After hitting 101 on April 20, the U.S. dollar currency index (DXY) fell sharply. This drop in the dollar hasn’t helped Bitcoin (BTC), which may be because the S&P 500 isn’t able to build on its strong rise on April 19.

This shows that Bitcoin is still very closely linked to the U.S. stock market.

Research says that even though Bitcoin’s price hasn’t moved much, this year will be a good year for the currency.

An Insider Intelligence report says that by 2022, the number of adult crypto users in the United States could rise from 28.3 million in 2021 to 33.7 million in 2022.

The number of people who use cryptocurrencies is also going up. This year, the number of people who use cryptocurrencies to buy things is going to rise to 3.6 million, which is a 70% rise.

This is another positive sign that could lead to more people using Bitcoin. Australian financial regulators have approved the first Bitcoin ETF, which will start trading on April 27.

The Australian Financial Review thinks the fund will get about $1 billion in new money.

If Bitcoin and some other altcoins keep going up, could the bears keep selling them.

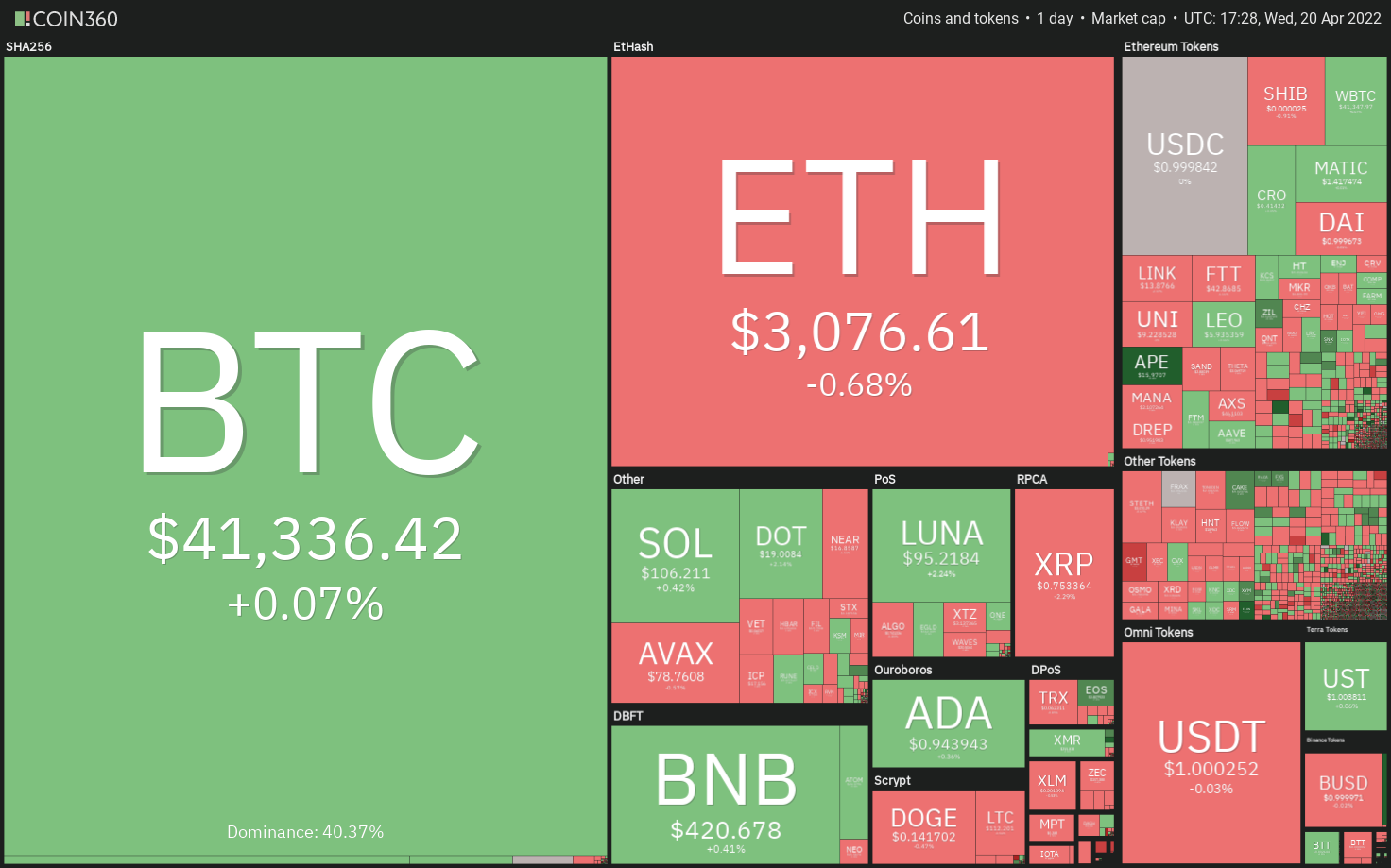

To find out, let’s look at the charts of the top 10 cryptocurrencies to see what they look like.

BTC/USDT

Bitcoin turned around quickly from $38,536 on April 18, which means that people are willing to buy it at lower prices.

A simple moving average (SMA) is a figure that shows how much a certain price has changed over time. The 50-day SMA is $42,000.

20-day EMA: It’s flattened out, and the relative strength index (RSI) is just below the middle, which means there’s a balance between supply and demand.

These two groups could have an imbalance if prices rise and stay above their 50-day SMA for more than a week.

That will make it more likely that the price will go up to $43,900.

If the bulls can get past this barrier, the momentum could pick up and the BTC/USDT pair could rise to the 200-day SMA ($48,052).

This is not true. If the price drops quickly from where it is now, it will show that bears are more active at higher prices.

Then, the sellers will try to get the pair to the support line of the ascending channel so that they can sell it.

ETH/USDT

ETH broke below the 50-day SMA (3,000) on April 18, but the bears couldn’t keep the price down.

