The cryptocurrency markets have gained 12.5 percent in the last seven days to achieve a market capitalisation of $2.44 trillion. That move, however, does not appear to inspire confidence, given the same level was tested 16 days ago following Ether’s (ETH) attempt to break $3,650 over the next six days.

Regulation appears to be a major source of anxiety for buyers, as the US House of Representatives is slated to vote this month on a $1 trillion infrastructure bill.

Along with specifying who qualifies as a broker, the legislation would impose anti-money laundering (AML) and know-your-customer (KYC) rules on a variety of different types of bitcoin transactions, which might be detrimental to DeFi protocols.

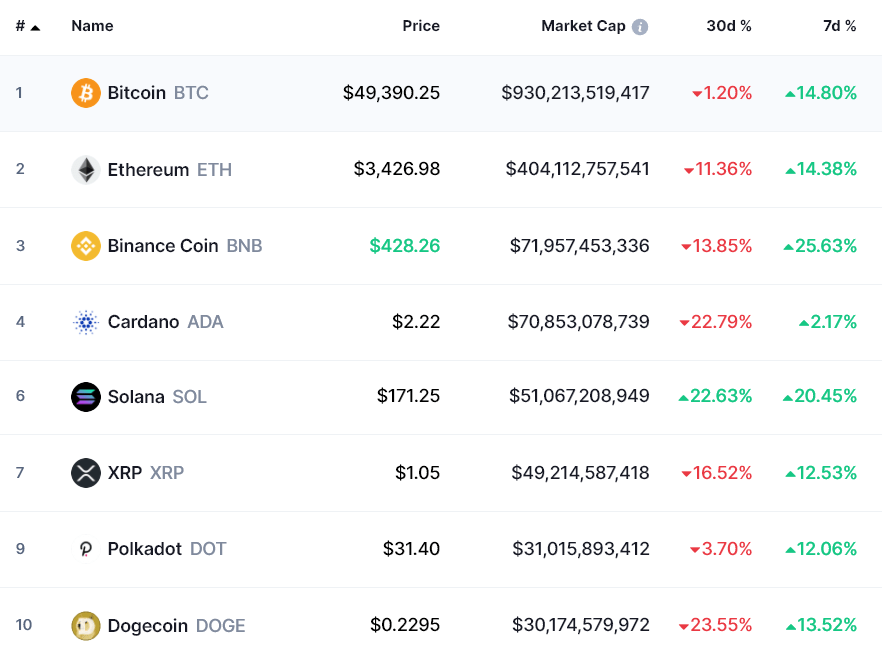

As shown in the chart above, the poor performance of the top ten cryptocurrencies has had a negative impact on investor mood during the previous 30 days. As a result, it is critical to consider more than simply the nominal price of Bitcoin (BTC) while evaluating the cryptocurrency. Traders should also look at Bitcoin’s derivatives indicators, such as the futures markets premium and the options skew, for additional insight.

The futures premium shows traders are slightly bullish

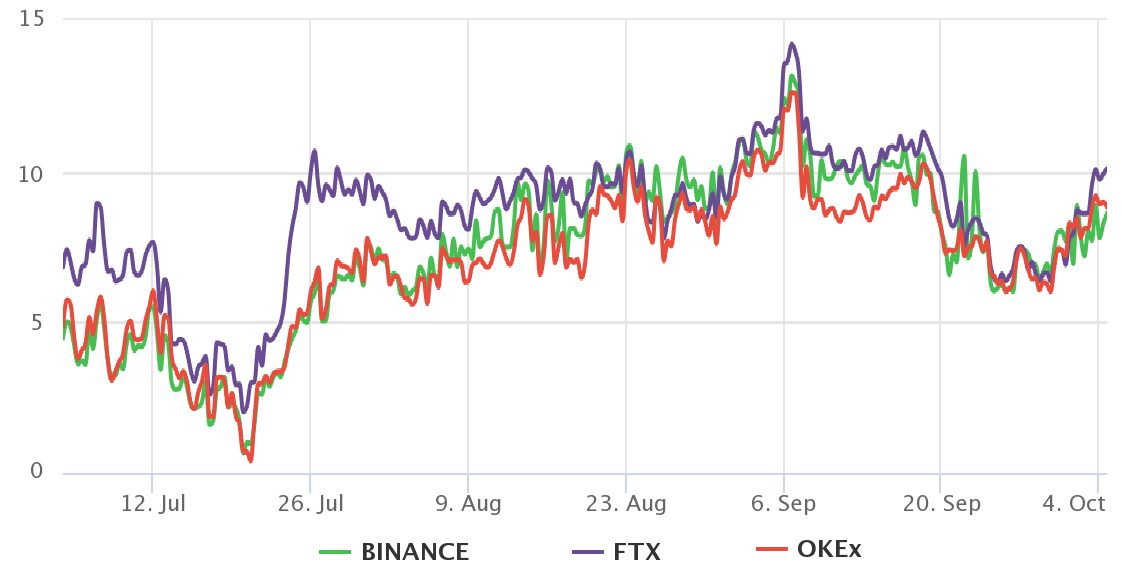

The basis rate, which is also known as the futures premium, is a measure of the difference between the prices of longer-term futures contracts and the current spot market prices.

In healthy markets, a 5 percent to 15 percent annualized premium is predicted, which is referred to as contango, which is a state of equilibrium. This price disparity is the result of sellers requesting more money in order to defer payment for a longer period of time.

As shown in the chart above, the current annualized premium of 9 percent is neutral, but it represents an improvement over the previous couple of weeks. Because traders remain cautiously optimistic, there is room for additional long leverage when trust has been restored to its full extent.

Options traders exit ‚fear‘ mode

It is necessary to examine the options markets in order to rule out externalities that are peculiar to the futures instrument.

The 25 percent delta skew is used to evaluate options that are similar in both call (buy) and put (sell) characteristics. When „fear“ is common, the measure will turn positive because the premium for protective put options is higher than the premium for similar risk call options.

When market makers are optimistic, the converse is true, and the 25 percent delta skew signal shifts from the positive to the negative territory. Readings in the range of -8 percent to +8 percent are typically considered to be neutral.

On September 25, as the $41,000 support level was repeatedly pushed, Bitcoin option traders entered the „fear“ zone, according to the chart. A significant shift has occurred, however, since the 30th of September, and the indication is currently located in the neutral zone.

Currently, both the futures basis and the options 25 percent skew indicate that the „glass half full“ scenario is likely to play out in the short term. In other words, even if Bitcoin has reached its highest level in 27 days and is trading over the $50,000 resistance, there is still potential for buyers to pile on more leverage before metrics begin to indicate overexposure and/or overconfidence.

When compared to the current dearth of derivatives data, a $50,000 breakout would be regarded as a sign of weakness. However, given the fact that the overall crypto capitalization is still at the same level as it was 30 days ago, as well as the unabated regulatory concerns, there is little reason to be concerned. No indicators of bearishness are currently visible on either the futures or the options markets at this time.

The author’s thoughts and opinions are entirely his or her own and do not necessarily reflect those of CoinNewsDaily. Each investing and trading action entails risk; before making a decision, you should conduct your own research.