Concerning price potential, Bitcoin (BTC) is staring in the possibility of outperforming Ether (ETH) in the short term.

So considers David Lifshitz, the chief investment officer in ExoAlpha, a Paris-based investment management service, who noted Bitcoin’s upside potential from the near-term is greater than that of Ethereum. He said after spotting a current shift in the BTC/ETH ratio.

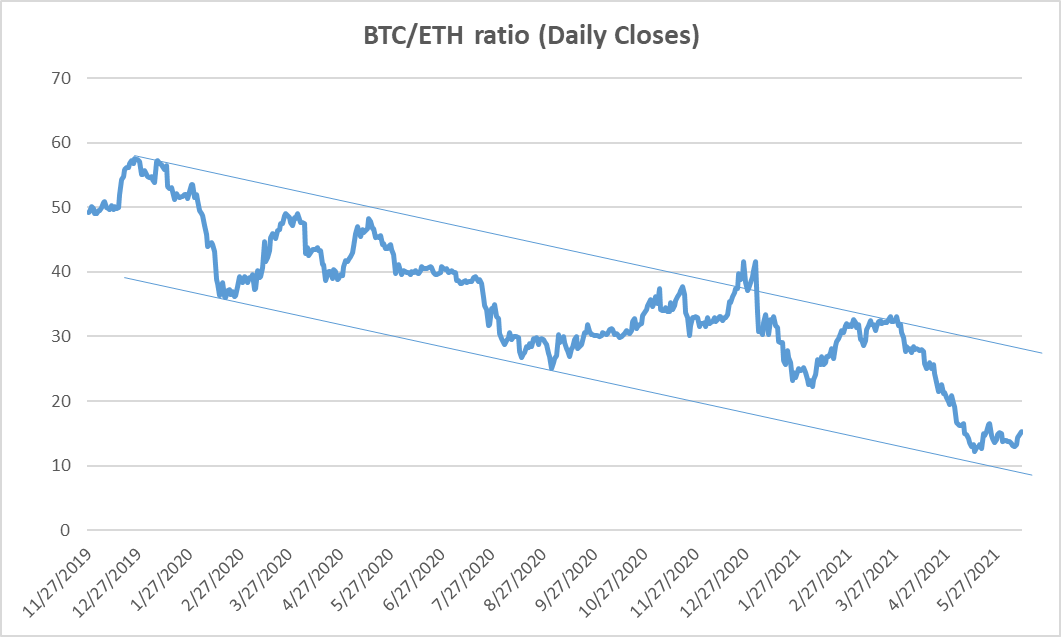

In detail, BTC/ETH contrasts the trend of Bitcoin and Ether. A lower reading suggests that the Bitcoin price is rising slower than Ethereum’s. Conversely, a greater BTC/ETH ratio suggests the Bitcoin price momentum is gaining an advantage over Ethereum.

