Bitcoin (BTC) directed the whole cryptocurrency market through a tumultuous period after nearly all the cryptoverse was painted red on May 19, a day now also known as „Black Wednesday.“

The irony of this crash in the price of the flagship cryptocurrency is that the cause for the meltdown was Elon Musk opining over concerns of Bitcoin’s energy intake, and his firm, Tesla, withdrawing its approval of Bitcoin as payment. Cointelegraph discussed more on this with the Market Insights group of OKEx, a cryptocurrency exchange. A spokesperson elaborated on those events, saying they were only triggers to shake an overheated marketplace:

„We had seen significant rallies in altcoins despite BTC facing continued downward pressure, and any hint of pessimism was enough for market participants to start selling their assets in a bid to lock profits or cut losses. The high volatility and sudden price shocks also meant that a lot of leveraged long traders were liquidated, resulting in further losses and a sharper price drop.“

Another element that extended the industry crash was China ramping up the ante against Bitcoin mining and trading actions. The news came as part of a general clampdown on illegal actions around securities in an attempt to sustain the stability of shares, bonds and forex markets from the State Council’s Financial Stability and Development Committee.

One of a number of different altcoins affected, Ether (ETH), the overriding altcoin, took a major hit to its price too. ETH struck an all-time high $4,362 on May 12, but following the market-wide bloodbath, the token’s price fell to a 30-day low of $1,922 on May 23, leading to a 55% price drop. In the rally that followed, the price grew over 35 percent to exchange in the 2,800 range.

Needless to say, both Bitcoin and Ether products dominate the crypto derivatives area because of the sheer prominence of those tokens. While price discovery of an asset is highly determined by the futures market, sudden price movements often result in huge losses to the investors involved.