There was a dip, but the bulls bought it. They then pushed the price back above the 50-day SMA.

On April 20, the price went above the 20-day EMA ($3,113), but the long wick on the day’s candlestick shows that bears will keep selling at higher prices.

The bears are now trying to keep the price below the 20-day EMA.

If they do well, the ETH/USDT pair could stay in a tight range between $2,883 and $3,166 for a while.

This tight range trading isn’t going to last very long, and it could lead to a big change in the range in the next few days.

After a break above $3,166, a possible retest of the 200-day SMA ($3,491) could open up.

BNB/USDT

The bulls bought when the price fell below the 50-day SMA ($408) on April 18. This shows that there is a lot of demand for lower prices.

On April 19, BNB broke above the 20-day EMA ($419), but the bulls are having a hard time keeping up the momentum.

Flat moving averages and an RSI just above the middle point suggest that the market will stay in a range for the time being.

In this case, the bears will try to get the BNB/USDT pair below the 50-day SMA again.

A break and close below $391 could lead to a fall to the strong support level of $350.

It could also be that, if the price bounces back off of the 20-day EMA ($419), the bulls will try to push it up above the strong resistance at $445 and try to break through the 200-day SMA ($471).

XRP/USDT

The long tail on Ripple’s (XRP) April 18 candlestick shows that there is a lot of buying at lower prices.

When the price hit the 50-day SMA on April 19, the bears fought hard to keep it.

If the price drops from where it is now, it will show that the XRP/USDT pair could stay in a range between the 50-day SMA and $0.69 for a while.

if the price breaks and closes below $0.69, it could open the door to a possible drop to $0.60.

If the price goes up, the bulls will try to push and keep the pair above $0.80.

If they can do that, the pair could rise to the area between the 200-day SMA ($0.87) and $0.91.

Because the flat moving averages do not give the bulls or bears a clear advantage, there isn’t a clear winner or loser in this case.

SOL/USDT

When Solana (SOL) hit a support line in an ascending channel on April 18, the bulls bought the dips to this level, which means they will do the same again soon.

