Selva Ozelli, an international tax lawyer and CPA, writes a monthly column called „Expert Take“ that talks about how new technologies and sustainability work together. She talks about taxes, AML/CFT regulations, and legal issues that affect crypto and blockchain.

At the end of 2021, a year in which Bitcoin (BTC) and Ether (ETH) rose 100 percent and 300 percent, Coincub ranked Singapore as the most crypto-friendly country in the world because of its „strong economy, positive legislative environment, and high rate of cryptocurrency adoption.“

Cryptocurrency consumer protection law

Singapore’s government has done a lot to help the blockchain industry grow.

If Coincub had chosen it as the best, the Monetary Authority of Singapore, the country’s main financial regulatory body, would have taken action quickly when the cryptocurrency market began to crash in January 2022 and enter bear market territory. This is what happened.

Consumer protection laws were passed by Singapore’s MAS in mid-January to protect investors who are constantly reminded of digital assets through billboard ads or crypto ATMs. They also banned all cryptocurrency-related advertisements and ATMs from public spaces.

In a statement, the Malaysian Securities and Futures Commission (MAS) said that while it „strongly encourages“ the development of blockchain technology and new ways to use cryptocurrency, cryptocurrency trading is „highly risky and not suitable for the general public.“

It is important not to make cryptocurrencies look like they don’t have very high risks when people are talking about them.

Payment Services Act, January 2020

When the Financial Action Task Force updated its anti-money laundering (AML) and anti-terrorism financing (CFT) cross-border risk guidelines for cryptocurrencies in 2018, Singapore’s Payment Services Act came into effect in January 2020. This law was a response to the updated guidelines.

This act is a flexible framework for regulating payment systems and service providers in Singapore. It establishes registration requirements for cryptocurrency businesses, as well as AML and CFT rules for businesses that do that.

MAS has been very picky when it comes to issuing licenses to businesses that use cryptocurrency. A lot of applicants have not been able to get permission to work in the country.

DBS Bank, OCBC Bank, IBM, and Fintonia Group, a Singapore-based fund manager, are just some of the businesses that have been given permission to run businesses.

Initial coin offerings

It came up with the first set of rules in August 2017 because there were a lot of initial coin offerings going on. If an ICO was thought to be giving out securities, it would have to follow rules.

When MAS released „A Guide to Digital Token Offerings,“ it gave more information and guidance on how cryptocurrencies are regulated in Singapore, as well as how to buy and sell them.

Taxation of cryptocurrencies

Singapore is a low-tax country.

Digital payment tokens will no longer be taxed in Singapore after January 1, 2020, according to Desmon Teo and Lee Vin Wee of the Big Four accounting firm Ernst & Young.

If you sell a cryptocurrency, you don’t have to pay taxes on the money you make.

Blockchain adoption

Because of its favorable regulatory and tax environment, Singapore has become a global hub for cryptocurrencies in just a short time. This is due to its use of blockchain technology in many parts of the economy, as well as the fact that it is a major financial center and shipping hub and has the 10th-highest GDP per capita.

On the one hand, MAS is excited about the future of crypto and blockchain technology, especially in cross-border payments and trade finance. On the other hand, MAS doesn’t think cryptocurrencies are good investments for people who don’t have a lot of money.

