Bitcoin (BTC) has recovered from a plunge below $60,000, showing that there is significant purchasing at cheaper levels.

According to CryptoQuant CEO Ki Young Ju, investors utilized market orders to purchase $840 million worth of Bitcoin futures when the price fell below $60,000.

This indicates that analysts are optimistic for the remainder of the year and expect the bull run to continue. Analyst TechDev expects that Bitcoin’s price trajectory in 2021 will be similar to that of 2017. If that occurs, Bitcoin may be preparing for a significant rise in the remainder of the year.

Mastercard is expected to announce that its financial partners and merchants on its payment networks will soon be able to add cryptocurrency services.

Mastercard has partnered with Bakkt to enable its customers in the United States to purchase, sell, and keep cryptocurrencies using custodial wallets.

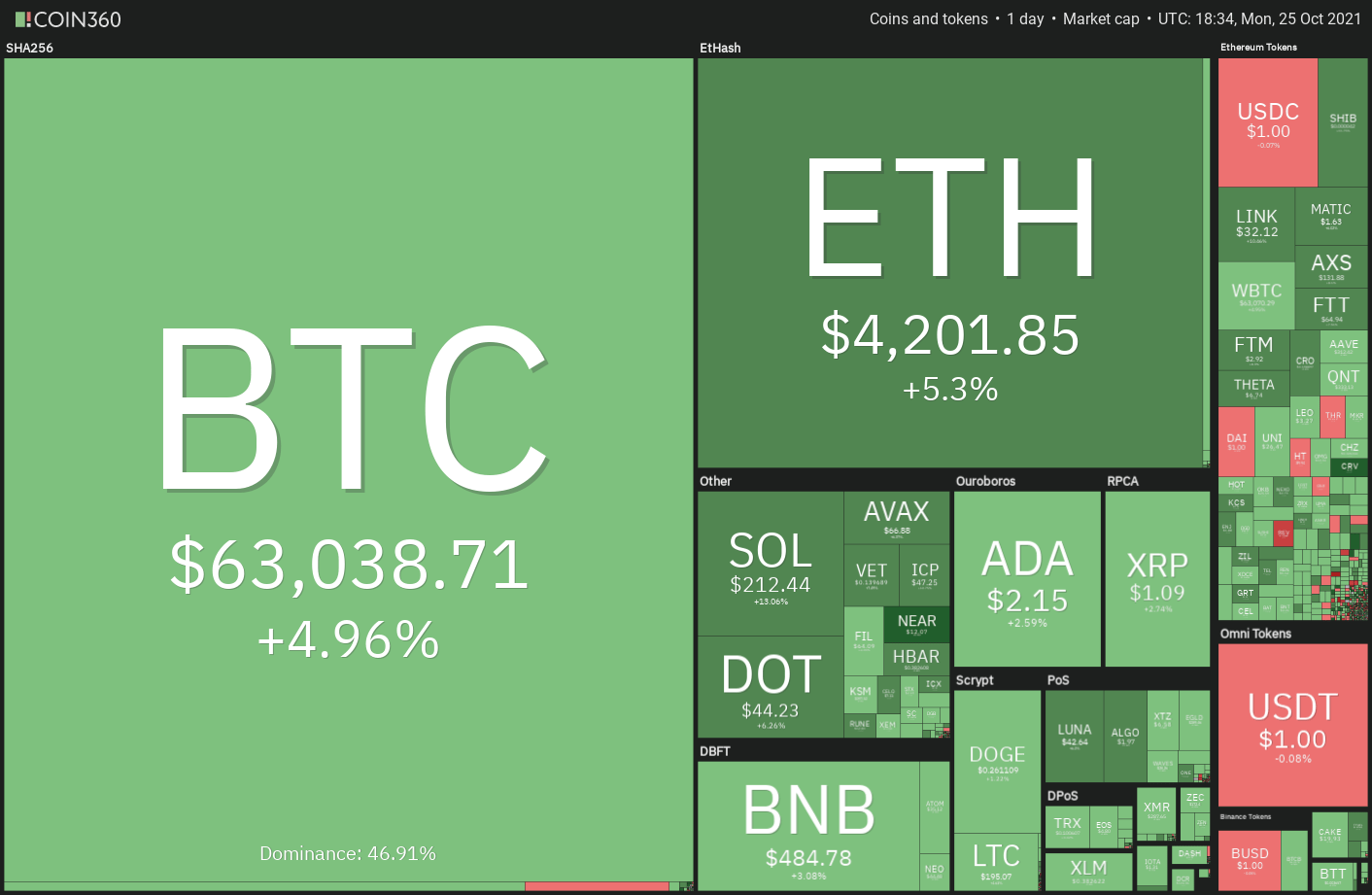

Is Bitcoin’s correction complete, and might it reach a new all-time high? If that occurs, will altcoins continue their uptrends as well? To learn more, let’s examine the charts of the top ten cryptocurrencies.

BTC/USDT

The long tail on the Oct. 23 and Oct. 24 candlestick suggests that bulls are attempting to defend the psychologically important support at $60,000. Bitcoin has resumed its up-move and will now attempt to challenge the overhead resistance zone at $64,854 to $67,000.

The rising 20-day exponential moving average (EMA) ($58,794) and the relative strength index (RSI) in the positive zone suggest that bulls are in control. The bullish momentum could pick up further if the BTC/USDT pair closes above $67,000.

That could open the doors for a possible rally to $75,000 and later to the target objective at $85,756.75.

This bullish view will invalidate if the price once again turns down from the overhead resistance and plummets below the 20-day EMA. That could result in panic selling by short-term traders and may pull the price down to the 50-day simple moving average (SMA) ($51,160).

ETH/USDT

Ether (ETH) dropped below $4,027.88 on Oct. 22 but the bears could not capitalize on this advantage. The bulls quickly reclaimed the level on Oct. 23, indicating strong buying on dips.

