BTC is currently trading 41% below its $64,900 all-time high and that move has driven the“Crypto Fear and Greed Index“ to the lowest level since March 2020. While retail anxieties the dip, professionals like global investment company Guggenheim Investments have filed with the United States Securities and Exchange Commission for a new fund that may look for exposure to BTC.

„I believe BTC has won the store of value game because it is a brand, it’s been around for 13-14 decades and it has a finite supply“.

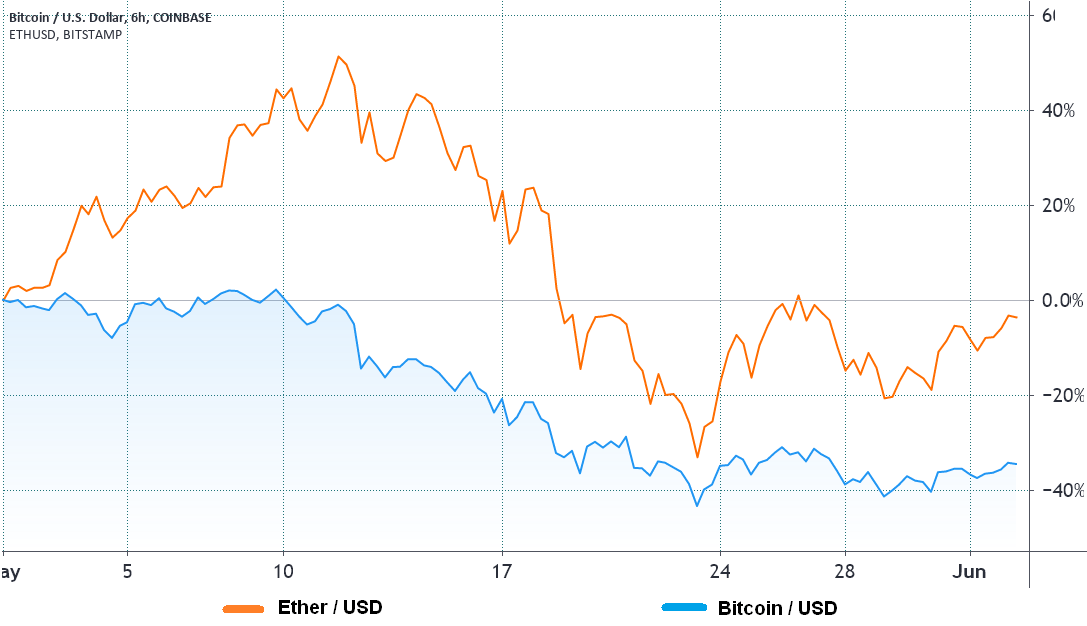

Ethereum network momentum continues to be outstanding

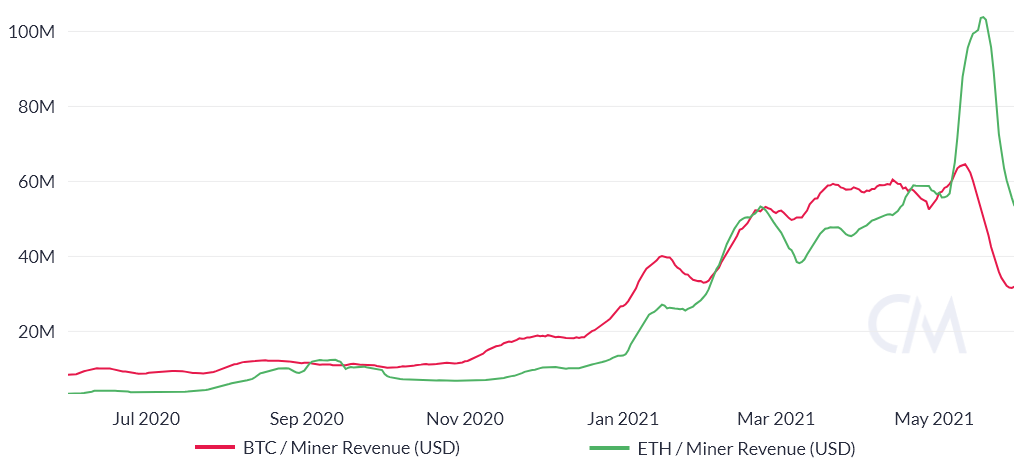

Ethereum overtook BTC in terms of miner earnings and network worth transacted right as a report by Goldman Sachs revealed the global investment bank believes that Ether has a“high chance of overtaking BTC as a dominant store of value.“ The report noted the growth of the decentralized fund industry and also the non-fungible token ecosystems being assembled on Ethereum.

Notice how Ethereum miners‘ revenue significantly outpaced BTC’s in May, reaching a $76 million per day average. This figure leapfrogged BTC’s $45 million in miners earnings, including the 6.25 subsidy per cube, plus transaction fees.

A similar situation happened in the total transacted and moved on each individual network. For the first time, Ethereum introduced a significant advantage in accordance with this metric.

The chart above shows the Ethereum network settling $25 billion each day on average, which is 85 percent higher than BTC’s. Stablecoins certainly played an important role, but so did the $50 billion net worth locked in decentralized fund software.

