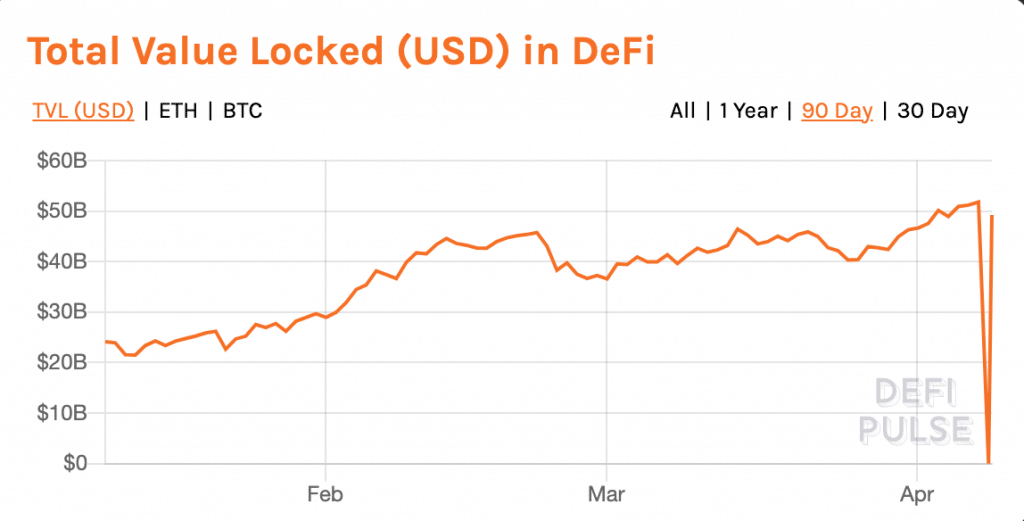

The initially quarter of 2021 was an eventful period for the DeFI earth. From January 1st to the finish of March, the ‘Total Benefit Locked’ (TVL), the sum of cash that is staying saved in DeFi protocols, rose from about $16 billion to extra than $49 billion.

Concurrently, a range of DeFi property have ongoing to carry out incredibly effectively. According to Information from Messari, at least 74 DeFi property have greater their worth by additional than 100% since the commencing of the year. 7 of these belongings have enhanced their worth by much more than 1000%.

Searching Ahead to Meeting You at iFX EXPO Dubai May well 2021 – Generating It Transpire!

The large efficiency of the DeFi place as a full seems to have created a type of ‘snowball effect’: the a lot more money that will come into DeFi, the a lot more new traders and customers it appears to be to attract. And so, the cycle carries on, or at minimum, that is what has been happening.

As we enter into Q2 of 2021, what’s upcoming for DeFi?

“Some Want to Be certain They Do not Skip Out on an Possibility to Make Income, Even though Other people Imagine in the Defi Mission and See It as the Potential of Finance.”

Nishank Khanna, Main Economic Officer of Explain Capital, told Finance Magnates that just one of the most crucial trends that will create this 12 months is the continual entrance of corporate investors into crypto property, which includes DeFi assets.

“Enterprises will carry on to obtain cryptocurrency,” Khanna explained to Finance Magnates. “Just like typical persons, enterprises have a concern of lacking out, as well. We can assume firms to continue on to make investments in cryptocurrencies for a couple motives. Some want to make certain they never skip out on an prospect to make revenue, even though other individuals think in the DeFi mission and see it as the long run of finance.”

“There is far more and additional buy-in from stakeholders who are impactful determination-makers and sector leaders, together with these at business corporations,” Khanna discussed to Finance Magnates.

Is DeFi Displaying Indications of Industry Maturity?

As additional of these massive traders enter into DeFi, the ecosystem could also start to show indicators of industry maturity.

Konstantin Richter, CEO and Founder of Blockdaemon, stated to Finance Magnates that: “there are escalating signals that it is by now beginning to enter a period of maturation with central banking companies and substantial businesses researching its prospective financial impression.”

“Although there are nevertheless kinks to be ironed out, specifically in regards its complicated UX and attracting a wider demographic of retail end users, DeFi is a tangible and completely ready for market place use-situation which has genuine potential to revolutionize our fiscal procedure.”

How just can DeFi revolutionize the monetary system as we know it? Clayton Weir, Main Tactic Officer of FISPAN, discussed that on a baseline stage, “decentralized finance (De-Fi) has remodeled banking for the foreseeable future and will be listed here to continue to be lengthy following the pandemic subsides.”

“While this technology is usually viewed from only a cryptocurrency lense, it goes further than this use situation,” he ongoing. “I consider decentralized finance to be a variety of finance that effectively cuts out intermediaries to streamline transactions. This is a section of the wider ‘Open Finance movement’ that is functioning towards a globally available alternative to each individual monetary support we use today from price savings to loans to insurance plan and a lot more.”

In other words and phrases, DeFi offers lots of of the identical fiscal services that banking companies do, but in a decentralized, autonomous manner. For example, “banks customarily accept deposits and provide loans to equally person and company shoppers as their lead giving, but De-Fi enables the borrowing and lending of cash on an even larger scale among unknown individuals and without the need of the middleman,” Weir defined.

“Third-bash purposes support provide loan companies and debtors together, devoid of an middleman necessarily finding included. The protocols are inclusive, and anybody can interact with them at any time, from any site, and with any forex sum.”

