Every week, we compile the most relevant news from Mainland China, Taiwan, and Hong Kong to bring you the most essential stories in the sector, including key initiatives, changes in the regulatory landscape, and enterprise blockchain integrations.

The exploits of ThorCHAIN and Chainswap have established that hacking cross-chain bridges appears to be the fashion of the season at this point.

This week, it was a local cryptocurrency project, Poly Network, that was defrauded of $615 million, prompting the crypto community to go on a dramatic witch hunt to search down the perpetrator.

Despite the fact that this subject has been extensively reported by the media, there are a few aspects that deserve to be discussed more.

Who are these projects?

Most western DeFi members were completely unfamiliar with Poly Network, despite the fact that they had amassed over $600 million in total worth locked in their accounts.

Dovey Wan of Primitive Capital covered this on Twitter, noting that the “Chinese crypto community always has their own version to utilize the same blockchain infrastructure, for good and bad, most are unseen and lack accessibility to westerners.” She also noted that the “Chinese crypto community always has their own version to utilize the same blockchain infrastructure, for good and bad, most are unseen and lack accessibility to westerners.”

Only after Poly got hacked most CT came to know this “crosschain” project with over $500m TVL, just as the PlusToken case in 2018

There are a VERY vibrant but completely different “Defi” communities happening in mainland China, despite the ban, despite many rugs and hacks

— Dovey “Rug The Fiat” Wan?? (@DoveyWan) August 11, 2021

So, what is it about Chinese programs that makes them fly so far beneath the radar?

Because of the cultural and language barrier, Chinese marketing teams may find it difficult to adapt into the fast-paced and arcane world of cryptocurrency Twitter.

The company does not spend time trying to win over foreign communities; instead, they concentrate on integrations that can bring users immediately over.

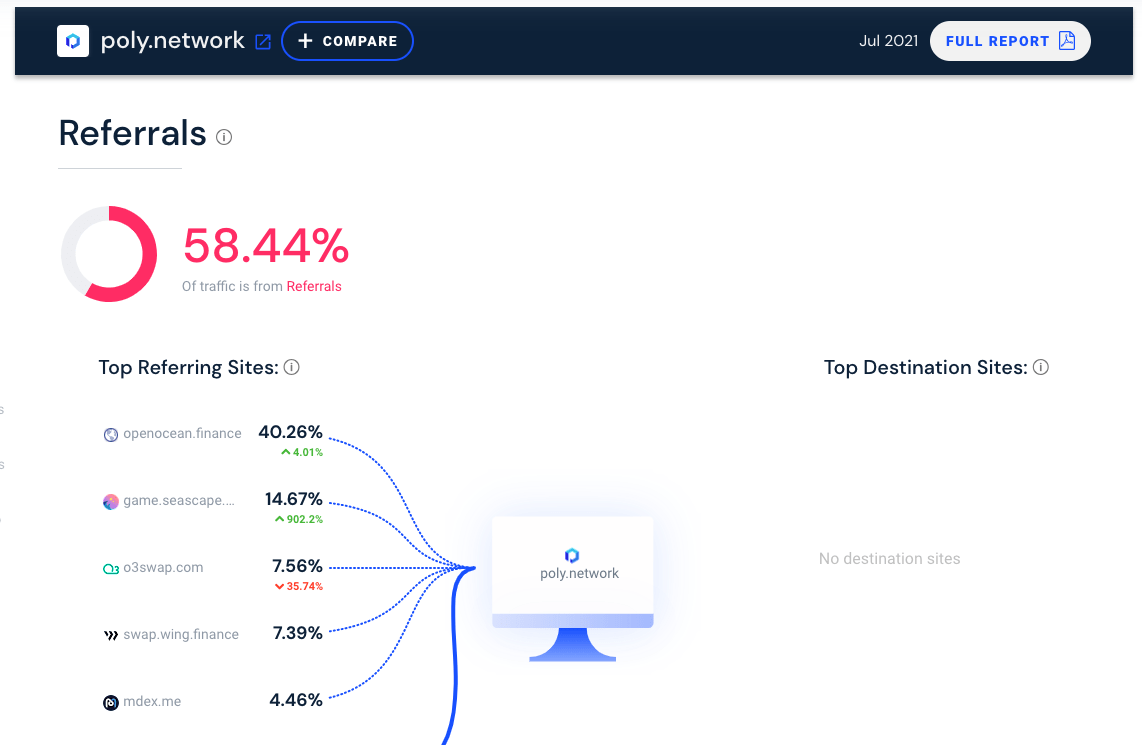

According to SimilarWeb, Poly Network received more than 58 percent of its web traffic from third-party website referrals, with Chinese decentralized applications (DApps) OpenOcean, O3 Swap, and Wing Finance being among the top three sources of referral traffic.