Cryptocurrency exchanges

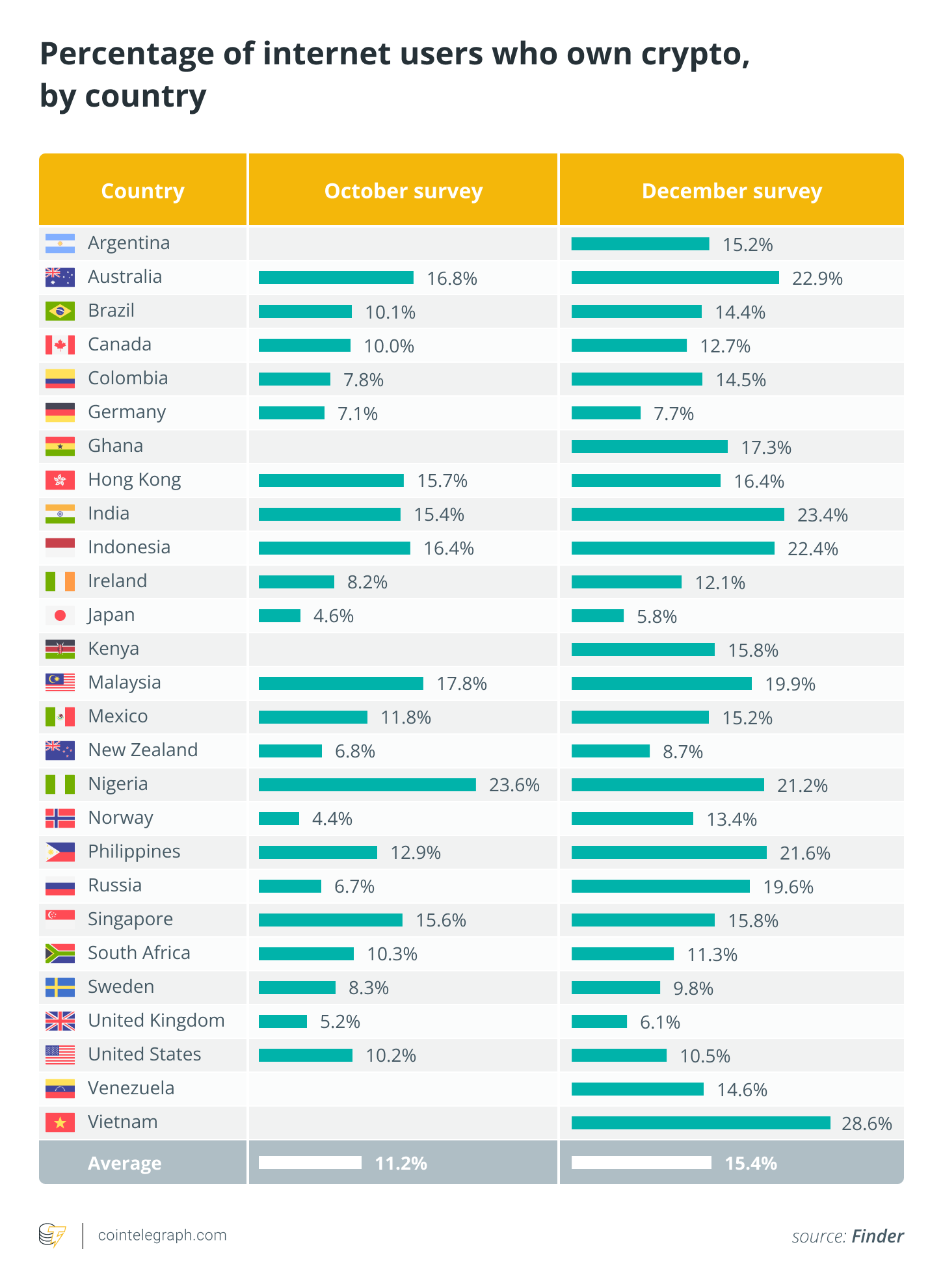

In one survey, 43% of Singaporeans own cryptocurrency.

In comparison, in South Africa, 11.3 percent of people own crypto. In the United States, 10.5 percent of people own crypto, and 9.8 percent in Sweden.

Coinbase, Kraken, FTX, Bybit, KuCoin, Vauld, Independent Reserve, Gemini, Coinhako, Tiger Brokers, Futu’s Moomoo, and Syfe are some of the many crypto exchanges that retail investors can use to buy and sell cryptocurrencies.

Hg Exchange is a Singapore-regulated private securities market that Binance, the world’s biggest crypto exchange, bought a stake in. Binance announced that it would stop running Binance Singapore by mid-February 2022.

This announcement was followed by a report from Reuters about how Binance’s corporate structure isn’t clear and how it doesn’t do well with global AML and CFT rules.

Cryptocurrency exchange Huobi, which is the sixth-largest in the world, says it will close all of its accounts in Singapore by the end of March 2022.

One of SIX Swiss Exchange’s sister companies, SIX Digital Exchange, has teamed up with SBI Digital Asset Holdings, a division of Japanese banking and financial services giant SBI Group, to set up a crypto exchange and central securities depository in Singapore. SIX Swiss Exchange runs Switzerland’s national stock exchange.

The joint venture, called Asia Digital Exchange, is meant to create a regulated, global liquidity pool for digital assets between Asia and Europe. It is called Asia Digital Exchange.

Banking

Several big banks have joined the Marketnode project, which is a digital asset joint venture between the Singapore Exchange (SGX) and the government-backed investment firm Temasek. These banks include BNP Paribas, BNY Mellon, Citibank, Deutsche Bank, HSBC, Orient Securities, Standard Chartered, Standard Chartered, and Societe Generale.