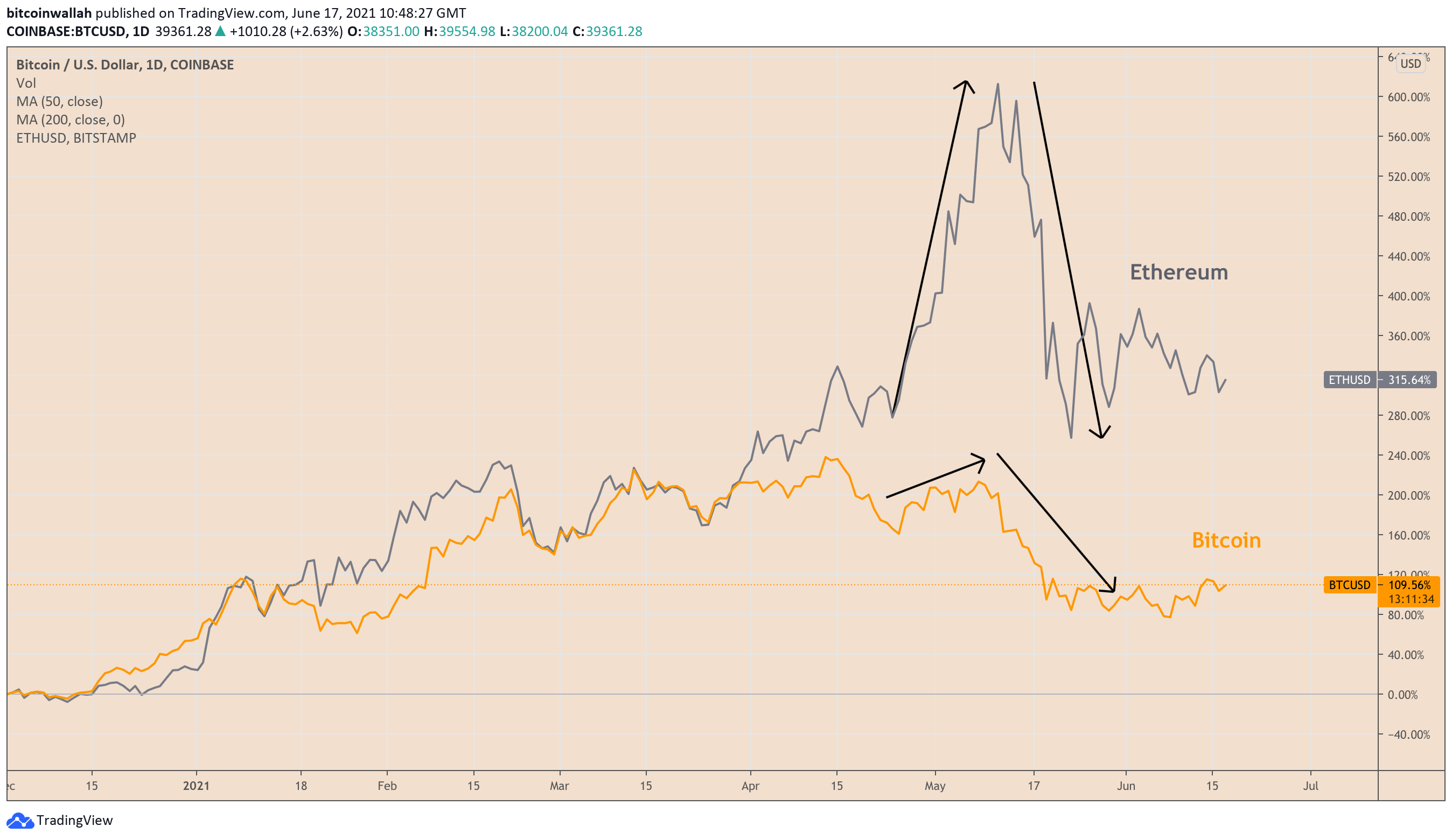

Naturally, Ethereum appeared like a heightened version of Bitcoin. After the BTC/USD exchange rate jeopardized, the ETH/USD exchange rate rallied but with greater margins. Likewise, when BTC/USD went down, ETH/USD dropped more.

The difference in price momentum sent the BTC/ETH ratio decreasing inside a descending channel range. In doing so, the ratio offered traders a means to judge which volatility — Bitcoin or Ether — would return superior gains concerning short-term relative strength momentum. Lifshitz weighed:

At the present level, the ratio suggests the BTC is underpriced vs. ETH, therefore an astute trader may buy Bitcoin and sell Ethereum in precisely the same dollar proportions, betting on the potential upcoming bounce of this ratio from the reduced channel bound toward the upper channel bound, then revert later when the ratio gets shut again to the upper bound.

Ratio flattening after Musk-led crash

The comparison between Bitcoin and Ether price momentums arrived as the Federal Reserve officials announced Wednesday they expect to begin raising interest rates in 2023, earlier than the previous forecast of 2024.

Bitcoin and Ethereum’s first response to the Fed news was adverse. The BTC/USD exchange rate closed the day 4.51% reduced, while ETH/USD went by 6.91%. In comparison, on May 19, after Elon Musk established a tweet war against Bitcoin, BTC/USD had fallen 14.29% and ETH/USD by 27.61%.

The readings pointed the difference between Bitcoin and ETH price momentums started flattening after the May 19 crash. Lifshitz called it as another sign that Bitcoin would be valuable than Ether.

He said:

„Over the last 3 weeks, the ratio of BTC/ETH relative prices seems flat and if we have a closer look in the last few days, the ratio is getting higher, meaning BTC tends to be valuable than ETH.“

Meanwhile, Lifshitz reminded the BTC/USD ratio’s relief bounce would do little in offsetting the descending channel strain. Hence, the ratio may continue to go lower after it tests the channel’s upper selection.

The scale of Bitcoin and Ether’s next trends — if upside or downside — depends upon their idiosyncratic technical and fundamental things.

Lifshitz said Bitcoin, which stays range-stuck between $33,000 and $39,000-40,000 area, would have to break over $42,000 to affirm a short-term bearish bias. In doing so, the grade cryptocurrency could rise to $50,000, a degree coinciding with the local bottoms of April 26 and May 12.

But for a bullish movement to happen, the executive added that Bitcoin miners would have to exhaust their selling or be convinced that they would later sell their BTC reservations at greater prices. Meanwhile, Dip buyers and institutional investors like MicroStrategy would provide additional upside tailwinds to the 50K-price target.“And of course in the center of this conflict between bulls and bears, there’s Elon Musk tweet-factory, being one time supportive of Bitcoin, 1 time not, which shakes the price each time,“ Lifshitz reminded.

As for Ethereum, Lifshitz expected the cryptocurrency to spike to $2,850 from the coming sessions. It’s the identical amount that ETH hit before popping up higher on May 3; meanwhile, in addition, it served as resistance as ETH tried to recover fully from its May 19 price bottom.

Ethereum bulls continued to grapple with a symmetrical triangle index on the reverse side and its inclination to send prices further reduced. Thus, they tend to send the prices from the direction of the previous trends.

„As the price approaches the apex of the triangle, some resolution is expected either down or up from the $2,500 level,“ said Lifshitz.

Meanwhile, one huge takeaway from both Bitcoin and Ethereum charts worried their volumes. While BTC/USD reported greater trading volumes after the May 19 price crash, Ethereum’s were more or less the same.