Analysts and pundits will try to find a way to explain price movements during the day when important economic numbers are released, and this is common in the crypto sector.

When the U.S. Bureau of Labor Statistics said that the Consumer Price Index (CPI) rose by 7.5% on Feb. 10, traders looked for a link to the price of crypto.

However, historical correlation data shows that investors should be very careful about whether there is even a connection between Bitcoin (BTC) and major economic indicators.

General investment advice would say that traders should not pay attention to intraday movements, because most assets don’t trade 24 hours a day.

Bitcoin’s order book depth isn’t even close to gold, WTI, or the S&P 500 futures in terms of how big they are.

It doesn’t even matter how stablecoin trading is added in. Bitcoin’s 7-day average volume is $7 billion, compared to $54 billion for the three largest S&P 500 exchange-traded funds.

There is a chance that a lot of orders from a single person could make the cryptocurrency market look skewed in the short term. The impact on WTI oil, the S&P 500, and gold tends to be a lot less.

Does Bitcoin price anticipate inflation data?

The price of Bitcoin fell to $43,200 after the 7.5 percent rise in the U.S. consumer price index was announced on Feb. 10. This led CNBC reporters to link the two events.

Bitcoin dips slightly as 10-year Treasury yield tops 2% on hotter-than-expected inflation report https://t.co/bI8NzMQRPD

— CNBC (@CNBC) February 10, 2022

That statement was correct about the market at the time, but you should look at economic data over a longer period of time.

There’s also the possibility that Bitcoin doesn’t have a good price correlation with other things. This is also a hypothesis that needs to be tested.

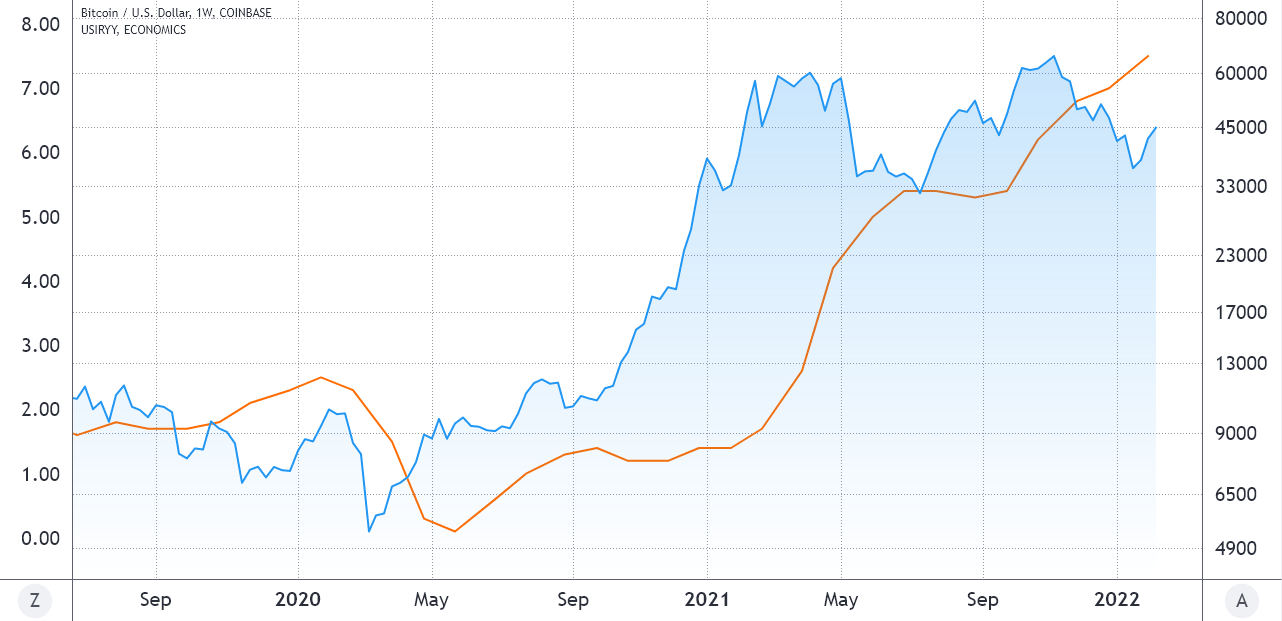

Using logarithmic charts, long-term charts of Bitcoin prices and U.S. inflation give the impression that they are linked and caused each other.