The bulls took the price above the 20-day EMA ($107) on April 19, but they’re having a hard time keeping it there.

This suggests that the bears keep selling on every small rise in the market.

If the price breaks below the 50-day SMA ($101), the bears will try again to get the SOL/USDT pair below the ascending channel and back to $75.

If the price rises from where it is now, the bulls will try to break through the $122 level of overhead resistance.

It could be possible for the stock to rise to the 200-day SMA ($147) if this level is broken and then closed above.

ADA/USDT

It was April 18 when Cardano (ADA) broke below the immediate support level of $0.91. The bears could not keep the price down.

In this case, it looks like the bulls are trying to make a new low.

People who want to buy could push the price above the psychological level of $1, which could make the bullish momentum stronger.

The ADA/USDT pair could then rise to $1.10 and then come back to $1.26.

A break and close above this level will show that there is going to be a new rise in prices.

If the price turns down from the overhead resistance, the bears will try to pull the pair down again.

It could first fall to $0.87, and if this level breaks, the pair could fall even further to the strong support at $0.74.

LUNA/USDT

Terra’s LUNA token rose above $75 on April 18 and hit the 20-day EMA ($91) at the same time.

This means that people are still optimistic and traders are buying when the price drops.

On April 19, the relief rally continued, and the price hit the 50-day SMA ($93) for the first time in a long time.

The bulls will try to keep up the momentum and try to get the LUNA/USDT pair to $100.

If the bulls can get over this obstacle, the chances of a retest of the all-time high go up.

Bears, on the other hand, will try to make sure the price doesn’t fall below $100.

If they succeed, it will show that traders may be taking profits when the market goes up.

That could lead to a range for a few days.

Related: BTC and ETH will break all-time highs in 2022 — Celsius CEO

AVAX/USDT

Avalanche (AVAX) fell below the uptrend line on April 18, but the bears could not keep the price down.

When the bulls bought a lot, they helped the price recover, and it reached its moving averages.

The bears are putting up a fight at the moving averages.

If the price keeps going down, the bears will try to sink and hold the AVAX/USDT pair below the uptrend line again.

If they do well, the decline could go down to $65.

This is not true. If the price rises and breaks above the moving averages, it will show that there is a lot of demand from the bulls.

A possible rise to $99 could open up.

The bulls will have to get over this obstacle to show that an ascending triangle pattern is about to start.

DOGE/USDT

DOGE rebounded off the 50-day SMA ($0.13) again on April 18, which shows that the bulls are fighting hard to keep the level.

On April 19, the rebound broke above the 20-day EMA ($0.14), but the bulls are having a hard time keeping the prices above that level.

This means that the bears are selling when the price rises to the next level of resistance, which is at $0.15.

In this case, the bears will try to get the DOGE/USDT pair below the 50-day SMA again.

It might fall to $0.12 if they do well.

If the price goes up from where it is now and breaks above $0.15, the bulls will try to push the pair above the neckline.

As long as they do well, the pair will make an inverse head and shoulders pattern, which has a pattern goal of $0.25.

DOT/USDT

Polkadot (DOT) turned up on April 18, which means that the bulls are defending the $17 level.

It may be hard for the price to get through the moving averages. The price has hit them.

If the 20-day EMA ($19.15) and the 50-day SMA ($19.31) don’t move, that means there’s balance between supply and demand. The RSI is just below the midpoint, which means there’s a good balance between supply and demand.

In this case, the buyers might have the upper hand if the DOT/USDT pair breaks and holds above the 50-day SMA.

The pair will then try to break through the strong overhead resistance at $23.

However, if the price drops from where it is now, the bears will try to pull the pair back down to $17 and then to $16 again.

The author’s thoughts and opinions are entirely his or her own and do not necessarily reflect those of CoinNewsDaily. Each investing and trading action entails risk; before making a decision, you should conduct your own research. Market data is provided by HitBTC exchange.