The goal is to look into how blockchain technology can be used in the capital markets through smart contracts, ledgers, and tokenization technologies.

Singapore-based RootAnt Global and the blockchain platform SETL are also working with Marketnode to build infrastructure for fixed income and multi-assets end-to-end development, as well as for the development of a single platform for both.

Grab, a Singapore- and Indonesia-based company that makes apps for transportation, food delivery, and cryptocurrency payments, and Singapore Telecommunications, which is based in Singapore, have both bought a 16.3% stake in PT Bank Fama International in order to look for digital banking opportunities in Indonesia.

The two got a digital banking license in Singapore together.

Cap and trade and renewable energy trading exchanges

Some people are trying to make the COVID-19 pandemic „green“ again, especially after the COP26 meeting in 2021.

Singapore is at risk because of global warming, with 30% of its land mass less than five meters (16 feet) above sea level.

Energy is made with natural gas in Singapore. A solar energy system developer in the country plans to spend $2 billion to build the world’s largest floating solar farm in Batam, Indonesia, which will double Singapore’s renewable energy capacity.

Temasek is working with DBS Bank, SGX, and Standard Chartered to make a blockchain-based exchange called Climate Impact X where carbon credits can be traded. This exchange will be called Climate Impact X.

People in the country already use a blockchain-powered exchange to buy and sell renewable energy from SP Group, a company that sells electricity to people.

