrend.

The bears may then pull the price down to $30,000 and when this level cracks, the selling may intensify and the pair may drop to $28,000 after which $20,000.

ETH/USDT

Ether (ETH) has rebounded sharply off the support line of the symmetrical triangle as dealers try to place a greater low. The cost could now challenge the immunity of the triangle in which the bears are very likely to mount a stiff resistance.

ETH/USDT daily graph. Resource: TradingView

If the bulls push the cost above the triangle, the ETH/USDT pair may rally to the 61.8% retracement level at $3,362.72. Such a move will indicate strong purchasing at lower levels. A break above $3,362.72 could indicate an end of the downtrend.

On the other hand, the bears will probably not give up easily. The downsloping 20-day EMA ($2,756) and the RSI just below the midpoint indicate the sellers have a minor benefit.

If the price turns down in the resistance line of the triangle, the bears will try to sink the price under the support line of the triangle. If they succeed, the pair may retest the May 23 panic low at $1,728.74.

BNB/USDT

Binance Coin (BNB) slipped under the $306.61 support on May 29 but the bears could not maintain the selling pressure at lesser levels. The altcoin quickly bounced back above $306.61 on May 30, implying accumulation on drops.

The bulls will now try to push the cost to the 20-day EMA ($400), which will be very likely to function as a rigid resistance. If the price turns down in the 20-day EMA, it will indicate the sentiment remains negative and dealers are available on rallies.

The bears will then try to pull the price down to $211.70. On the contrary, in the event the bulls push the price above the 20-day EMA and the $428 immunity, the BNB/USDT pair may muster to the 50-day SMA ($512).

ADA/USDT

Cardano (ADA) dipped under the 50-day SMA ($1.51) on May 29 but the bears could not capitalize on the breakdown. The altcoin bounced back above the 50-day SMA on May 30, indicating buying at lower levels.

The apartment 20-day EMA ($1.61) and the RSI close to the midpoint indicate a balance between demand and supply.

This equilibrium will tilt in favor of their buyers if they could push and maintain the price above the downtrend line. The ADA/USDT pair could then rally to $1.94 and if this level is triggered, the next stop may be a retest of this all-time high at $2.47.

On the flip side, if the price turns down in the downtrend line, then the bears will once more try to split the $1.33 support. If they succeed, the pair may drop to $1.24 and then $1.

XRP/USDT

The bears pulled XRP under the 0.88 support on May 29 but they could not maintain the reduced levels. The altcoin bounced back above $0.88 on May 30, indicating strong purchasing by the bulls.

Resource: TradingView

If the buyers may propel the price above the 20-day EMA ($1.08), it will imply a short-term bottom has been produced at $0.65. The XRP/USDT pair may then muster to the 50-day SMA ($1.32) and after to the downtrend line.

This optimistic view will invalidate if the cost turns down in the 20-day EMA. If this occurs, the bears will try to pull back the price under $0.80. If they have the capacity to do this, the pair could challenge the 0.65 support.

DOGE/USDT

The volatility in Dogecoin (DOGE) has reduced due to lack of aggressive purchasing or selling by dealers. The moving averages have finished a bearish crossover and the RSI is in the negative territory, suggesting the bears have the upper hand.

Resource: TradingView

If the price turns down in the 20day EMA ($0.36), the bears will try to pull the price under the critical support at $0.21. If they succeed, the DOGE/USDT pair will complete a bearish head and shoulders pattern. The pair could then adjust to $0.10 and then $0.05.

Conversely, if the bulls push the price above the 20-day EMA, the pair may rise to the overhead resistance at $0.47. A breakout of the immunity could result in a rally to $0.59.

DOT/USDT

Polkadot (DOT) is trying to rebound off the support in $17.50. This is a positive sign as it shows that the bulls aren’t waiting for a dip to $15 to buy. The altcoin could rise to the 26.50 level, which is very likely to function as a rigid resistance.

DOT/USDT daily graph. Resource: TradingView

The downsloping moving averages and the RSI under 40 indicate the bears have the upper hand. If the price turns down from $26.50, the DOT/USDT pair may extend its stay within the scope for a couple more days.

The upcoming bullish move could start when the buyers push the price above $26.50. This could result in a rally to $31.28 and then to the 50-day SMA ($33). Alternatively, another leg of this downtrend could start if the bears sink the price under $15.

UNI/USDT

Uniswap (UNI) is in a downtrend but the bulls are working to form a greater low at $21.50. The cost rebounded off this support on May 30 and the bulls will now try to push the price above the 20-day EMA ($28.27) and the overhead resistance at $30.

UNI/USDT daily graph. Resource: TradingView

If they succeed, it will indicate the downtrend may be over in the brief term. The UNI/USDT pair may then rally to the 50-day SMA ($33.94). This degree may behave as rigid resistance but if the bulls may clear the hurdle, the pair may rise to $38.15.

The downsloping 20-day EMA indicates the bears have the upper hand but the RSI above 44 indicates the bulls are making a comeback.

This optimistic view will nullify if the price turns down in the 20-day EMA and fractures under $21.50. Such a transfer could cause a decline to the May 23 low at $13.04.

