Nonfungible token-based projects such as Loot and The N Project have fueled unprecedented interest in the Metaverse, reviving hopes that blockchain will finally reach the masses. Is history condemned to repeat itself, or is it doomed to repeat itself? The issue is that the very things that grab the public imagination ultimately undermine the functioning of the underlying platforms and raise entry barriers to new heights. In this post, I’ll examine the basic flaws that contribute to this dynamic, with the objective of resolving them once and for all.

The core issue is that legacy blockchain technology — notably Ethereum — imposes significant entrance barriers, impeding the Metaverse’s capacity to grow.

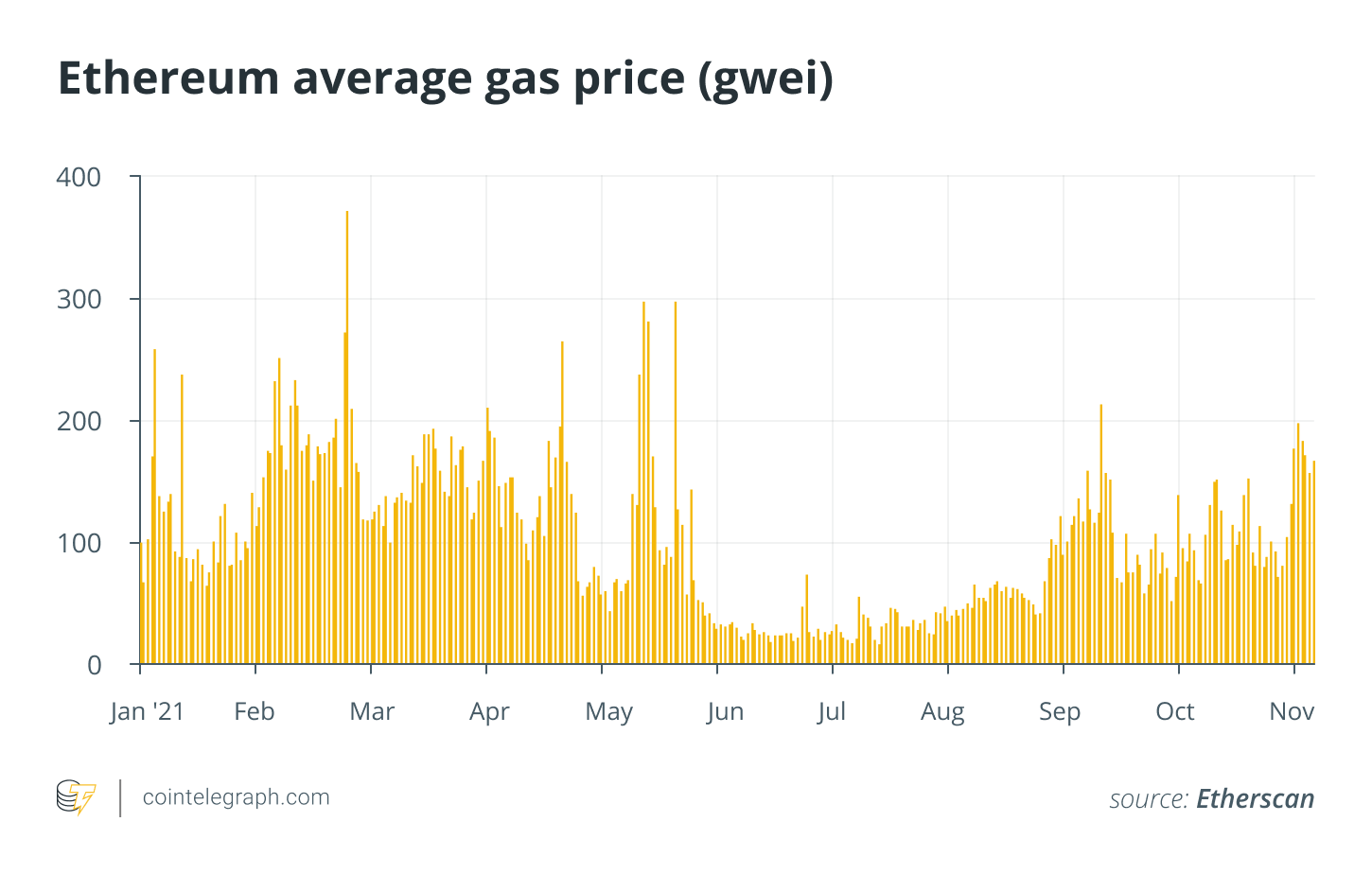

These concerns are further exacerbated by the network’s failure to allow consumers to price their network consumption statically.

