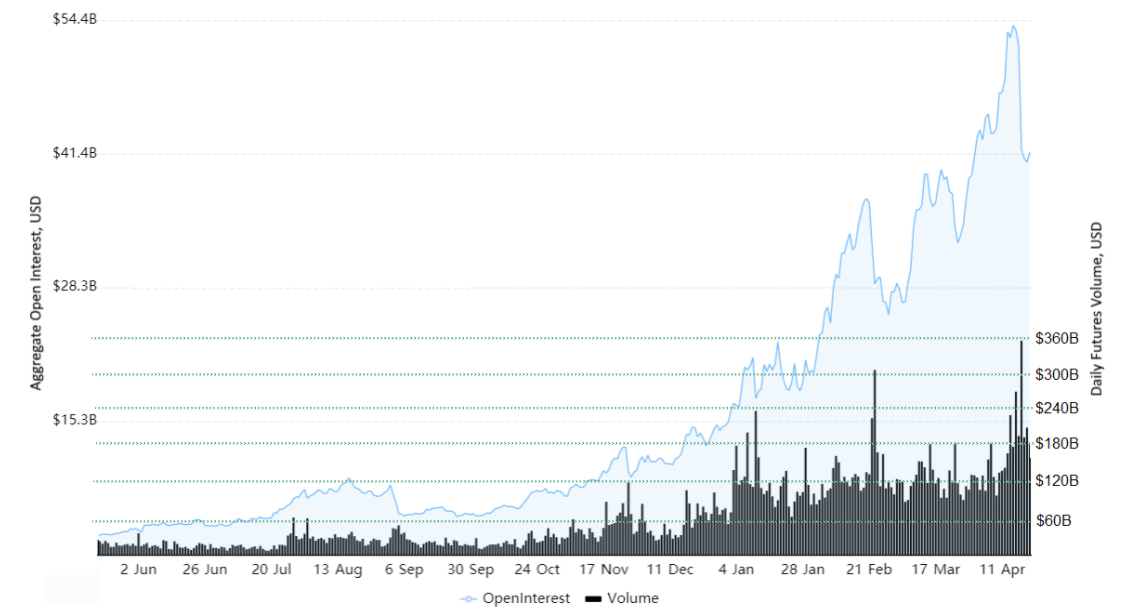

Futures contracts have been widely used by cryptocurrency traders for the last two years, as evidenced by the fact that total open interest in derivatives more than doubled in just three short months.

The fact that futures sales exceeded gold, a market with a daily volume of $ 107 billion and a long history, demonstrates their popularity.

However, each exchange maintains a distinct order book, index calculation, leverage limits, and rules for cross and isolated margins. These distinctions may appear insignificant at first glance, but they can have a significant impact on a trader’s needs.

Open interest

Aggregated futures open interest (blue) and daily volume (black). Source: Bybt

Aggregated futures open interest (blue) and daily volume (black). Source: Bybt

As illustrated above, the aggregate value of open futures positions increased from $ 19 billion to $ 41 billion today.

Meanwhile, the daily traded volume has surpassed $ 120 billion, a significant increase from the previous year’s $ 107 billion.

