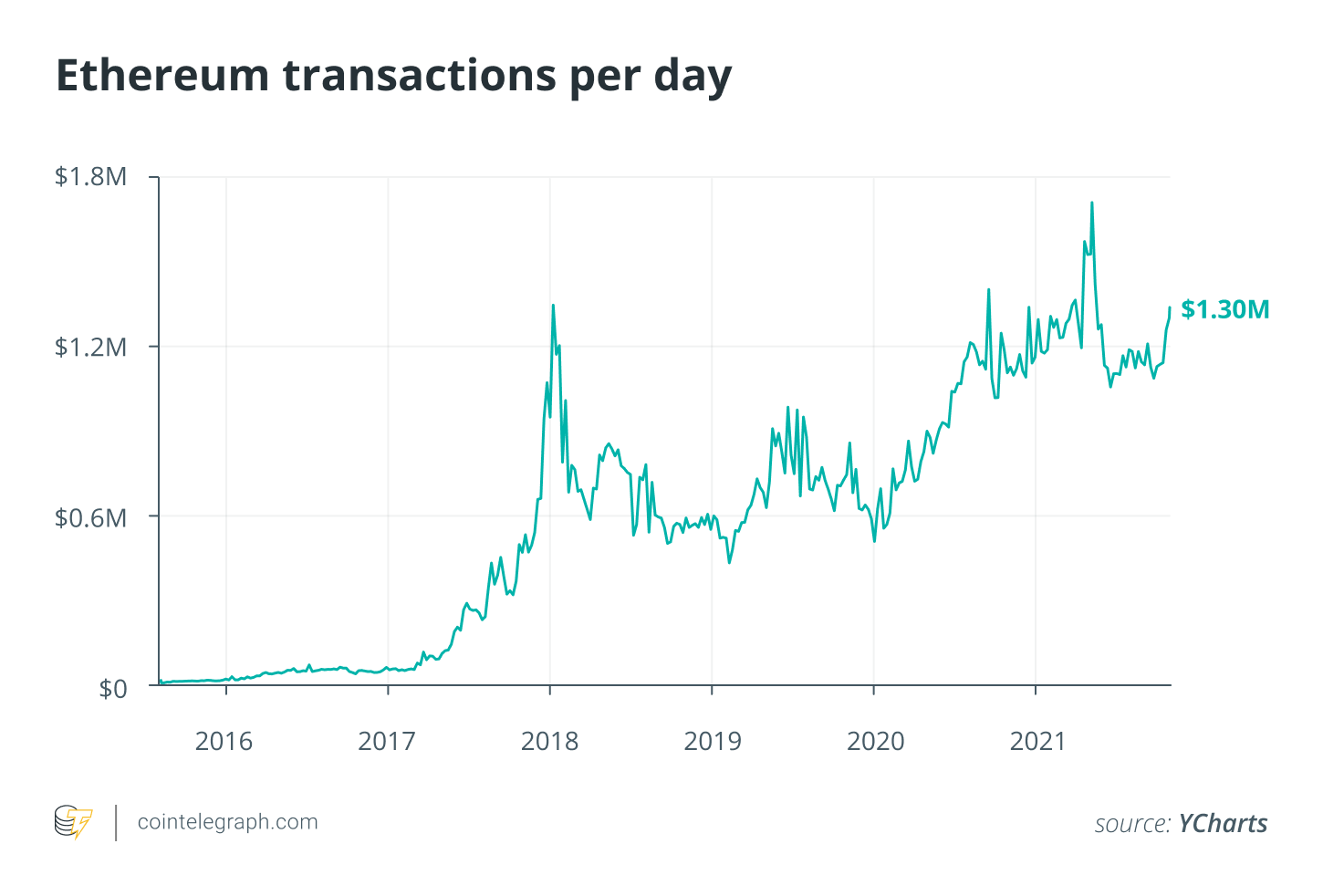

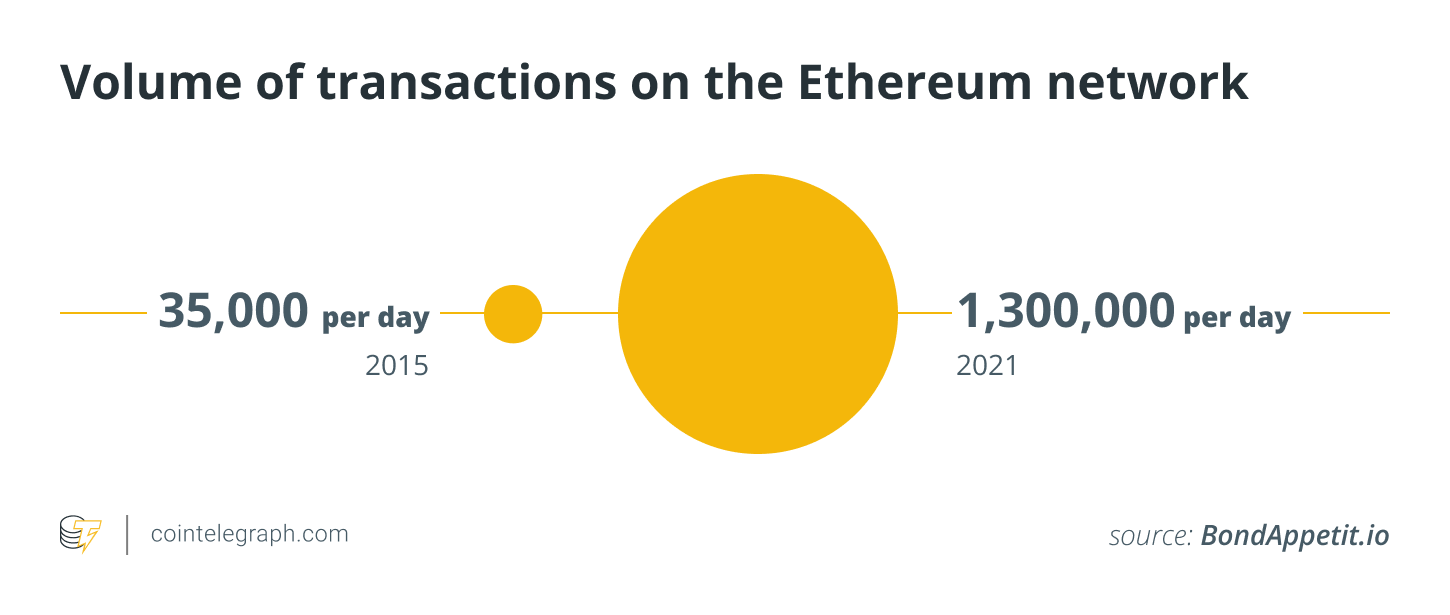

Decentralized finance (DeFi) is a natural result of blockchain technology with ready infrastructure to expand the technology’s reach. Ethereum network transactions have increased 33x to 1.2 million per day, and blockchain transactions would exceed millions if other chains were added.

