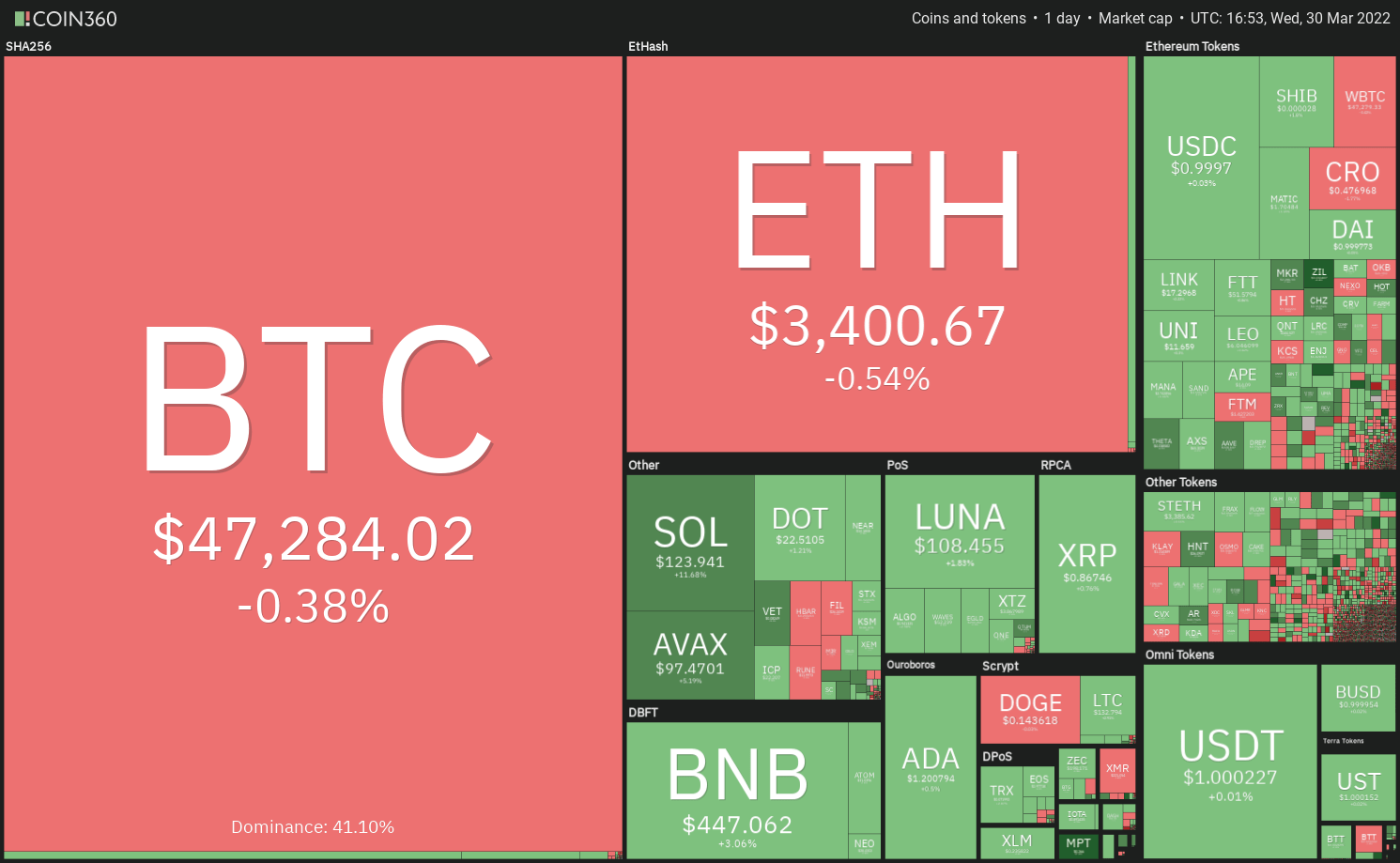

BTC’s (BTC) rally is taking a break near the 200-day simple moving average (SMA), and that has caused BTC and some other altcoins to either fall back or consolidate.

In the last few days, Terraform Labs has been buying a lot of Bitcoin for the company.

During the week of March 30, the wallet address, which has been thought to be that of Terra, received $139 million worth of Bitcoin, which brought its total to about $1.5 billion in BTC.

With Terra on its tail, MicroStrategy looks like it’s ready for the fight.

MacroStrategy, a subsidiary of the business intelligence company, has gotten a $205 million loan from Silvergate. The money will be used to buy Bitcoin, pay for general business expenses, and pay the fees and interest on the loan.

The people who want to buy aren’t just interested in the two companies.

Data from CoinShares shows that institutional investors put $193 million into digital asset investment products last week, which is the most money they’ve put in since early December of 2021.

With a lot of money coming in from institutional investors, could Bitcoin and the major altcoins break above their overhead resistance levels?

Let’s look at the charts of the top 10 cryptocurrencies to find out what they look like.

BTC/USDT

On March 28, Bitcoin reached the 200-day SMA ($48,288), but the bulls could not push the price above it.

They tried to get over the high bar again on March 29 and didn’t make it.

The bears will now try to push the price down to $45,400.

If the price moves back above this level, the bulls will try to push the BTC/USDT pair above the 200-day SMA again.

If they do well, the two could start their journey to $52,000.

An EMA that rose to $43,531 and an RSI that is close to the overbought zone show that bulls are in charge. This means that prices are likely to rise.

If the price turns down and falls below the 20-day EMA, this positive view will be false.

It might be possible for the pair to stay in the ascending channel for a few more days.