The bulls thwarted another attempt by the bears to pull the price below $4,027.88 on Oct. 24, as seen from the long tail on the day’s candlestick. If bulls sustain the price above $4,027.88, the ETH/USDT pair could rise to the all-time high at $4,375.

A break and close above this resistance could start the pair’s journey toward the psychologically important level at $5,000.

Contrary to this assumption, if the price turns down from the current level, the bears will try to pull the pair below the 20-day EMA ($3,826). This is the first sign that the bullish momentum may be weakening. The pair could then drop to the 50-day SMA ($3,473).

BNB/USDT

The bulls are buying on dips to the 20-day EMA ($461), indicating that the sentiment remains positive. Binance Coin (BNB) could now rise to the stiff overhead resistance at $518.90.

A breakout and close above $518.90 will suggest the start of a new up-move. The BNB/USDT pair could then attempt to rally to the pattern target at $554. A break above this level could push the pair to $600.

The upsloping 20-day EMA and the RSI in the positive zone indicate the path of least resistance is to the upside. This bullish view will invalidate if the price turns down from the current level or the overhead resistance and plummets below the 50-day SMA ($423).

ADA/USDT

Cardano (ADA) broke and closed marginally below the support line of the symmetrical triangle pattern on Oct. 24. This suggests that the uncertainty of the past few days may be resolving in favor of the bears.

If bears pull the price below $1.09, the ADA/USDT pair could start its southward journey toward the strong support at $1.87. The marginally downsloping 20-day EMA and the RSI just below the midpoint suggest that sellers have a slight advantage.

This negative view will invalidate if the price turns up from the current level and breaks above the resistance line of the triangle. That could trap the aggressive bears, resulting in a rally to $2.47 and then to the pattern target at $2.80.

XRP/USDT

Ripple (XRP) slipped below the 20-day EMA ($1.09) on Oct. 24 but the long tail on the day’s candlestick suggests that bulls are buying at lower levels. The buyers will now try to push the price above the downtrend line.