Is DeFi a Instrument for the “Rich to Get Richer”?

In truth, the expression ‘inclusive’ and the concept of inclusivity has been an vital component of the ethos of the DeFi planet. However, as much more institutional and company investors have ongoing to enter into the DeFi place, critics have pointed out that DeFi may possibly be a software to make the “rich get richer.”

For illustration, Chainflow’s Chris Remus wrote a piece on TheDefiant.io about how Evidence-of-Stake (PoS) algorithms, on which a lot of DeFi protocols run, add to centralization and make “the rich get richer.” In the tagline for a CoinDesk write-up, Crypto Author and Analyst, Leigh Cuen named DeFi “a whale’s match.”

Nevertheless, as Cuen wrote, that does not imply that “normies” are generating “life-altering amount[s] of money” from taking part in the DeFi universe.

Proposed article content

PayRetailers and CONMEBOL Sudamericana – Developing Solid BrandsGo to posting >>

In fact, Nishank Khanna told Finance Magnates that: “while DeFi is arguably helping the loaded get richer, there is a reduced barrier to entry when it will come to investing in cash.”

“Lower-prosperity men and women and communities have the opportunity to obtain cryptocurrencies and build wealth as well,” he stated.

And in fact, though DeFi “whales” and substantial institutional investors might have more cash to engage in with, there is practically no barrier to enter into the DeFi ecosystem.

Nick Pappageorge, Senior Analyst at Delphi Electronic, told Finance Magnates that: “everyone using these protocol-primarily based products and services is on even footing, so it’s not a loaded-getting-richer story.”

“DeFi is extra inclusive than the common technique due to the fact a lower-revenue individual receives addressed the exact same as a large corporation,” he mentioned.

Still, there is a learning curve when it comes to participating in and earning from DeFi: “the preliminary cohort of DeFi buyers in all probability have a tendency to be crypto-indigenous and perfectly-resourced,” Pappageorge explained.

“Little is in the way for decreased-prosperity men and women and communities to just take gain of these expert services specifically when fuel charges (a barrier to adoption that can necessarily mean each and every ‘click’ in just the DeFi app costs $10+) get decreased considerably with the upcoming enhance to Ethereum.”

Accessibility & Inclusivity in DeFi

For that reason, DeFi is in truth a great deal additional inclusive, or at the very least, has the possible to be a great deal additional inclusive, than the traditional economic method as we know it.

“DeFi is trustless and permissionless by default, this means that anyone can use the services,” Pappageorge spelled out. “In principle, this is substantially far more inclusive than the classic financial method where by the realities of credit scoring, restrictions, and financial gain motive imply specified consumer groups get superior phrases than others.”

“There is also a increased assure of liquidity and protection due to the fact the platforms controlling your dollars cannot abruptly determine to adjust the phrases,” he continued. “For illustration, I’ve found centralized exchanges all of a sudden end the buying and selling of a specific token pair arbitrarily, leaving traders not able to consider edge of the value action.”

There are also realistic and logistical things that make DeFi perhaps much more obtainable to broader groups of consumers. “DeFi is also digitally-native and 24/7, so you don’t have to have to wait around for small business hours to get access to a loan,” Pappageorge claimed.

Will DeFi Intersect with Standard Banking?

And certainly, this type of accessibility toward lending and other kinds of money products and services is what Pappageorge thinks has contributed so heavily to DeFi’s results.

“The most vital points becoming finished appropriate now are arguably in buying and selling and lending…Decentralized buying and selling and lending have develop into the backbone of the DeFi economic system.” Projects like Uniswap and Aave, for case in point, mimic the companies of real-earth companies these types of as Coinbase and BlockFi respectively, except with all these added gains. The means to borrow and trade is now opening up a lot of new opportunities in the area.”

And though the distinction concerning DeFi and the common economical system has been rather deep, it is doable that banking companies could eventually acquire a leaf out of the DeFi guide.

FISPAN’s Clayton Weir advised Finance Magnates that: “banks, in specific, are at an advantage when it will come to having advantage of DeFi mainly because they presently hold a huge volume of data about their consumers.”

“This is a substantial opportunity for banking institutions, as their function is evolving from storing money to distributing it, and they are ever more acting as a validator among a variety of decentralized ledgers using the information they previously have entry to,” he said.

“For instance, a lender has insights into a client’s overall payment community, which indicates that they are then able to rationalize and contextualize those people insights to later deliver them back to the customer in the type of an extremely potent person expertise to the shopper for potential earnings.”

Therefore, DeFi-driven fiscal expert services could just one working day grow to be the norm. “A substantial quantity of global financial institutions will turn out to be linked by this extremely highly permissioned and secure network exactly where they can communicate to each and every other about a wide range of information factors. But in the quick phrase, account validation is where the lender is key. In the foreseeable future, that is what will change the ease, the openness, the time and the execution expenses of how we go money internationally.”

“There is a big hard work close to the shopper/person expertise, and it’s not just related to furnishing classic banking services. It is about providing guidance, suggestions and choice-generating equipment — and the very best final decision-earning instruments are those that are driven by info.”

![naga review unveiling the platformac280c299s copytrading value proposition 1[1]](https://www.coinnewsdaily.com/wp-content/uploads/2022/04/naga-review-unveiling-the-platformac280c299s-copytrading-value-proposition-11-350x250.png)