If anything, Bitcoin has been ahead of the economic data by about three months.

In September 2020, it rose above $11,000, while inflation data stayed below 1%. In May 2021, it rose again above $11,000.

After that, the price of Bitcoin „cooled off,“ and it didn’t break the $60,000 level. Two months later, the CPI rose by 5.4 percent.

Over the last year, the correlation coefficient between Bitcoin prices and U.S. inflation fluctuated between 0.95 and 0.94.

So, from a statistical point of view, it doesn’t make sense to link one to another.

Do traditional markets really show correlation with Bitcoin?

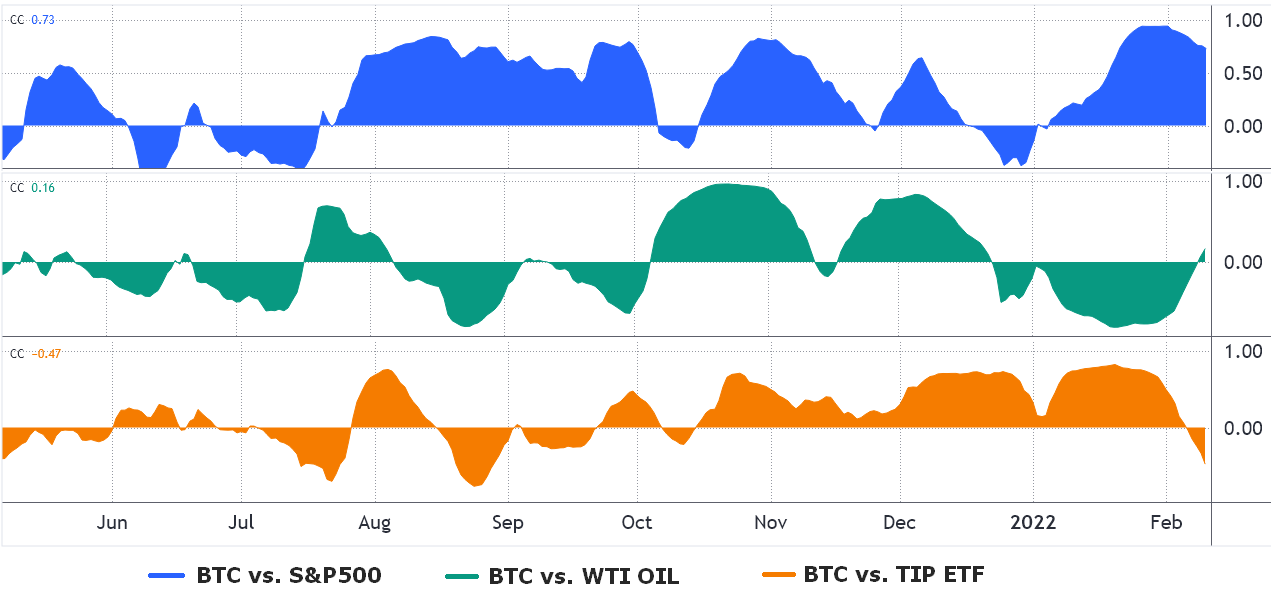

Another common mistake is to say that Bitcoin’s performance is linked to the performance of other assets.

There might be a few months in a year where there is a 0.65 (positive or negative) correlation, but the data doesn’t back this up.

Between August and September 2021, for example, the S&P 500’s correlation to BTC was 0.65.

However, that is a bad way to look at things, because a longer period of time doesn’t show that.

Other major assets like the WTI oil price and the iShares TIPS Bond ETF, which tracks an index of inflation-protected U.S. Treasury bonds, did not have a price relationship with Bitcoin’s value at all.

Investors should not pay attention to the price movements that happen during the day after economic data is released, according to a lot of different data points. At times, the data makes it look like correlation and causation are the same thing.

Inflation or other data can have an effect on short-term prices, but it doesn’t always have an effect on the long-term trend.

As shown in the correlation chart, Bitcoin isn’t like any other stock or bond.

The author’s thoughts and opinions are entirely his or her own and do not necessarily reflect those of CoinNewsDaily. Each investing and trading action entails risk; before making a decision, you should conduct your own research.