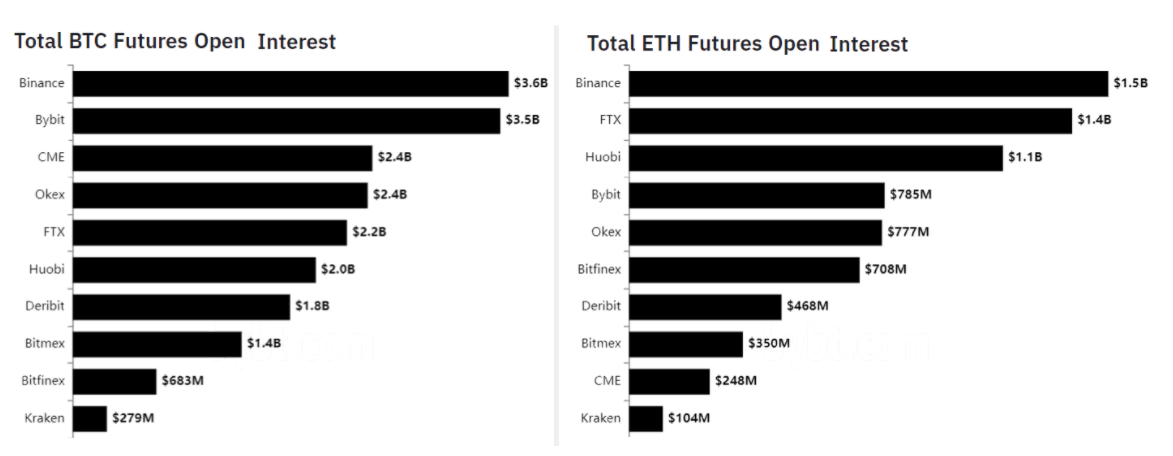

However, while Binance futures have the largest market share, a number of other exchanges have significant volumes and open positions in this space. These exchanges include FTX, Bybit, and OKEx.

Some differences between exchanges are immediately noticeable, for example:

FTX, for example, calculates unlimited contracts (inverse swaps) every hour, rather than the usual 8-hour window in the traditional market.

BTC and ETH futures Open Interest, USD. Source: Bybt

BTC and ETH futures Open Interest, USD. Source: Bybt

It should be noted that CME is the third largest provider of Bitcoin (BTC) futures, despite the fact that only monthly contracts are available.

A notable feature of the traditional CME derivatives markets is that they require a minimum 60 percent margin deposit, although brokers may offer leverage to certain clients.