The crash led to huge liquidations

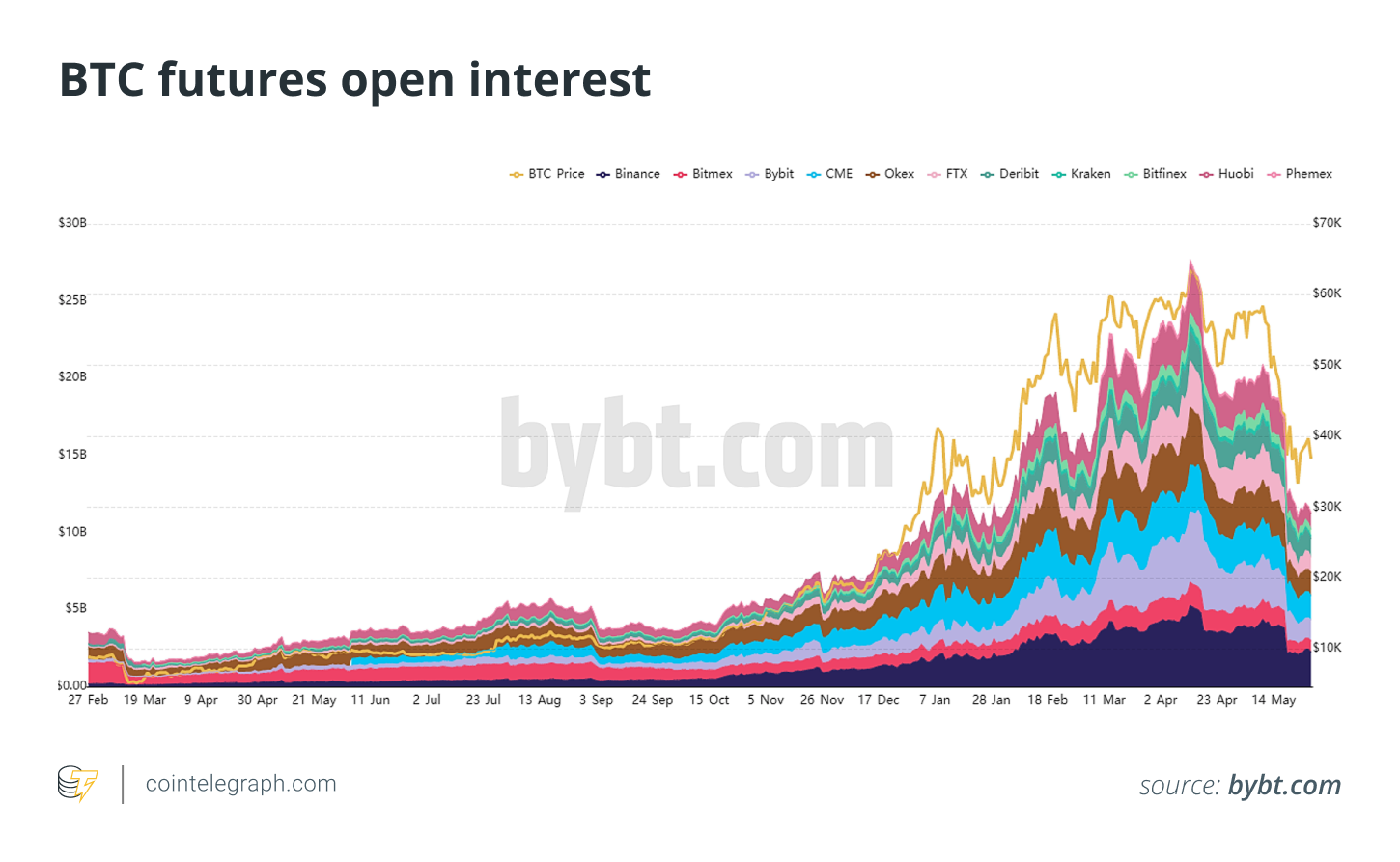

The Bitcoin futures marketplace has seen enormous growth in 2021 and the increase in the spot price. Open interest in exchange-traded BTC stocks reach an all-time high $27.68 billion on April 13.

The OKEx Insights team elaborated,“Approximately $8.61 billion of positions were liquidated across derivatives exchanges on Black Wednesday.“ The spokesperson added,“Currently, no substantial rebound in open curiosity is visible, indicating that the sector is lacking confidence.“

The open interest in the BTC options market also observed a similar drop on May 23. It attained a 90-day low of $6.66 billion, a 55% drop in the all-time high $14.77 billion on March 18.

„„BTC and ETH crashing caused implied volatility levels and thus options premiums to spike hugely. Market manufacturers adjusted their prices since realized vol was greater than suggested vol. Because most large customers use our innovative portfolio margining system, liquidations would typically not occur at such elevated levels, as we’d delta hedge instead.“

