More than the weekend, $10 million was stolen through an exploit on the Rari Capital decentralized economic protocol. A hacker manipulated a good deal to withdraw big quantities of ETH tokens, draining the protocol’s offer. Whilst Rari has already fashioned a program to compensate affected buyers, the exploit is only the hottest in a sequence of multi-million dollar thefts from decentralized finance platforms.

For example, before this yr, EasyFi dropped as significantly as $60 million through a vulnerability in its computer software also ForceDAO missing $367,000 in early April.

On the lookout Forward to Conference You at iFX EXPO Dubai May perhaps 2021 – Generating It Materialize!

Martin Gaspar, Research Analyst at CrossTower, instructed Finance Magnates that: “According to The Block, around $120 million of resources ended up stolen in DeFi hacks in 2020.” Even so, “This has by now been exceeded in 2021, with roughly $300 million of exploits so considerably,” he reported, citing the list of exploits taken care of by DeFi media platform Rekt.

In addition to hacks and exploits, the DeFi ecosystem has been targeted by regulators as a feasible breeding floor for funds laundering and other monetary crimes. Phony DeFi platforms have appeared and then promptly disappeared in a rising range of ‘rug pull’ cons.

What is triggering the increase in DeFi-associated cybercrime?

As DeFi Grows, Hackers and Criminals Are Subsequent the Dollars

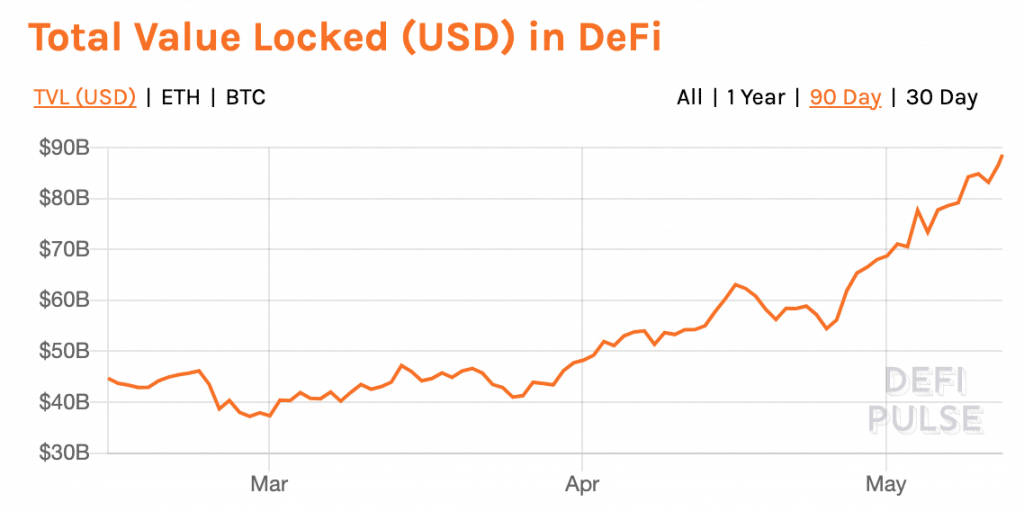

A person of the primary motorists, if not the key driver, of the expansion of criminal offense in the DeFi sector is the straightforward reality that DeFi is increasing more substantial and larger. Gaspar said that: “higher full worth locked (TVL), or deposits, throughout DeFi protocols in 2021, may perhaps be even more incentivizing attackers.”

Indeed, on January 1st, 2021, there was $15.1 billion ‘locked’ into DeFi protocols. At press time (just around five months later), that determine had ballooned to extra than $88.6 billion.

As DeFi has developed, hackers have adopted the income. Monica Eaton-Cardone, Co-Founder and Chief Operating Officer of Chargebacks911, informed Finance Magnates that without the need of intervention, this pattern could continue unabated: “If selling prices start to climb, we’ll see a big migration to DeFi platforms,” she said.

Parallel phenomena can be observed with the development of the cryptocurrency marketplace in standard. As current market caps acquired bigger, crime received even bigger. Furthermore, “Last 12 months, when the COVID lockdowns pressured tens of millions of people to rely on eCommerce and home deliveries for the 1st time, there was a significant increase in cybercrimes,” Eaton-Cardone pointed out. “Online shoppers were defrauded for the reason that they didn’t definitely comprehend how the electronic earth worked.”

Likewise, as additional new end users continue on to enter the DeFi room, they could turn out to be a more substantial target for malicious actors. “Bluntly mentioned, inexperienced shoppers make faults and are a lot more vulnerable to fraudsters and robbers,” Eaton-Cardone stated. “If tens of millions of inexperienced traders migrate to DeFi platforms, the cybercriminals will definitely be waiting around.”

“Crypto-hackers are presently stealing billions every year have confidence in me, they are salivating at the prospects of a speedy influx of new, inexperienced targets. Defi is not exactly straightforward for anyone to use. There are complexities that can–and most unquestionably will–lead to costly faults.”