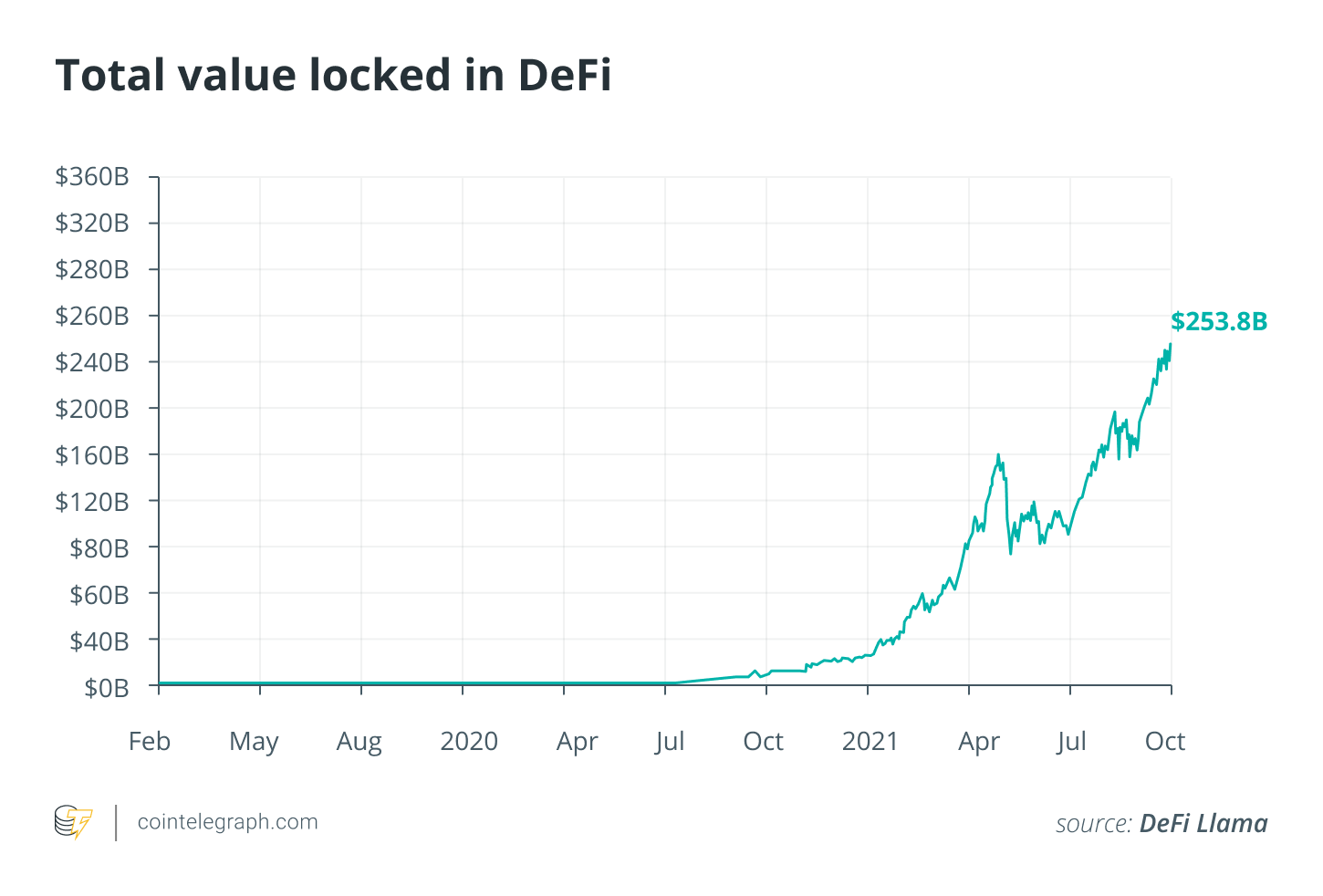

DeFi services like Uniswap, which facilitates daily exchanges worth over $1 billion, and lending and borrowing protocols like Aave, Compound, and BondAppetit all began these transactions. While these are significant figures, they are a fraction of the trillion-dollar conventional finance (TradFi) business.

DeFi is only scratching the surface of the TradFi services

The traditional financial system comprises facilitating the exchange of goods and services through markets such as the stock market, debt market, derivatives market, commodities market, and payment. This is made possible by service providers — banks, insurance firms, stock exchanges, financial intermediaries, and custodians, to name a few — who earn trillions of dollars from the services they give.

Currently, mainstream DeFi services include lending, borrowing, decentralized trading, and yield aggregation – a small list in comparison to the breadth of financial services available in TradFi. This will not be the case indefinitely, since the DeFi developers are actively researching and expanding the ecosystem’s offerings. Protocols that achieve the optimal product/market fit will experience tremendous growth, as evidenced by dYdX’s recent ascent.

