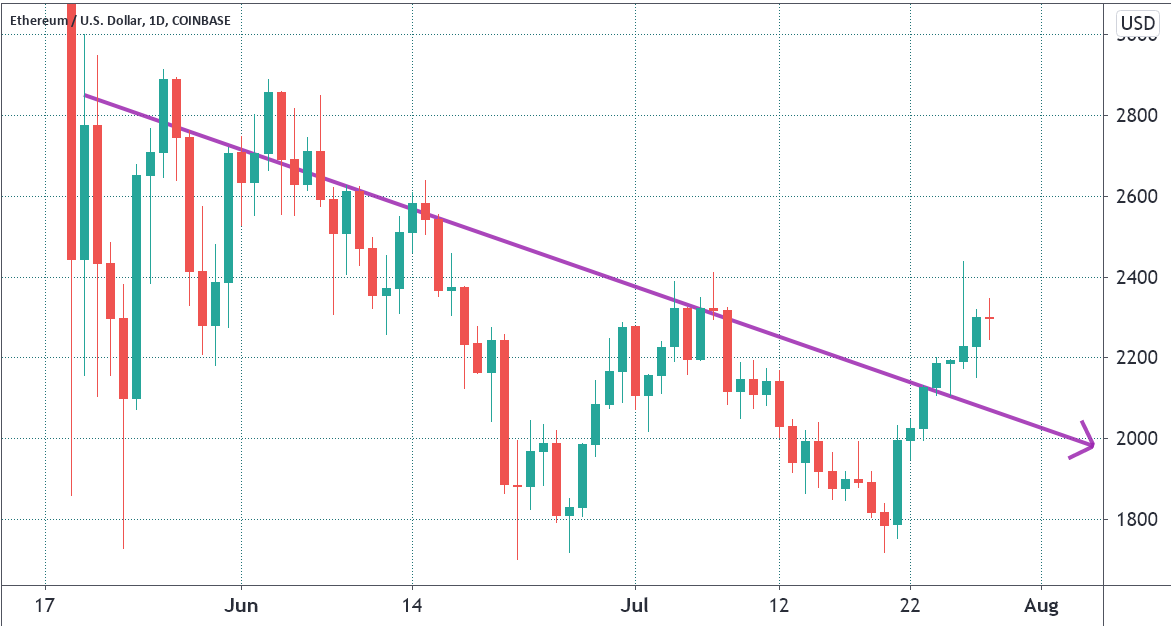

ETH (Ethereum) has been in a downward spiral ever since the Ethereum co-founder Vitalik Buterin delivered his keynote speech at the StartmeupHK Festival 2021 last month.

In a fireside chat session on May 27, Vitalik stated that the Proof-of-Stake migration had been delayed due to internal team conflicts, which had caused the launch to be delayed.

‚Phase One,‘ which introduces scalability through sharding and is expected to be completed by 2022, has been delayed, according to CoinNewsDaily.

Furthermore, because of DeFi’s inherently decentralized nature, it is possible that the benefits of sharding-style processing will be outweighed by the costs of running transactions through a relay chain.