Remaining Secure in the DeFi Globe

In addition to new customers, the proliferation of DeFi platforms has led to the development of many new DeFi platforms. As these, some analysts have in contrast the DeFi increase to the ICO bubble of 2017 when quite a few new assignments ended up designed and deserted as hard cash grabs.

While the scenario is not solely the similar, the simple fact continues to be that not all DeFi platforms are made equal. As such, some could be much far more vulnerable to assault than other folks. Fintech consultant Gaurav Sharma, who is the founder of BankersByDay.com, informed Finance Magnates that some platforms may perhaps have “scrambled to upscale their on the internet functions and didn’t have adequate time to secure and loopholes.”

As these kinds of, Gaspar reported that: “The most common crime looks to be exploits in which an attacker works by using a function in the code in a way that its developers and auditors forgotten.”

“This normally enables them to swap property in pools for a higher quantity than was intended to be feasible, or to only withdraw funds from a protocol,” he claimed.

Recommended article content

Additionally500 Reaffirms its Dedication to Social ResponsibilityGo to post >>

As a result, there is even now a substantial total of ‘buyer beware’ in the DeFi space, users have to go previously mentioned and beyond the surface to keep risk-free in the decentralized finance ecosystem: “A superior technique to being risk-free is to only use DeFi protocols that have several audits and that have not skilled an exploit for at least several months,” Gaspar mentioned.

“That getting said, there is generally a risk that even the most tried and examined protocols could be exploited by some means.”

“The Big Unsolved Trouble Is What Evolving Regulatory Demands Will Suggest.”

And undoubtedly, whilst there are DeFi platforms that may have unintentionally (or intentionally) been still left vulnerable to exploit, inside market security requirements are slowly but surely developing for DeFi.

Doug Schwenk, the Chairman of Electronic Asset Investigate (DAR), instructed Finance Magnates that: “Certainly the sophistication in structure and build [of DeFi protocols] are improving upon.”

Hence, “The massive unsolved issue is what evolving regulatory requirements will suggest,” he continued.

“FATF has lately produced a session for comment that could indicate decentralized exchanges, and other DeFi methods would need to have to apply classic money institution compliance, these types of as KYC and AML,” he stated, adding that: ”Those modifications would require a pretty substantial new method by DeFi platforms if they come to pass.”

Indeed, they would. At the moment, 1 of the advertising details of most DeFi platforms is that they can be made use of totally anonymously. On the one hand, this removes limitations to entry for individuals who may not have the implies to recognize themselves in accordance to traditional monetary business benchmarks. On the other hand, this may well permit dollars laundering and other forms of fiscal criminal offense to go unchecked.

“Defi platforms are appealing, at least in part, simply because they bypass particular banking regs,” Eaton-Cardone explained to Finance Magnates. “Anyone with a smartphone can lend or borrow. Client verification isn’t as strict. So, by their extremely character, DeFi platforms are going to be far more susceptible.”

“It’s a tricky balancing act simply because we covet the financial freedoms that appear with currently being unregulated, but at the exact time, customers hope the protections that can only appear with regulations.”

As this sort of, Schwenk claimed that: “The greatest concern by regulators may perhaps be funds laundering, which is complicated to show or disprove with the commonly out there info, while some corporations are tackling it.”

And in truth, a wave of regulation could be headed straight for DeFi. Gaspar told Finance Magnates that: “Law enforcement has been investing in blockchain analytics methods that can track consumer activity on general public blockchains.”

“In addition, The Economic Action Task Power (FATF) has suggested in modern assistance that virtual asset provider providers (VASPs), which could involve DeFi protocols, could will need to acquire information on the people that interact with them.”

When the Mother nature of the Cyberthreat Variations, the System Need to Improve with It

The bottom line is this: as DeFi grows, the quantity of criminal offense will also develop. Consequently, the amount of money of regulation will proceed to improve in an attempt to keep regulations in check out.

“Cybersecurity is an eternal, never ever-ending match of cat and mouse, with both equally sides frequently striving to a person-up the other,” Eaton-Cardone stated. “But in today’s game, each sides are trying to make the superior mousetrap. Each sides are investing in R&D. It is turn into a hi-tech arms race, with the excellent fellas using know-how to develop and secure, and the bad men working with engineering to infiltrate and reverse-engineer. “

“Nobody understands for guaranteed what the different monetary platforms will search like in 10 a long time, but I warranty you, they’ll look strikingly different than they do currently for the reason that the cyberthieves will have rendered our existing platforms out of date,” she continued. Codes can be stolen, compromised and cracked. Regrettably, time is on the aspect of the criminals.

“When the mother nature of the cyberthreat alterations, the platform should transform with it, or perish due to the fact of it.”

![naga review unveiling the platformac280c299s copytrading value proposition 1[1]](https://www.coinnewsdaily.com/wp-content/uploads/2022/04/naga-review-unveiling-the-platformac280c299s-copytrading-value-proposition-11-350x250.png)