The trillion-dollar TradFi market is ripe for disruption

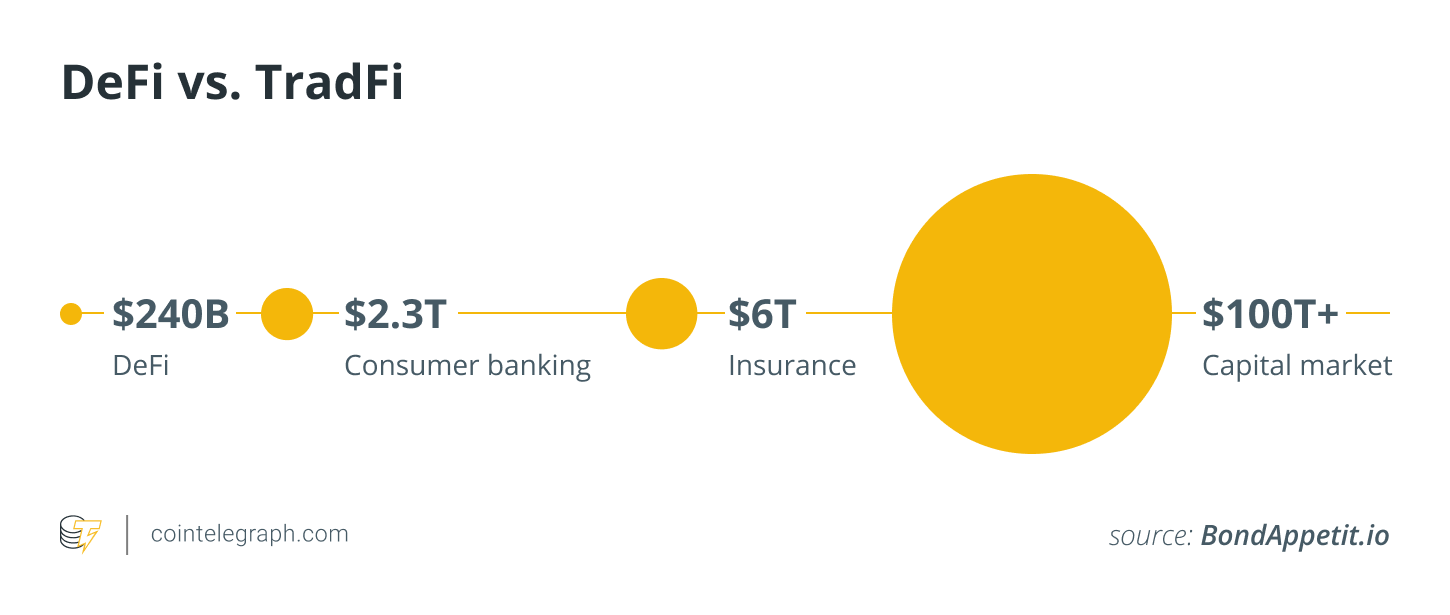

Consumer banking. Global retail banking income is expected to be $2.3 trillion, spread across a variety of consumer financial products, including loans/lending, mortgage products, and payment services. Consumer payments and transactions generate approximately $500 billion in annual revenue for banks worldwide and could be accessible with a frictionless user interface, a global stablecoin, and widespread acceptance points — which was the objective of Facebook’s Diem prior to regulatory opposition.

Capital market. Global equities market capitalisation is anticipated to exceed $100 trillion, compared to just over $243 billion in decentralized finance’s total value locked (TVL). Security tokens are an unavoidable trend for which authorities will eventually need to accept and build a regulatory framework, and centralized and decentralized exchanges that adhere to the know-your-customer (KYC) standard can participate in TradFi’s trillion-dollar equities market.

Insurance. Global insurance is another trillion-dollar TradFi industry that smart contract technology has the potential to perfect. Approximately one-third of global insurance premiums are devoted to administrative and commission fees, ultimately undercutting the consumer. Smart contracts enable the cost-effective, rapid, and accurate implementation of insurance procedures, from underwriting to claims, and will provide a profitable revenue stream for the DeFi business.

DeFi’s addressable market size

Transaction volume. In 2021, the Ethereum network will execute over 1.3 million transactions per day, including remittance, trading, lending, and borrowing, among other forms of activities. This is a negligible amount in comparison to the over 1 billion daily credit card transactions worldwide and the over 5.5 billion daily trading volume on the NASDAQ. Capturing 1% of credit card transactions on the Ethereum blockchain would more than 8x-ing its present volume.

Protocol revenue. The combined annualized revenue from all DeFi protocols is anticipated to be $5 billion. Again, this is a drop in the bucket when compared to the global retail banking income of $2.3 trillion, the global cross-border payment revenue of $2 trillion, and the global stock exchange revenue of $35 billion. The TradFi industry is so valuable that capturing a 1% market share equates to tenfolding DeFi earnings.