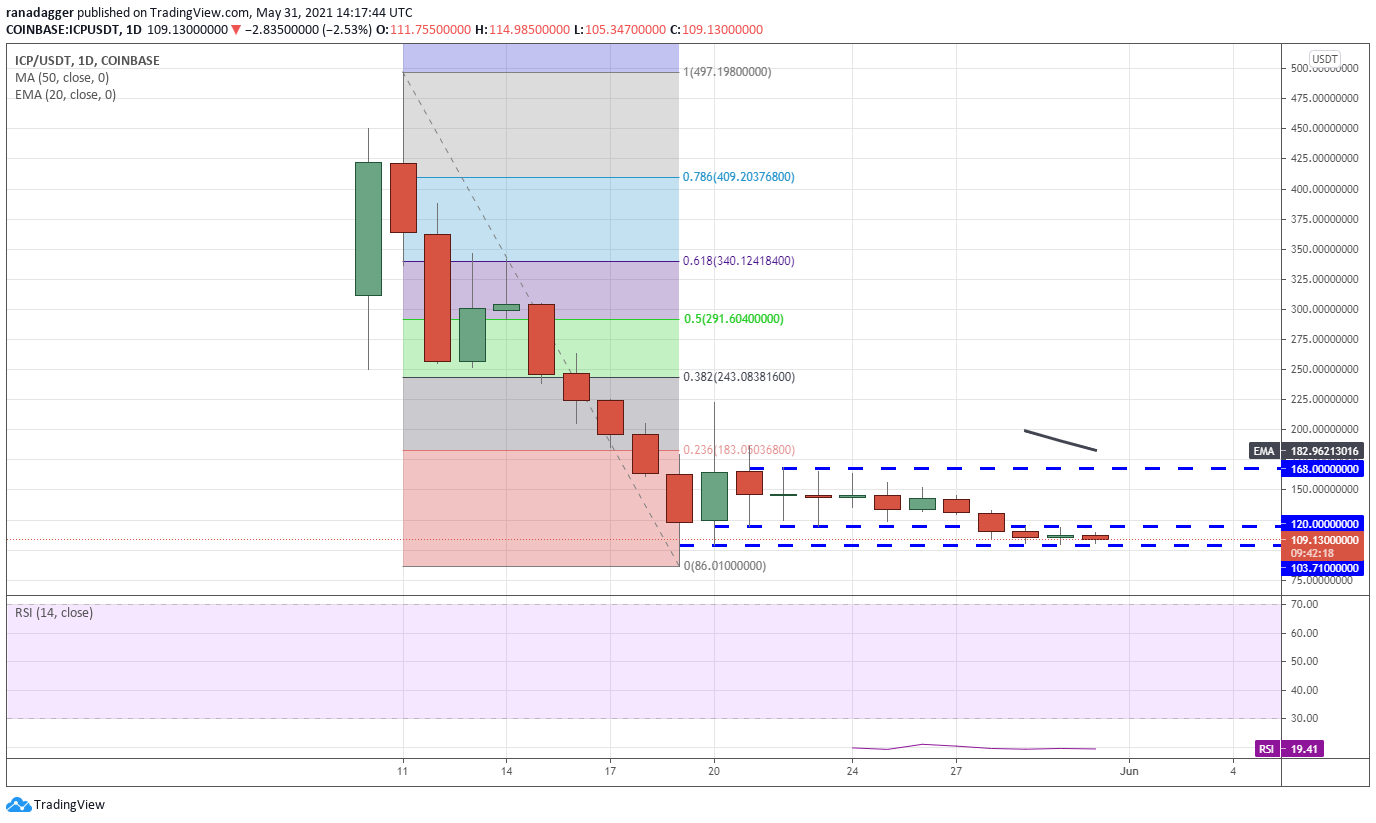

ICP/USDT

Internet Computer (ICP) fell under the $120 to $168 scope on May 28 but the bears have not been able to pull on the cost under the immediate support at $103.71. The price is stuck between $103.71 and $120 for the past three days.

This tight-range trading signals indecision among the bulls and the bears. In case the uncertainty resolves to the downside, the ICP/USDT pair may challenge the May 19 low at $86.01. A break below this support can pull the price down to $60.

On the flip side, if the bulls push and maintain the price above $120, it will indicate a lack of sellers at reduced levels. The pair could then slowly move up to $168. A breakout and close above $168 can start a relief rally which may reach the 38.2% Fibonacci retracement level at $243.08.

BCH/USDT

BTC Cash (BCH) is trying to rise above $685.36. If bulls maintain the price above this overhead resistance, the altcoin could rise to the 20-day EMA ($821), which will be very likely to function as a rigid resistance.

Resource: TradingView

If the price turns down in the 20-day EMA, it will indicate the sentiment remains negative and dealers are available on every minor rally. If the bears sink the price under $600, then the BCH/USDT pair may fall to $468.13.

On the contrary, in the event the bulls push the price above the 20-day EMA, it will imply that demand exceeds supply. That could start a rally to the 38.2% Fibonacci retracement level at $919.60 and then to the 50% retracement level at $1,059.07.

The views and opinions expressed here are solely those of the author and don’t always reflect the views of Cointelegraph. Every single investment and trading movement involves risk. You need to run your own research after making a determination.

Market data is provided by HitBTC exchange.