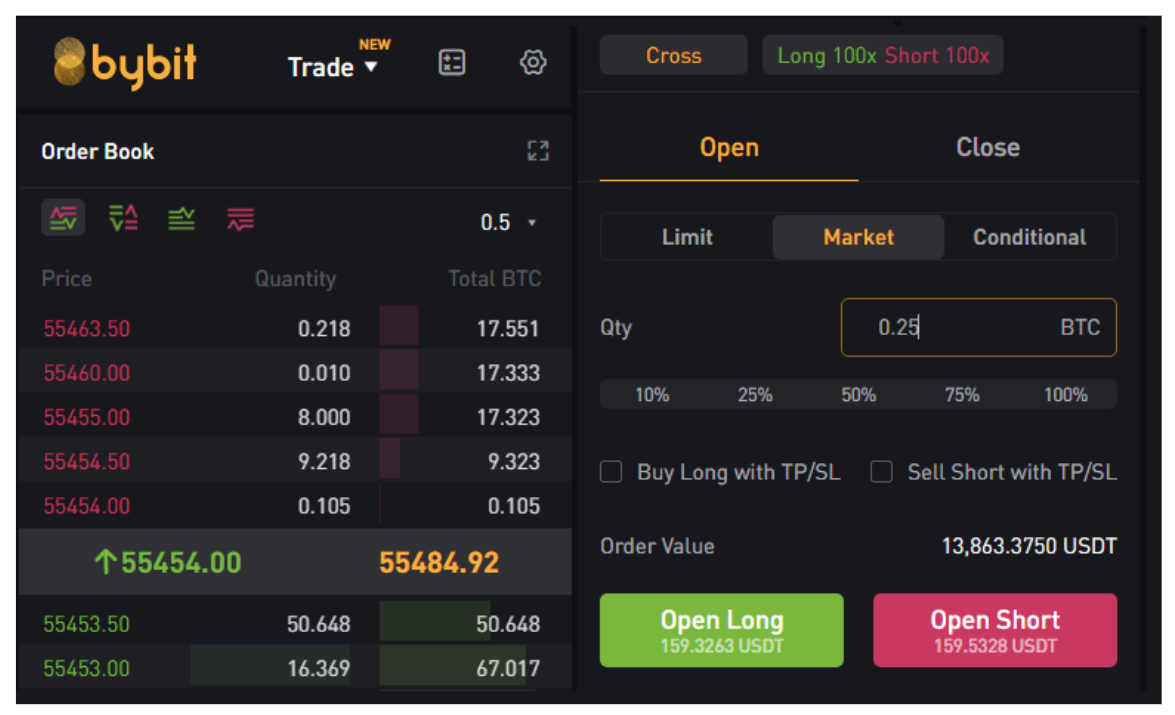

Stablecoin versus token-margined contracts

With cryptocurrency exchanges, the vast majority of them allow for leverage up to 100 times the amount of money that is invested in the cryptocurrency market. The majority of orders for Tether (USDT) are placed in Bitcoin, which is the cryptocurrency’s native currency. In contrast, inverse perpetual order books (token margined) are displayed in contracts that have a value of one dollar or a hundred dollars, depending on the exchange, and are displayed in contracts with a value of one dollar or a hundred dollars.

BTC Perpetual USDT Futures Order Entry. Source: Bybit

BTC Perpetual USDT Futures Order Entry. Source: Bybit

To place a Bybit USDT Futures order, a BTC-denominated amount is required, as shown in the preceding image, and the same procedure is followed at Binance.

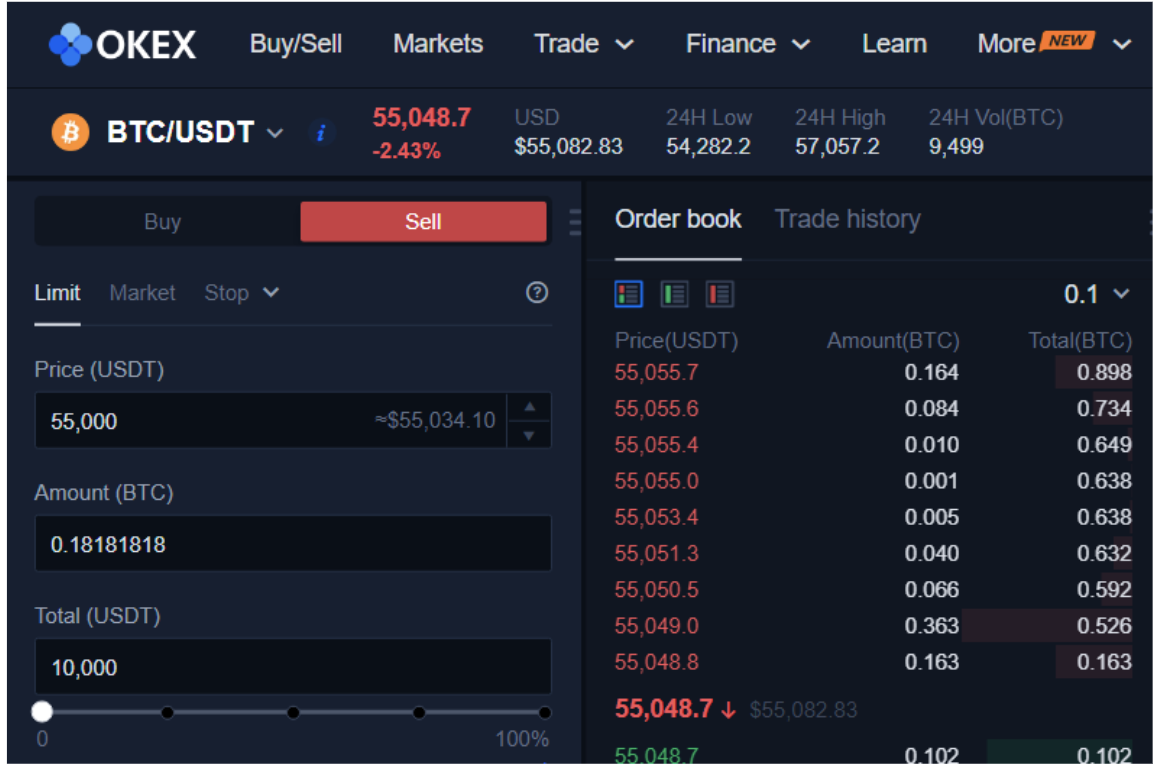

OKEx and FTX, on the other hand, provide customers with a more convenient option that allows them to enter a USDT amount and have it automatically converted to BTC terms.