Compound Finance, on the other hand, receives more than half of its traffic from direct hits, with only 16 percent of its traffic originating through third-party websites.

CoinMarketCap and CoinGecko are the two most important websites for referrals for Compound.

This demonstrates that there is a significant difference between the behavior of Chinese and international users, and that in order to reach both groups, two completely different techniques must be implemented.

Untangling the web

Another more taboo talking point is that many of these huge Chinese DeFi initiatives are linked to other projects, which is a common occurrence in the industry.

The Poly Network has linkages to the O3 network, which was incubated by Neo in the first place.

The extent to which Neo is involved is unclear, but it explains why Poly Network founders are rarely seen marketing their company in the public arena.

These so-called „founders“ are frequently only public relations representatives for the parent corporation.

With the creation of a second token, the parent business reaps all of the benefits of doing so without incurring the reputational and legal risks associated with being attached to it.

If the side project is successful, it will be able to provide assistance for the main network.

If it doesn’t work, everyone just goes on with their life as if nothing had occurred.

Because many of their users‘ assets were compromised as a result of the hack, O3Swap is facing a significant public relations crisis.

This isn’t the first time the team has had to deal with negativity; they were previously accused of having a backdoor function inserted into their code that would allow them to pull a rug from under people’s feet.

Despite the fact that this has never been exploited, it raises questions about the intentions of the developers in general.

Following the hack, a deluge of hostility descended on local social media, with remarks calling into doubt the integrity of Chinese-made projects in particular.

According to one person on Weibo, you could beat him to death before he got his hands on a Chinese project, while another user simply asserted that it was an inside job.

Another more taboo talking point is that many of these huge Chinese DeFi initiatives are linked to other projects, which is a common occurrence in the industry.

The Poly Network has linkages to the O3 network, which was incubated by Neo in the first place.

The extent to which Neo is involved is unclear, but it explains why Poly Network founders are rarely seen marketing their company in the public arena.

These so-called „founders“ are frequently only public relations representatives for the parent corporation.

With the creation of a second token, the parent business reaps all of the benefits of doing so without incurring the reputational and legal risks associated with being attached to it.

If the side project is successful, it will be able to provide assistance for the main network.

If it doesn’t work, everyone just goes on with their life as if nothing had occurred.

More importantly, prior to the introduction of DeFi, poor projects would never get off the ground, resulting in a slow and agonizing gentle drop in value for token holders.

Investors in this model may still have a chance to recover a portion of their cash if they sell their securities on secondary markets.

Code can be deployed and hundreds of millions of dollars in TVL can be amassed very quickly under the new paradigm of DeFi forks, and there are no proper risk controls in place.

Audits can be shallow, and exorbitantly high rates can entice ordinary investors to provide liquidity by creating a sense of urgency.

If the code is hacked, all of the assets are forfeited, resulting in a much more immediate and complete loss for the investors involved.

Looking for silver linings

Overall, the Chinese blockchain community responded quickly and collectively, which was a significant plus in this situation.

Slowmist, a smart contract auditor, worked fast with exchanges to minimize the alternatives available to the attacker in terms of liquidating cash.

According to the corporate blog:

“Special thanks to the teams such as Hoo, Poly Network, Huobi ZLabs, ChainNews, WePiggy, TokenPocket, Bibox, OkLink and many individual partners for synchronizing relevant attacker information with the SlowMist security team on time under the premise of compliance, and buying valuable time for tracking attacker.”

The co-founder of cryptocurrency exchange Huobi, Du June, made the same decision on social media, claiming that the company would do everything in its ability to defend the cryptocurrency community.

This will be a heartening indication for Chinese DeFi customers who wish to see confidence restored between the various companies in the market.

Huobi has taken notice of the large sum stolen from the #PolyNetwork tonight. Our risk control and security teams are already tracking and identifying the addresses involved. We’ll do everything in our power to assist and protect the crypto community. #StrongerTogether

— Du Jun (@DujunX) August 10, 2021