ETH/USDT

ETH broke and closed above the $3,411 level on March 29, but the bulls couldn’t get past the 200-day SMA ($3,488).

Bears haven’t yet given up, and they’re trying to stop the recovery at the 200-day SMA in order to keep it from going up.

If the price stays below $3,411, the bears will try to push the ETH/USDT pair down to the 20-day EMA ($3,042) if they can.

A strong rebound from this level will show that the mood has changed and people are buying when the market is down.

The bulls will try to push the price above the 200-day SMA again.

If they do well, the pair could rise up to $4,000.

If the price breaks below the 20-day EMA, it will show that traders may be hurrying to get out of the market.

The pair could fall to the 50-day SMA ($2,853).

BNB/USDT

In the short term, BNB trading has settled into a tight range between $425 and $445. This means that bulls have taken in the supply and are now trying to take over.

The upslope of the 20-day EMA ($409) and the RSI in the overbought zone show that the bulls are in charge.

BNB/USDT could rise to $467 and then $500 if they keep the price above $445.

Price can go the other way, too. If the price goes down and breaks below $425, then the pair could fall to its 20-day EMA.

People should keep an eye on this level because a break and close below it will show that the bullish momentum has slowed.

For a few more days, the pair could move between $350 and $445.

XRP/USDT

XRP broke above the level of $0.91 on March 28, but the bears didn’t let the price stay there for long.

This shows that the bears are fighting hard to keep the area between $0.91 and $1.

The bulls want to keep the price above $0.86.

A rise to $0.91 could happen again if they do well.

You might see more of a rise if this level breaks and closes above. That could open the door to a possible rise to $1.

If the price stays below $0.86, the bears will try to push the pair below the moving averages.

If they can do that, it will show that the bullish momentum has slowed down.

They could then fall to $0.70.

ADA/USDT

On March 28 and 29, Cardano (ADA) had a long wick on its candlestick. This shows that the price isn’t going to hit $1.26.

Bulls haven’t lost much ground.

People who look at the 20-day EMA ($1) and the RSI, which is in the overbought zone, say that the path of least resistance is to the upside.

If buyers push and keep the price above $1.26, the ADA/USDT pair could rise to the 200-day SMA ($1.51) and then to $1.60.

If the price drops below $1.15, the bears will try to get the pair to the 20-day EMA.

a break and a close below this level could send the pair to $0.74.

LUNA/USDT

Terra’s LUNA token broke and closed above the overhead resistance at $96 on March 28. Although the long wick on the day’s candlestick showed selling near $100, the bulls did not allow the price to break back below $96.

There was a lot of buying again on March 29. The bulls pushed the price above the all-time high of $105, which was set in January.

If the price stays above $105, the buying momentum could pick up. The LUNA/USDT pair could rise to $115 and then $125.

Because the RSI is showing signs of being negative, this isn’t a big deal, but it could be.

If the price drops below $105, the pair could fall to $96.

This is important for the bulls to hold on to because a break and close below it could make people even more likely to sell.

They could then fall to the 50-day SMA ($78).

SOL/USDT

For the last two days, Solana (SOL) has been above the $106 level. This shows that the bulls are buying.

If the price stays above $122, the SOL/USDT pair could start a new uptrend that could reach the 200-day SMA ($150).

As long as the bulls can get past this level, the rally could go up to about $180.

If the price turns down from where it is now and breaks below $106, it will show that the break above $122 may have been a bull trap.

Afterwards, the pair could stay stuck at $81 to $122 for a while.

AVAX/USDT

Two days ago, the wick on the candlestick was very long. This means that the bears are trying to keep the level at $98.

However, the bulls haven’t let Avalanche (AVAX) fall below the 20-day EMA ($85).

In this way, it looks like the traders aren’t in a hurry to get out of their positions.

The rising 20-day EMA and the RSI in the positive zone show that the bulls are in charge.

If buyers push the price above the $98 to $100 level, the AVAX/USDT pair could pick up speed and rise to $120.

Short-term, this positive view will be thrown out if bears keep the price below the 50-day SMA ($81).

Such a move will show that the pair could stay in the $65 to $98 range for a few more days.

DOT/USDT

Three days ago, Polkadot (DOT) ran into a lot of resistance at $23. The bulls haven’t given up ground to the bears, which is a good sign for the stock.

There is a good chance that the bulls are expecting a break above the high level of resistance.

This means that the path of least resistance is going up. The 20-day EMA ($20) is going up and the RSI is going up, which means that there will be less resistance going up.

If the price stays above $23, the DOT/USDT pair could pick up speed and rise to the 200-day SMA (29).

If the price goes down from where it is now and breaks below the 20-day EMA, it will show that the bullish momentum may be weakening.

They may stay between $16 and $23 for a while.

DOGE/USDT

March 28 saw the price of Dogecoin (DOGE) rise above $0.15. The long wick on the day’s candlestick shows that bears are selling at higher prices.

Moving averages have crossed in a positive direction, and the RSI is in the „bullish“ zone, which means that the bulls have the upper hand.

If the price moves up from where it is now and breaks above $0.15, the DOGE/USDT pair could rise to the overhead resistance at $0.17, where the bears may again try to stop it.

If the price keeps going down and breaks below the moving averages, it will show that the pair may stay in the range between $0.17 and $0.10 for a while longer.

The author’s thoughts and opinions are entirely his or her own and do not necessarily reflect those of CoinNewsDaily. Each investing and trading action entails risk; before making a decision, you should conduct your own research. Market data is provided by HitBTC exchange.