Apes and penguins are pricey

Fees associated with popular NFT marketplaces can be an insidious problem, as projects frequently impose these levies on users, often with excessive assumptions of their profit potential. A cursory examination of Etherscan reveals the staggeringly huge value of transaction fees paid each project. Bored Ape Yacht Club and Pudgy Penguins have charged its users 106.7 and 111.4 Ether (ETH) to engage with their smart contract, respectively. Users of these two projects have collectively been required to pay approximately $1 million in transaction fees!

Axie Infinity, truly NFT-based?

However, here’s the rub: Those projects are not actually built on NFT! Players in Axie Infinity can battle and breed small animals that can subsequently be sold or leased to other players due to their implementation as NFTs. This is why Axie Infinity is an excellent example of a truly NFT-based game. The issue is that the more a game utilizes NFTs and the benefits of a blockchain-based asset, the more ETH customers must pay in fees.

On the Ethereum blockchain, both the trade and breeding parts of these games incur transaction fees. Axie Infinity has paid more over 15,000 ETH in transaction fees, which is almost $60,000,000! That is money that the developers could have spent on product development, but more significantly, it is money that users could have spent on additional digital content from Axie Infinity and other game producers.

The catch-22 for new users and publishers

Many new users drawn to the NFT craze immediately begin listing their own NFT on a marketplace like OpenSea. In an ideal world, this would be an excellent opportunity to recruit another blockchain champion by providing an exceptional user experience. Regrettably, the transaction fee for simply placing an item for sale on OpenSea is currently roughly 0.1 ETH, or about $400. That is hardly the type of user experience that leads users to believe they are interacting with futuristic technology!

These outrageous costs not only deter new users from learning about the blockchain craze, but also deter larger business entities from developing on top of blockchain platforms. Why would large video game producers include NFT interoperability in their titles if the end user would have to pay upwards of $100 to exchange in-game weapon skins? No consumer, surely, would be enthusiastic about in-game NFT items that cost more to trade than the base game.

Even if a huge video game publisher wished to cover these blockchain transaction fees on behalf of their player base, the fees would remain prohibitively high and would climb proportionately during the game’s lifecycle. In effect, this game publisher would be penalized as their game’s replay value increases! Given these flaws in the existing transaction price model for blockchains, it’s unsurprising that video game creators and publishers have been slow to embrace blockchain-based digitization of in-game assets.

