As of June 1, Ether (ETH) has dipped more than 40% after launching a record high of $4,384 in May.

The significant move back for the planet’s second-largest cryptocurrency by market capitalization has prompted many analysts to predict additional declines. For instance, Clem Chambers, chief executive of financial analytics portal ADVFN, sees the recent ETH/USD plunge as reminiscent of the beginning of 2018’s crypto crash that preceded a 24,000percent -and bull run.

Ether surged more than 4,500% after bottoming out in March before it wiped off almost 60 percent of these gains in just two weeks of trading in May. Chambers noted that the ETH/USD exchange rate stayed at risk of declining lower, including that it might take“three and a half years‘ time“ for the set to recover its all-time large.

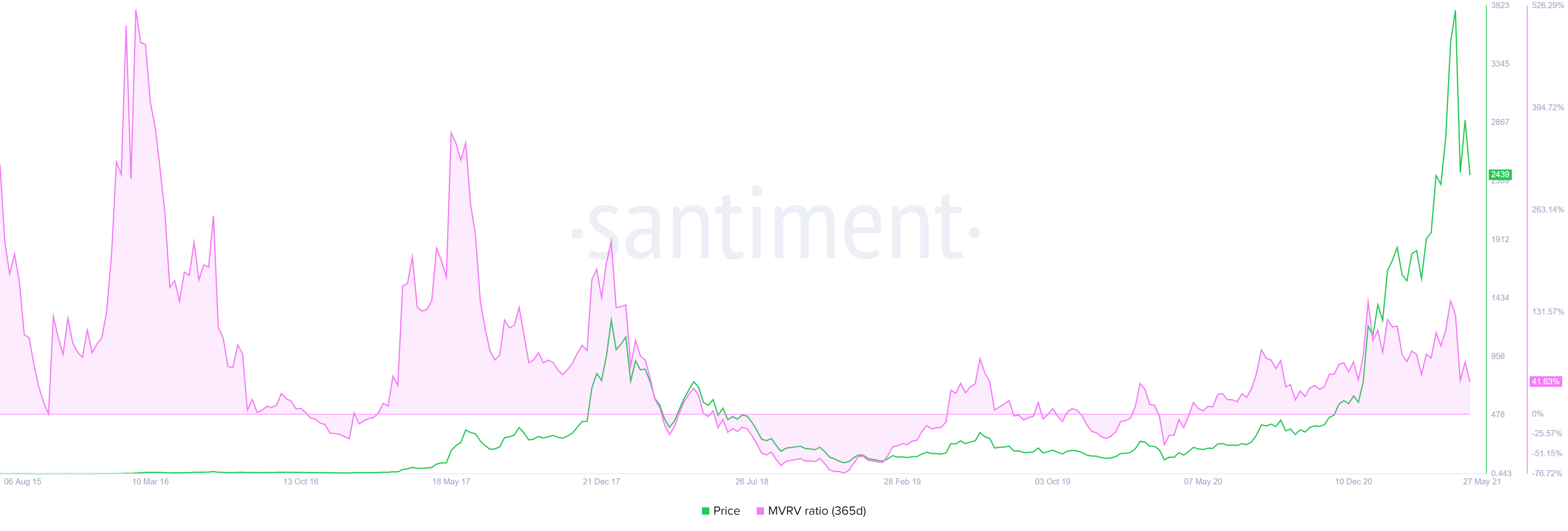

Akash Girimath, financial correspondent in FXStreet, also noted the ETH/USD exchange rate may drop to $1,200, mentioning Santiment’s 365-day market-value-to-realized-value (MVRV) version. The indicator measures the profit/loss standing of investors that have purchased ETH in the past 12 months.

Major network update in July

Investors still have a month to correct their bias toward ETH since the blockchain endeavor prepares for a significant network update that is expected to come in July.

Dubbed ETH Improvement Proposal 1559, or EIP-1559, the update is likely to eliminate the ETH system’s major problem: greater transaction fees. It would do so by substituting ETH’s“first-price-action“ fee version with a foundation network fee that would vary based on network requirement.

Vitalik Buterin and Eric Conner, the author of EIP-1559, expect that the update would create a more efficient commission market and simplify the gas payment process for clients and decentralized application (DApp) software.

Meanwhile, the EIP-1559 also proposes to burn transaction fees, thereby introducing deflation into the ETH ecosystem. Its impact on ETH prices could be comparable to the way BTC (BTC) halvings impact BTC/USD market rates, with lesser supply against greater need leading up to greater prices.

Nevertheless, some believe that EIP-1559 is not quite as bullish for ETH since it appears to be. Kyle Samani, managing partner at Multicoin Capital, contended that when the bids for ETH/USD go up, ETH would nevertheless become expensive to use.

A lot of people see EIP 1559 as bullish for ETH. But, @KyleSamani and @kaiynne think embracing EIP 1559 could have a few pitfalls — such as unit bias and greater gas prices (because ETH are more costly ).

What do you believe? pic.twitter.com/tbUTsrNWSd

— Laura Shin (@laurashin) May 26, 2021

OKEx analyst Rick Delaney also seemed to be careful in calling EIP-1559 an all-and-all bullish occasion for ETH. Nevertheless, he added that the suggestion would make ETH appealing for wealthier investors.