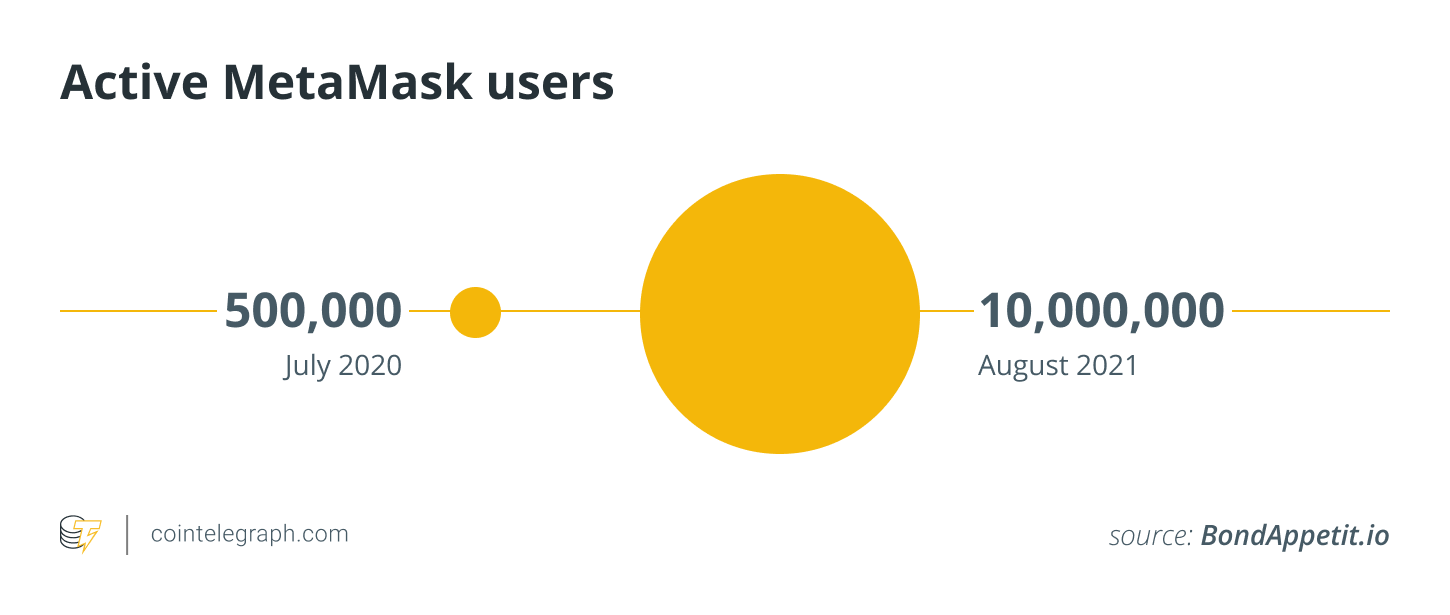

Crypto crackdown accelerates DeFi trend. Even if nations such as China continue to crack down on cryptocurrency, this will simply serve to increase the use of DeFi. In August 2021, the number of active Ethereum wallet and browser plugin MetaMask users has tenfolded to ten million. While this appears to be a large figure, it represents only a 5% penetration rate among the world’s 221 million cryptocurrency users. This demonstrates that mainstream crypto consumers accustomed to frictionless centralized services such as Robinhood represent a sizable untapped market for DeFi that can be captured by improving the UI/UX.

DeFi is a three-year-old company with services that became mainstream for the cryptocurrency industry in the summer of 2021. Compound and Aave, as well as decentralized exchanges Uniswap and Curve, reinforced their status as market-leading protocols with the first-mover advantage. These were not easy to get by.

Hayden Adams, the founder of Uniswap, just published a post chronicling his journey to the launch of Uniswap V1 – it is the culmination of faith, friendship, support, and hard work over the crypto winter. The DeFi building community has gotten stronger in this new cycle, as more programmers from traditional startups and major tech have entered the blockchain and DeFi scene, which can only mean that we now have more resources than ever to grow the area and technology.

On February 4, 2004, a dorm room experiment grew into a $1 trillion firm with 3 billion users by 2021 – it is now known as Facebook, or Meta following a rebranding. DeFi is still in its infancy, and with the money and expertise now streaming into the field, increasing 100x in the next five years is not a pipe dream; it is a foregone conclusion.

The author’s thoughts and opinions are entirely his or her own and do not necessarily reflect those of CoinNewsDaily. Each investing and trading action entails risk; before making a decision, you should conduct your own research.

Artem Tolkachev is the founder and CEO of BondAppetit, as well as a DeFiHelper investor. He has been a lawyer and entrepreneur specializing in intellectual property and information technology since 2011. Artem developed and led Deloitte CIS Blockchain Lab in 2016. He spearheaded a number of innovative projects as part of that initiative, including the implementation of enterprise blockchain solutions, the tokenization of real-world assets, the tax and legal structuring of security token offerings, and the development of cryptocurrency and blockchain legislation.