Fee-less blockchains

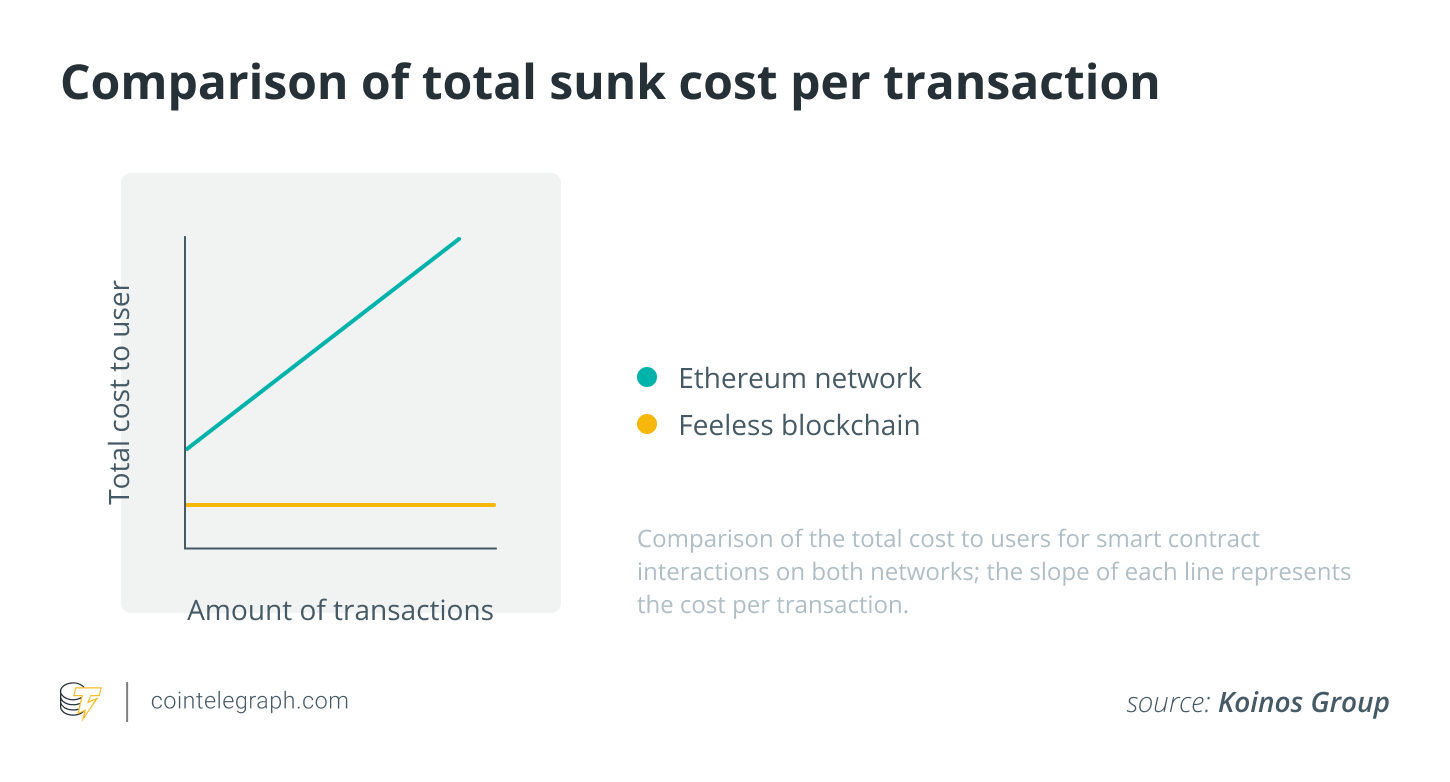

Clearly, current NFT-based games on legacy blockchains have significant flaws. This is largely due to their transaction pricing model, which discourages new users from adopting NFT assets and discourages video game developers from including them into their game. Regrettably, we are still a long way from seeing triple-A video game titles utilize blockchain technology to track ownership of in-game goods. Consumers and publishers would simply be unable to endure the cost of transacting on a fee-based blockchain.

However, there is hope. It is feasible to remove fees from the blockchain user experience. Since its debut in 2016, the Steem blockchain (which famously forked into Hive to resist Justin Sun’s hostile takeover attempt) has operated on a fee-free paradigm. Splinterlands, one of the most successful blockchain-based games, has made amazing use of Steem’s and now Hive’s fee-free properties.

The essence of the solution included inside those blockchains is the introduction of a token derivative or „property“ that is used in place of something like Ethereum’s gas to „pay“ for transaction costs, and that may be „delegated“ from one user (such as a developer) to another user (like a player).

The adoption of a token derivation to cover transaction costs enables game makers to price their network usage statically over time. If this seems a little perplexing, fear not; I shall clarify.

Consider for a second what would have happened if Axie Infinity had been established on a fee-free blockchain that leveraged such a token derivative rather than forcing users to spend their balance. If this were the case, the creators might have purchased a fixed amount of local currency proportional to the amount of network bandwidth required for the game and then allocated network resources to new users.

Fueling growth

To begin, it would have enabled new users to trade their Axies and interact with in-game smart contracts without incurring transaction fees. This would therefore allow the game to grow organically, since players would not be deterred by the cost of entry. It would lessen the entry barrier, bringing in new players and increasing demand for in-game assets.

Such a fee structure could allow for game publishers and developers to pay a one-time fixed cost for consistent network usage. You pay each transaction on Ethereum, which is a significant — around $60,000,000 significant, as of November 2021 — issue for games like Axie Infinity. Of course, what happens when the user’s token derivative is depleted? Wouldn’t they be exactly where they began? That is, unless it regenerates throughout time!

Because we are discussing a characteristic of a token, rather than the token itself, it may be programmed in any way we choose without having a substantial economic impact. This property’s goal is not to exchange value, but to encourage network utilization, and it can be structured appropriately. If we do not want customers to be compelled to constantly purchase additional tokens, all we need to do is have the token property renew over time, which would also provide us with the static pricing we seek and theoretically endless transactions for the user! As a result, a game like Axie Infinity would only need to make a single purchase and would never again be required to pay — or have their player base pay — transaction fees.

Resources might be continuously delegated from the publisher or developer to the active player or user base, enabling players to interact with smart contracts for free and resolving a $60 million dollar inefficiency in the NFT gaming industry.

The existing fee-based transaction structure directly jeopardizes widespread adoption. Along with developing the first consumer-friendly blockchain, we at Koinos Group are developing a system that will enable major enterprises to more accurately price the expenses associated with adopting this cutting-edge technology.

The author’s thoughts and opinions are entirely his or her own and do not necessarily reflect those of CoinNewsDaily. Each investing and trading action entails risk; before making a decision, you should conduct your own research.

Thomas Clement is a blockchain analyst at Koinos Group, a blockchain development company dedicated to helping people leverage blockchain to benefit humanity.