Green cryptocurrency mining companies

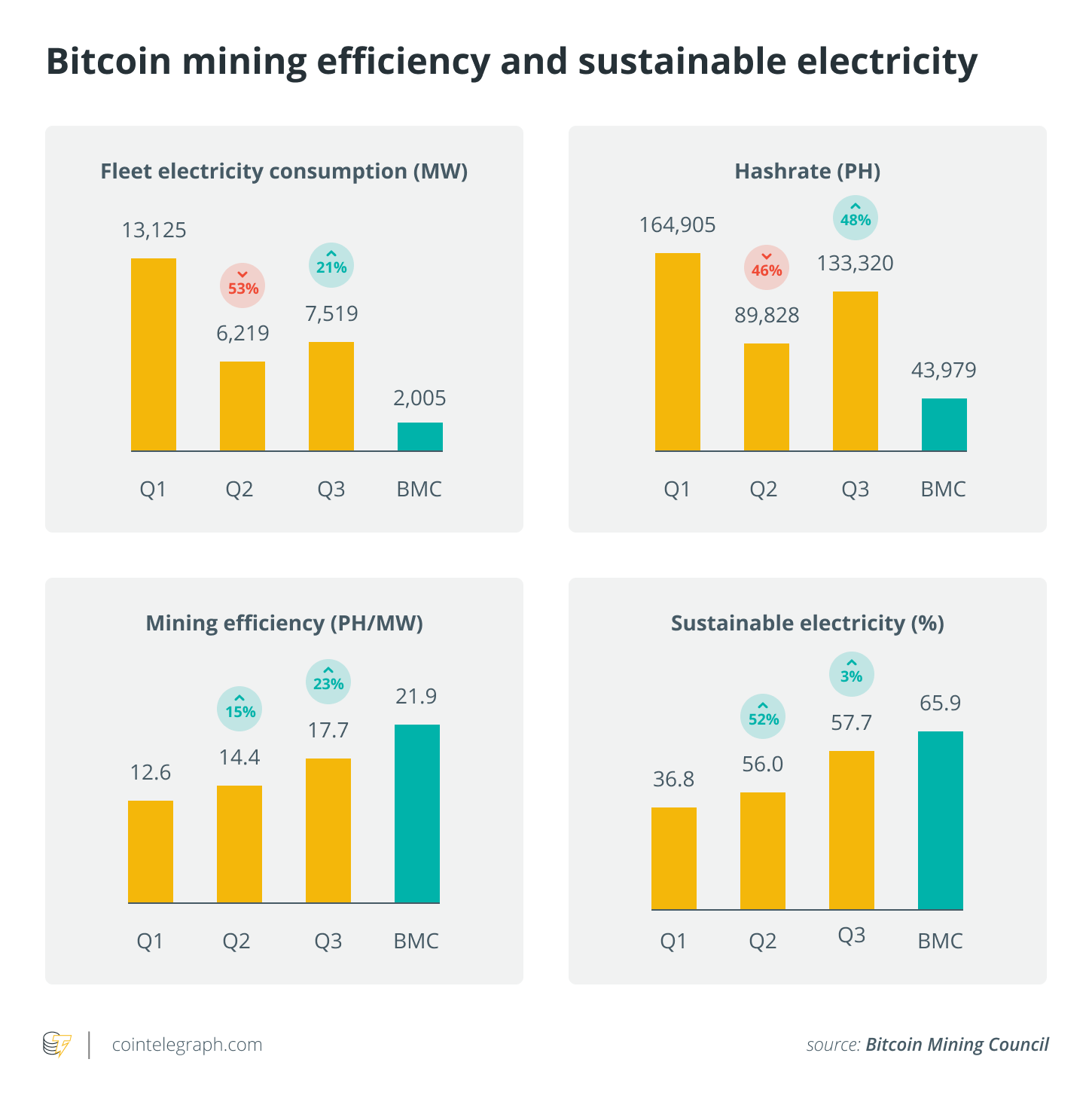

Cryptocurrency mining is the process of getting new tokens by solving complicated math problems with powerful computers that use a lot of electricity.

China, which used to be the world’s biggest crypto miner, shut down crypto miners in May 2021 because the value of cryptocurrencies was unstable. Profitability of mining companies is linked to the price of cryptocurrencies.

It’s true that Bitdeer, Saitech, Sharemine AI, and BitFuFu are all Singapore-based companies that mine cryptocurrency outside of the country.

Bitdeer and Saitech want to become public companies on Nasdaq.

Saitech uses the waste energy from mining to power homes, farms, and businesses.

They use clean energy that comes from hydroelectric and solar power to mine.

Shipping

A recent study by Nanyang Technological University in Singapore looked at the shipping industries in Singapore and China and found that digitizing shipping documents could cut more than 99 percent of the carbon emissions that come from paper documents.

People at PSA International, which runs world-class container ports in Singapore and Antwerp, are looking into using blockchain and digital assets to help them meet goals to cut back on pollution.

They are part of supply chain blockchain platforms TradeLens and GSBN, as well as Global eTrade Services, which sells its Open Trade Blockchain for documents.

An environmental, social, and governance project has been agreed to by PSA and a consulting firm in Singapore. The project will be carried out by the RHT Group of Companies.

Startups

Tribe Accelerator is a blockchain accelerator that was started by Trive Ventures, a venture capital firm in Singapore. Its main goal is to increase and speed up blockchain adoption in Asia, not just for financial applications.

It is the first one that the Singaporean government has helped fund (it is backed by MAS and Temasek).

All of these companies have also given money to the project. Citibank is one of them. IBM is another. BMW is another. Korea Investment Partners and Mandiri Investment Management Singapore, a subsidiary of Indonesia’s state-owned Bank Mandiri, are also backers.

So far, Tribe has given money to more than 30 businesses worth more than $1 billion.

In November 2021, Microsoft launched its Singapore GreenTech Challenge to help startups move faster in order to help Singapore meet its Green Plan.