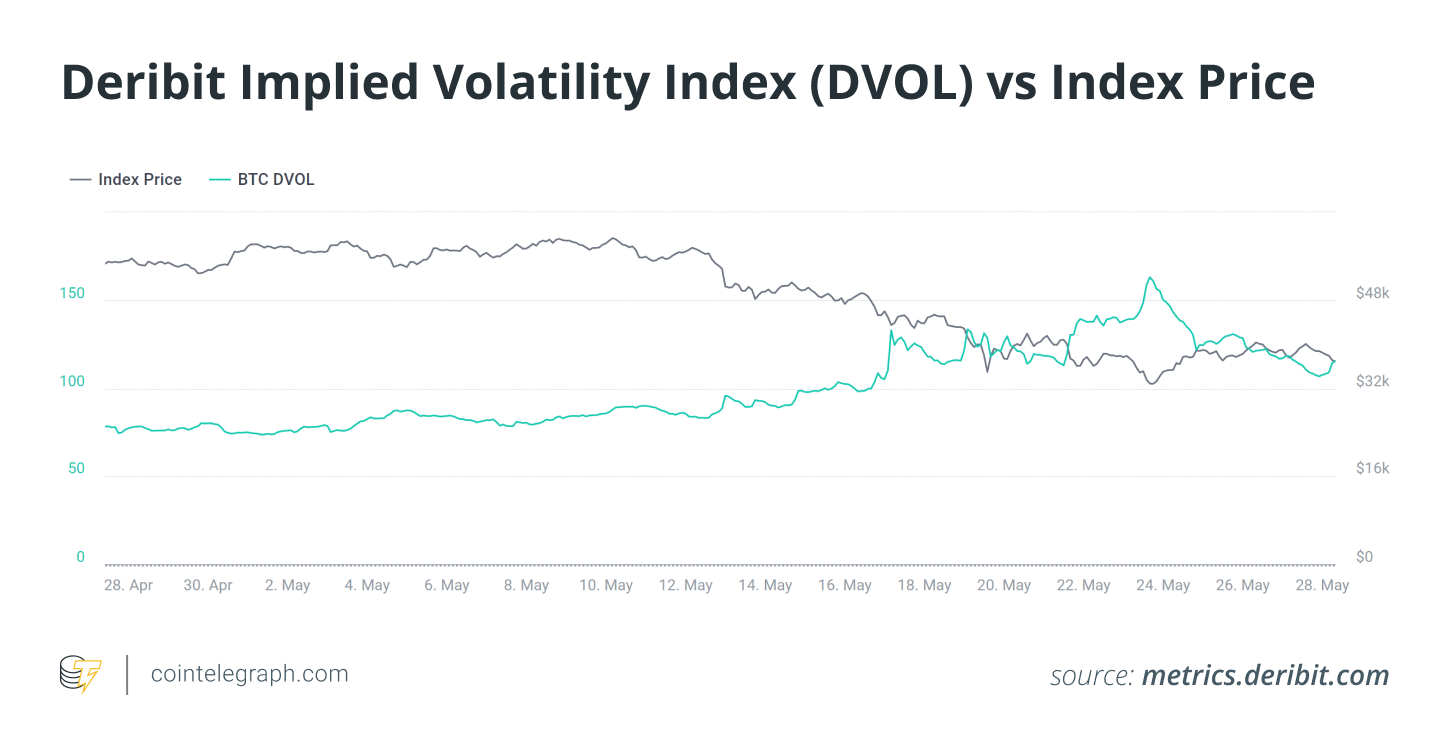

An appearance at the Deribit Implied Volatility Index (DVOL) provides insight into the forward-looking volatility. It gives the 30-day annualized anticipation of volatility. Strijers further afield how DVOL could have been used as a precursor for the markets. He explained,“DVOL would have been a fantastic sign of the turbulence to come. Around midnight on Wednesday preceding the drop, the DVOL started climbing.“

The downward trend of BTC’s price can be tracked back to May 12, when Bitcoin dove below $50,000. The OKEx Insights spokesperson further remarked on this trigger by stating that the tweet by Musk has“struck a great deal of fear into the crypto marketplace,“ including,“The top of quarterly futures dropped from 3.5% to less than 1%. This indicated that the futures market was quite cautious and didn’t anticipate much price appreciation.“

On the flip side, OKEx’s long-short ratio, an indicator of retail opinion for the token, remained very high leading to the sell-off triggered on Black Wednesday. This divergence from the regular trend implies that the price would move in a way unfavorable to retail investors.

Shane Ai, Who’s responsible for product research and development of crypto derivatives in Bybit — a cryptocurrency derivatives trade — explained to Cointelegraph:

„Option markets intensified the sell-off, especially as BTC prices broke below the 45K area and heavy put seller liquidations were seen. This resulted in 1) a massive spike in IV across all durations; and 2) that the whole futures term structure being sold below to amounts at level to or below spot.“

Almost $3 billion options expire on May 28

Ai further spoke on the factor driving this:“The rally was catalyzed by huge spot purchasing pressure — as seen from Coinbase premiums spiking above 7 percent as we headed into U.S. trading hours — amidst funding rates sustaining at negative levels over following intervals.“