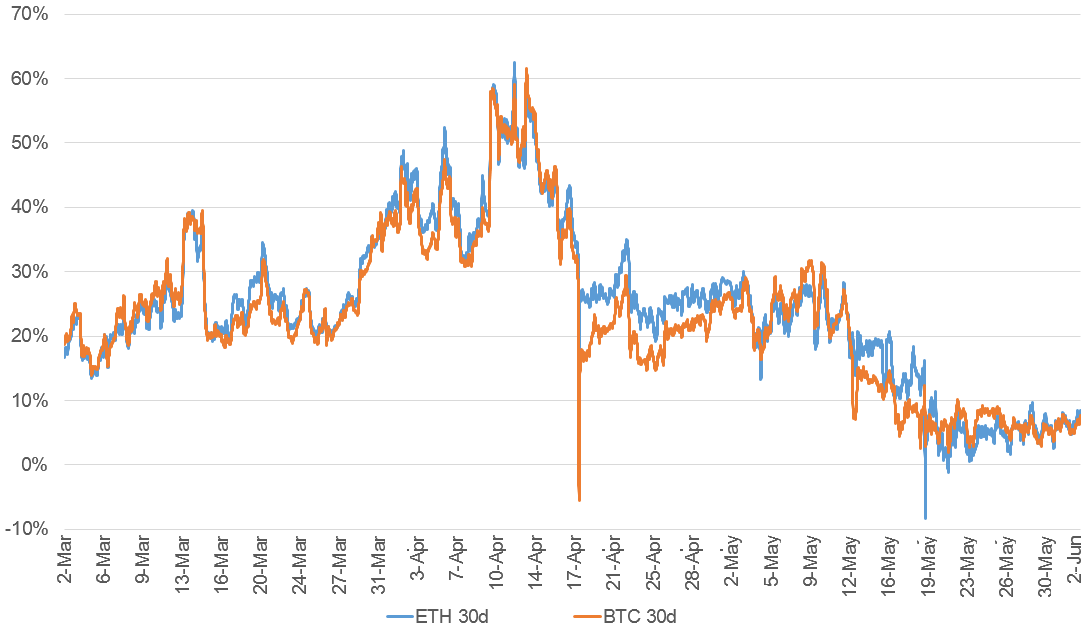

The futures premium is slightly bearish

After measuring the futures premium, the two BTC and Ether exhibit similar levels of bearishness. The basis rate measures the gap between longer-term futures contracts and the current spot market amounts.

The one-month futures contract generally trades with 10 percent –20 percent premium versus regular spot exchanges to justify locking the funds instead of instantly cashing out.

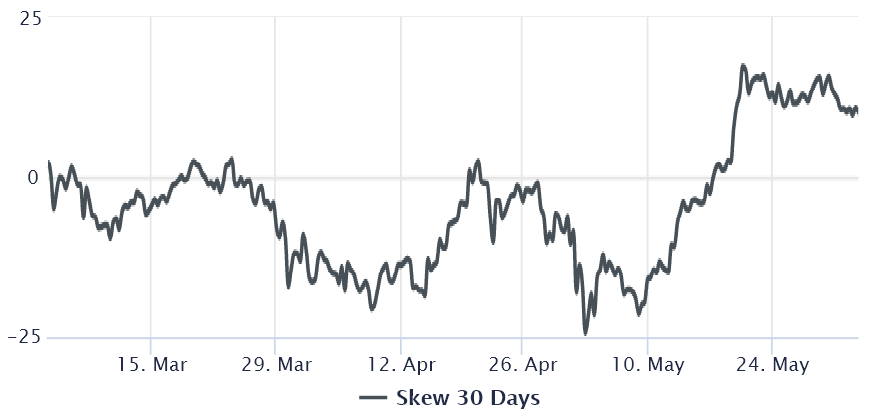

Ether’s 25% delta skew signals“fear“

To evaluate Ether dealer’s optimism, one should look at the 25% delta skew. The metric will turn positive if the neutral-to-bearish set options premium is higher than similar-risk telephone choices. This situation is generally regarded as a“panic“ scenario. On the flip side, a negative skew translates to a higher cost of upside down protection and points toward bullishness.

Similar to the stocks premium, Ether choices 25% delta skew was ranging above 10% since May 19. This implies that market manufacturers and whales are reluctant to offer downside protection, indicating“fear“. Albeit remote from an extremely adverse situation, both Ether derivatives signs point to a complete lack of bullishness, regardless of the altcoin 270% profit year-to-date.

In the face of this disappointing information, some analysts will find the „glass half full“ as it leaves space for a positive surprise. The Ethereum Improvement Proposal 1559, or EIP-1559, expected for July, will produce a foundation network fee that would vary based on network requirement. The upgrade also proposes to burn transaction fees, thereby introducing deflation to the Ethereum ecosystem. OKEx analyst Rick Delaney said that it „may improve the strength’s appeal among the world’s weakest investors.“

The perspectives and opinions expressed here are only those of the author and do not always reflect the views of CoinNewsDaily. Every investment and trading movement involves risk. You should conduct your own research after making a decision.