If they manage to do that, it will suggest a change in the short-term trend. The XRP/USDT pair could then rally to $1.24 where the bears may again mount a stiff resistance. If the price turns down from this level, the pair could remain range-bound between $1.24 and $1 for a few days.

A break and close below $1 could tilt the advantage in favor of bears, resulting in a decline to the strong support zone at $0.88 to $0.85. Conversely, a break and close above $1.24 could push the pair to $1.41.

SOL/USDT

The long tail on Solana’s (SOL) Oct. 24 candlestick shows that traders aggressively bought at lower levels. Sustained buying has pushed the price to a new all-time high at $218.93 on Oct. 25.

If bulls sustain the price above $216, the SOL/USDT pair could start its journey toward $239.83. The rising 20-day EMA ($173) and the RSI in the overbought territory indicate that buyers have the upper hand.

However, if the price turns down from the current level, it will suggest that bears are in no mood to relent. The pair could then drop to $177.70 and remain range-bound between these levels for a few days.

A break and close below $171.47 will be the first sign of weakness, which could pull the pair down to the trendline.

DOT/USDT

Polkadot’s (DOT) shallow correction from $46.39 suggests that bulls are not rushing to the exit as they anticipate the up-move to continue. The rising moving averages and the RSI above 63 indicate that bulls are in command.

The buyers will now try to push the price above $46.39 and retest the all-time high at $49.78. A breakout and close above this resistance could signal the start of a new uptrend, which has a target objective at $53.90.

If the price turns down from the current level or the overhead resistance, it will suggest that demand dries up at higher levels. The bears will then attempt to pull the DOT/USDT pair below $38.77. If that happens, the decline could extend to the 50-day SMA ($34.65).

DOGE/USDT

Dogecoin’s (DOGE) tight range trading between the downtrend line and the 20-day EMA ($0.24) resolved to the upside on Oct. 24. The strong momentum on the day pushed the price above the overhead resistance at $0.27 but the bulls are struggling to sustain the higher levels. This suggests that bears are defending the overhead resistance.

The DOGE/USDT pair could now drop to the 20-day EMA. If the price rebounds off this support, it will suggest that the sentiment has turned positive and traders are buying on dips. That will increase the likelihood of a break above $0.28.

If that happens, the pair could climb to $0.32 and then $0.35. Conversely, if bears pull the price below the moving averages, the pair could drop to the strong support zone at $0.21 to $0.19. A bounce off this zone could keep the pair range-bound for a few days.

LUNA/USDT

Terra protocol’s LUNA token turned down from the overhead resistance at $45.01 on Oct. 22 and bounced off the 20-day EMA ($40.03) on Oct. 24, indicating that the price is stuck between these two levels.

The gradually upsloping moving averages and the RSI in the positive territory indicate a slight advantage to buyers. If bulls thrust and sustain the price above $45.01, the LUNA/USDT pair could challenge the all-time high at $49.54.

A break and close above this resistance could clear the path for a further rally to $60.57. Alternatively, a drop below $40 could sink the pair to the strong support zone at $34.86 to $32.50. The selling could accelerate if this zone cracks.

UNI/USDT

Uniswap (UNI) continues to trade in a narrow range between the neckline of the inverse H&S pattern and the 20-day EMA ($25.68). This suggests that bears are defending the neckline while bulls are refusing to give up the 20-day EMA support.

Tight ranges usually result in a strong trending move. A break and close above the neckline will complete the inverse head and shoulder pattern. The UNI/USDT pair could first rise to $31.41 before heading for the pattern target at $36.98.

The gradually rising 20-day EMA and the RSI just above the midpoint suggests a minor advantage to buyers. Contrary to this assumption, if the price plummets and sustains below the moving averages, a drop to $22 is possible.

The author’s thoughts and opinions are entirely his or her own and do not necessarily reflect those of CoinNewsDaily. Each investing and trading action entails risk; before making a decision, you should conduct your own research. Market data is provided by HitBTC exchange.