„A potentially deflationary ETH — thanks to EIP-1559’s fee-burn mechanism — can improve the asset’s appeal among the world’s wealthiest investors,“ Delaney said in April. „Likewise, the launching of staking within a continuing upgrade to ETH 2.0 appears to be contributing to the present rising requirement.“

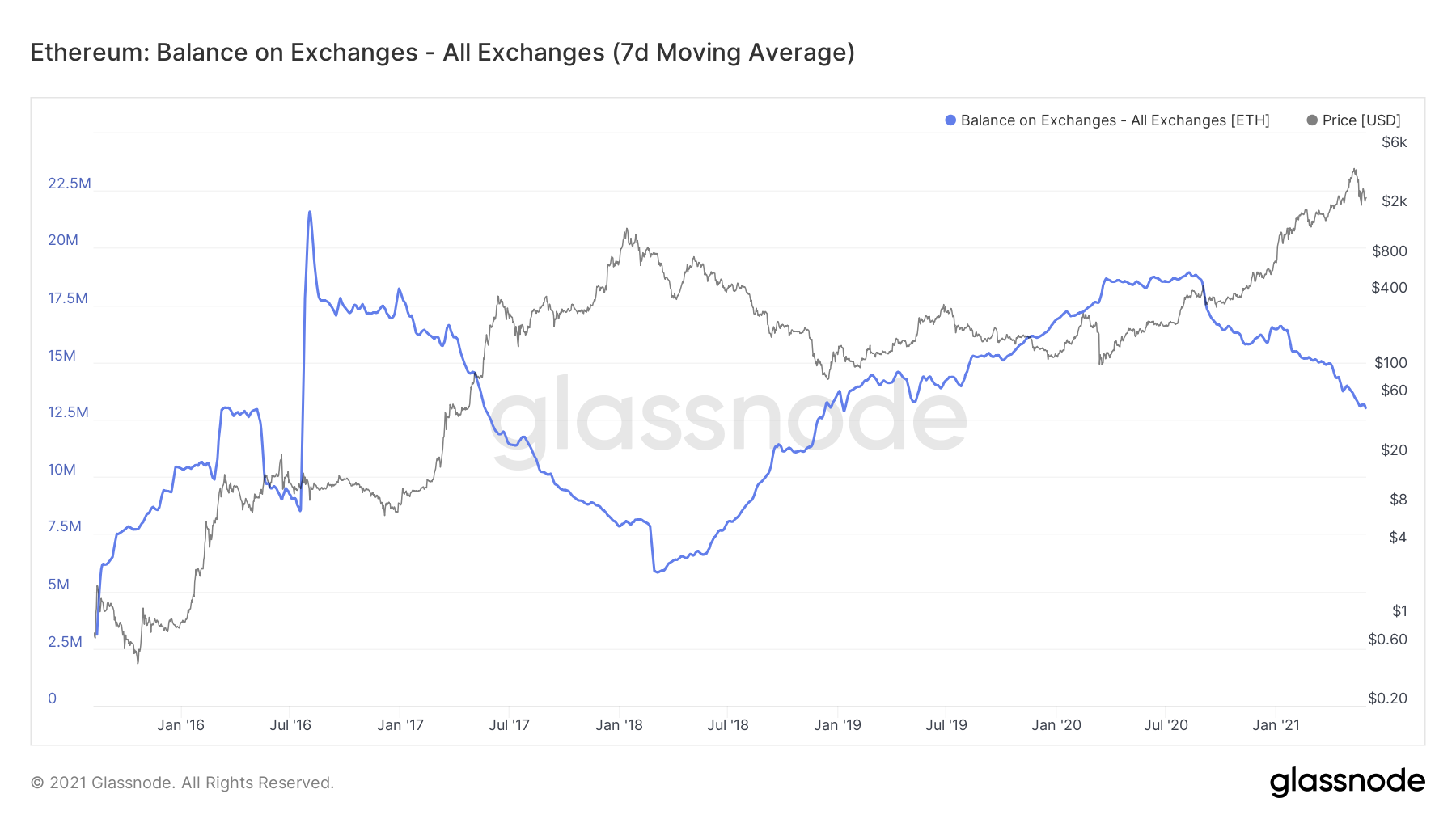

Decreasing Quantity of Ether on exchanges

Recent Glassnode data demonstrates that ETH continues to flow out of cryptocurrency exchanges even following its 40% price crash.

The“ETH: Balance on Exchange — All Exchanges“ metric shows that ETH reservations held throughout trading platforms‘ hot wallets dropped from 13.9 million on May 1 to 13.1 million on May 31 — a 5.75% fall.

Technical construction breakout

At least two economists visit Ether prices diluting their bull trend based on setups.

PostyXBT envisions ETH/USD trading inside an ascending triangle pattern, the initial concrete construction that formed following the pair’s correction from $4,384 to $3,590.

Normally, the triangle pattern surfaces during a bearish correction, and it could produce a continuation breakout move to the downside. Nevertheless, PostyXBT anticipates the price to keep the triangle support while targeting its own resistance trendline to get a bullish breakout move.

„Nothing to bank and no transaction to shoot at the moment, just something that I am watching,“ the pseudonymous analyst added.

„No cause of aggressive entries in those market conditions. Lower low invalidates the thought.“

The Crypto Cactus, another separate analyst, laid a similar upside outlook for Ether, except they stated the cryptocurrency was atop medium-term ascending trendline service, as shown in the chart below.

The analyst — that is cautious, such as PostyXBT — noticed that traders could go into a long position on a perfect retest of ETH’s present resistance trendline (the flat line near the $2,500–$2,600 area).

„Still completely avoiding leverage as spot has cycles proceed that sufficient to make it interesting,“ they added.