Central bank digital currency

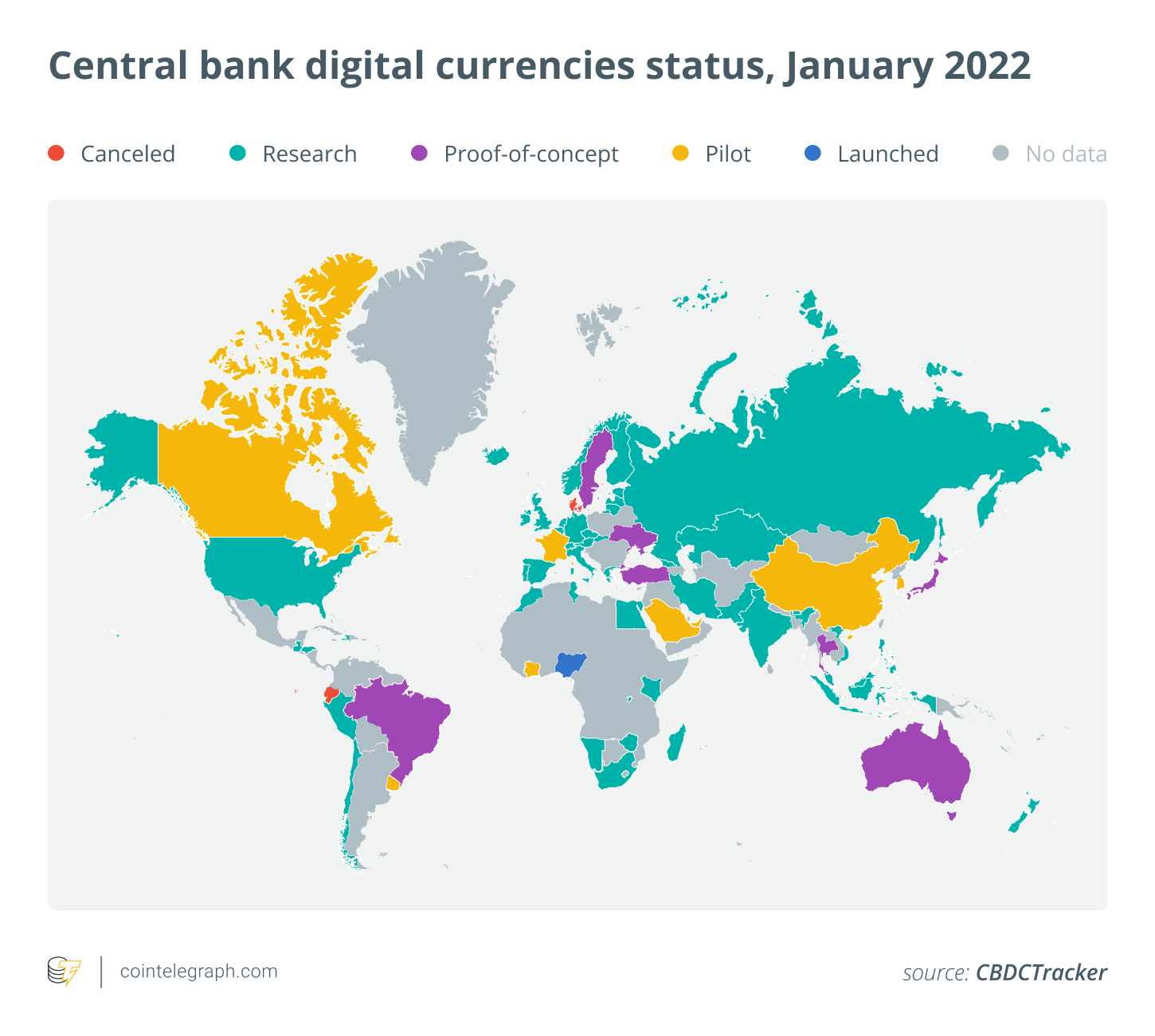

It says that Singapore is one of 87 countries that is looking into a central bank digital currency (CBDC) through its Project Ubin.

MAS has been testing CBDCs and talking about setting up multiple CBDC arrangements in order to speed up, cut costs, and be more transparent about cross-border payments, which MAS wants to improve.

It has made a prototype multi-currency wholesale settlement network that can be used to issue and distribute different CBDCs on the same network with help from China.

Nonfungible token

It was Singapore Art Week 2022, which ran from Jan. 14 to Jan. 23. At the S.E.A. Focus showcase, digital artists from Asia were celebrated in a first-of-its-kind nonfungible token (NFT) show.

It was the last weekend of Singapore Art Week, and the ArtScience Museum in Singapore opened its new show, „Radical Curiosity: In the Orbit of Buckminster Fuller.“ Adrian George, the director of programs and exhibitions and museum services at the ArtScience Museum, says that the show opened in conjunction with the last weekend of Singapore Art Week.

Richard Buckminster Fuller, an American architect, systems theorist, inventor, and author, was known as the „grandfather of the future“ by his fans. He predicted a technology that is very similar to the blockchain, which is the technology that makes cryptocurrency possible.

In a video from 1967, Fuller says:

“I’ll have to talk about something which will be one of the very big, new realizations by 2000 AD, which will be a realistic scientific accounting system of what is wealth. […] Wealth is energy.”

„Radical Curiosity: In the Orbit of Buckminster Fuller“ didn’t have any NFTs, but one of Fuller was made by Freeos and shared on Twitter, so you can see it here:

Just dropped this Buckminster Fuller #NFT to all of our #Freeos Beta Testers. Thank you everyone!https://t.co/yBXH5ZRJEu pic.twitter.com/zmyRKu64R1

— Freeos (@Freeos_dao) October 6, 2021

The views, thoughts and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of CoinNewsDaily.

Selva Ozelli, Esq., CPA, is an international tax attorney and certified public accountant who frequently writes about tax, legal and accounting issues for Tax Notes, Bloomberg BNA, other publications and the OECD.