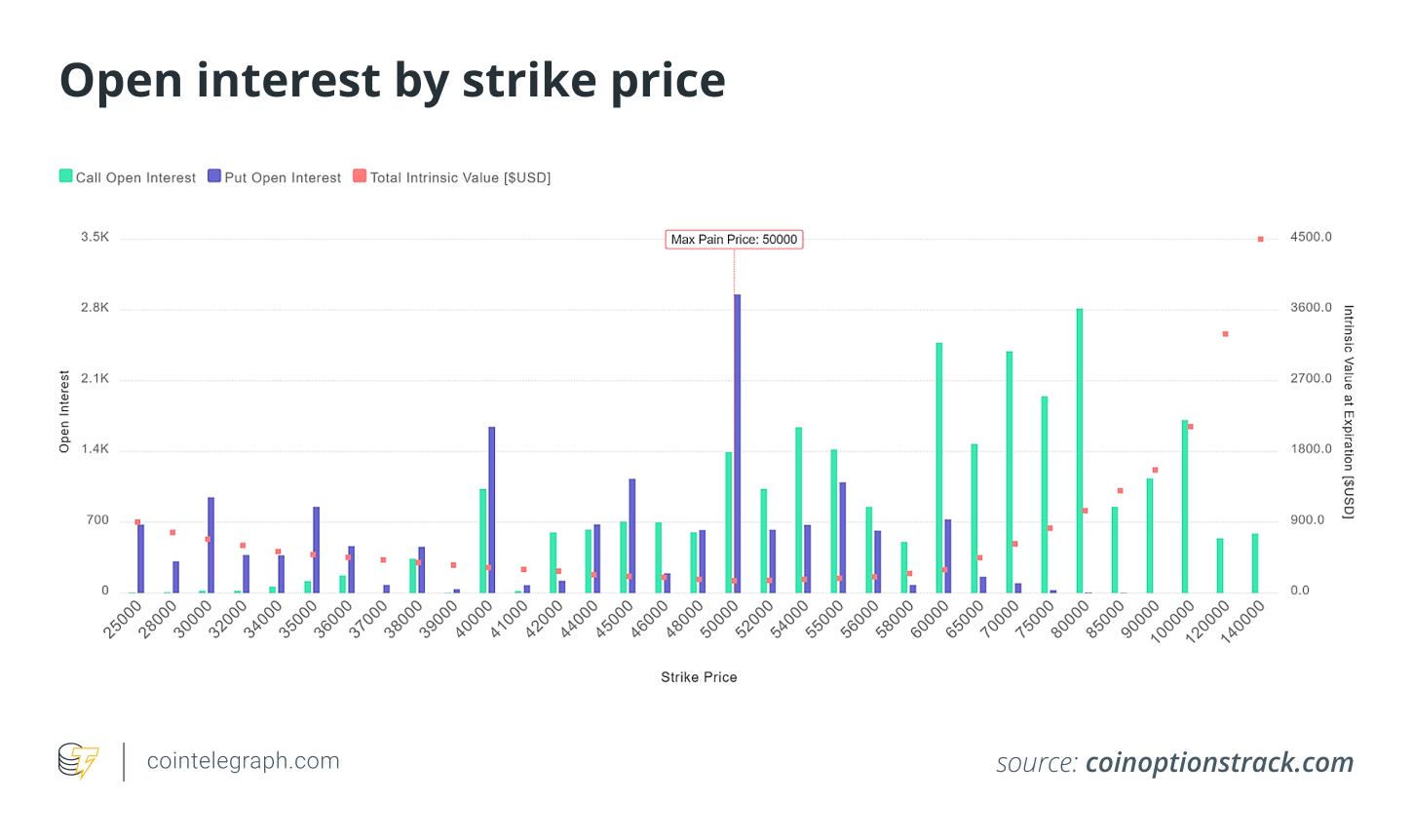

Another event looms large in the end of May, a major options expiry. As almost $3 billion worth of options expire, data indicates that bears dominate this expiry.

According to info from CoinOptionsTrack, the max pain price for the BTC options expiry is $50,000. Max pain price is the price where the largest number of options contracts are at loss. The largest open interest comes from put options with a strike price of $50,000 followed closely by places with a strike price of $40,000. There could be a slight recovery in prices leading up to the expiry, but the current market opinion does not back such a move.

Strijers further mentioned,“A great deal of calls will expire OTM [from The Currency ]; put buyers will probably see that their hedges or insecure puts have brought the protection they were searching for. An interesting level to monitor could be the 40K level with 2K put open interest.“

Since the price of Bitcoin currently hovers around the $40,000 range, it is going to be interesting to see the wake of the expiry and the influence on the price of the asset. Since BTC’s volatility reach a 2021 high recently, there is a possibility that further large movements in price can be anticipated.