BTC Perpetual USDT Futures Order Entry. Source: OKEx

BTC Perpetual USDT Futures Order Entry. Source: OKEx

In addition to contracts denominated in USDT, OKEx also offers a USDK pair. Similarly, Binance Perpetual Futures offers a Binance USD (BUSD) book in addition to its other products. For those who do not wish to use Tether as collateral, there are a variety of other options available.

Variable funding rates

Some exchanges allow clients to take advantage of extremely high leverage, which, while not posing a significant risk in terms of overall risk because there are liquidation engines and insurance funds in place to deal with these situations, will put pressure on the funding rate in the short term. As a result, long positions on these exchanges are typically penalized.

ETH Futures 8-hour financing rate. Source: Bybt

ETH Futures 8-hour financing rate. Source: Bybt

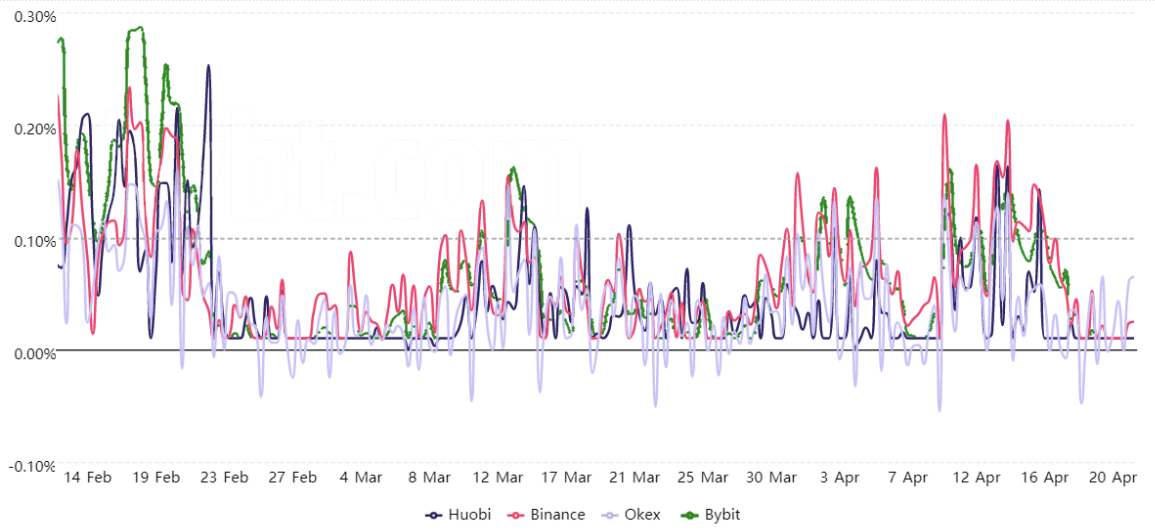

Following is a graph demonstrating that Bybit and Binance typically have higher funding rates, whereas OKEx consistently has the lowest funding rate.

Traders must be aware that there are no rules in place to enforce this, and that the rate may fluctuate between assets or take advantage of temporary spikes in demand.

Even a difference of 0.05 percent results in a 1% increase in costs per week, according to the study.

As a result, it is critical to compare the funding rate from time to time, particularly during bull markets, when the fee tends to increase at an alarming rate.

The views and opinions expressed are those of the author only and do not necessarily reflect the views of CoinNewsDaily. Every investment and trading step is associated with risks. You should do your own research when making a decision.

![naga review unveiling the platformac280c299s copytrading value proposition 1[1]](https://www.coinnewsdaily.com/wp-content/uploads/2022/04/naga-review-unveiling-the-platformac280c299s-copytrading-value-proposition-11-350x250.png)