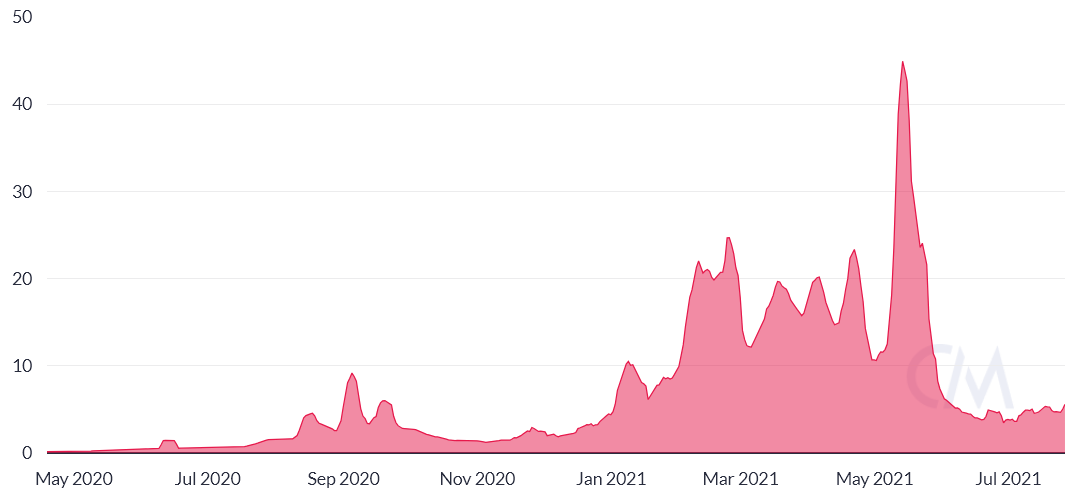

The exact reason for Ether’s precipitous decline from its all-time high is impossible to pinpoint, but the rising price of natural gas undoubtedly played a role in reducing investor confidence.

Because of this, traders were encouraged to experiment with alternative networks such as Binance Smart Chain (BSC) and Polygon’s layer-2 solution, which are both currently in development.

On April 15, the Berlin upgrade went live, and the chart above shows that the $45 average gas fee occurred a full month after the Berlin upgrade.

The Ethereum community agreed that the Berlin hard fork would have less immediate impact in the short term, but that it would pave the way for the long-awaited London hard fork’s EIP-1559 protocol, which would be implemented on August 4.

This brings us to one of the three factors that have the potential to have a negative impact on the price of Ether in the short term.

London Fork delay

The Ethereum London hard fork is a step on the road to the final Eth2 release in 2022, which is scheduled for that year.

The long-awaited update is scheduled for August 4, but it has already been postponed due to the fact that the previous schedule called for it to be released in late July.

EIP-1159, which aims to burn a portion of the fees generated on the Ethereum blockchain, will have the greatest impact on miners because it will reduce the amount of money they can earn from mining.

Furthermore, EIP-3554 introduces an incremental difficulty adjustment that encourages the migration to the new Proof-of-Stake blockchain, which is currently under development.

The track record of Ethereum developers in terms of delivery does not inspire confidence either.

In the event that only a partial upgrade were to take place and the more contentious changes were to be postponed, the price of Ether could fall because a portion of the current rally is based on the excitement surrounding the hardfork.

Miner exodus

The primary focus this time around is on social issues rather than technical issues, as opposed to the previous time around, which was primarily concerned with technical issues.

Ethereum miners will shift their efforts to a competing network as soon as it becomes clear that their revenue source is going to be phased out over time.

The algorithms of some lesser-known projects, on the other hand, may be modified so that they can support Ethereum hash mining on their blockchain.

In spite of the fact that the vast majority of smart contract blockchains have been designed to support the proof of stake consensus model, this continues to be the case.

The implementation of an additional security layer to take advantage of increased hashing power as a result of an Ethereum miner exodus should not be ruled out as a possibility if the Binance Chain or the Solana blockchains decide to do so. There is no reason to believe that the increased hashing power will prevent them from doing so.

However, just because such a scenario is still a long way off in the future does not rule out the possibility that it will have a negative impact on the price of Ether in the immediate future.

Multi-chain dApps

As Eth2 is fully implemented and as decentralized applications (dApps) upgrade their code to support parallel processing, adding multi-chain support will become more appealing (sharding).

Curve and AAVE, the two most popular DeFi protocols in terms of total value locked, have both expanded their support to include blockchains other than the Ethereum blockchain, bringing their total value locked to more than $1 trillion.

The data from DeFi Llama shows that Polygon is currently in possession of $550 million worth of Curve contracts, with AAVE possessing an additional $1.8 billion in Curve contracts.

As a result, users and decentralized applications (dApps) would be more likely to turn to alternative solutions than the network itself, making it the most likely „Ethereum killer.“

Meanwhile, the transition to Proof-of-Stake (PoS) allows for the strengthening of competing blockchains as a result of the transition.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of CoinNewsDaily. Every investment and trading move involves risk. You should conduct your own research when making a decision.