Crypto markets have misplaced approximately 30 p.c off of their complete market place capitalization around the earlier seven days. As crypto rates carry on to tumble, and traders scramble to close their volatile holdings, the stablecoin industry is surging: according to CoinTelegraph, the complete stablecoin supply has grown by approximately 190% more than the earlier 90 days. However, not all stablecoins are made equivalent.

Amidst the valuation bloodbath, centralized stablecoins are executing greater than ever–Tether (USDt) and Centre’s USD Coin (USDC) are respectively #3 and #10 in CoinMarketCap’s list of largest cash by marketplace cap. Facts from CoinGecko demonstrates that collectively, the two coins keep about 80% of all stablecoin industry capitalization.

Wanting Forward to Conference You at iFX EXPO Dubai Might 2021 – Creating It Occur!

Though these centralized stablecoins are undertaking perfectly amidst the crypto marketplace crash, algorithmic stablecoins are one more story. Algorithmic stablecoins maintain their benefit by mechanically escalating or reducing their personal provide or the supply of the asset to which they are pegged. Even so, according to CoinTelegraph, some of these coins have dropped their pegs.

“This Also Shall Pass”?

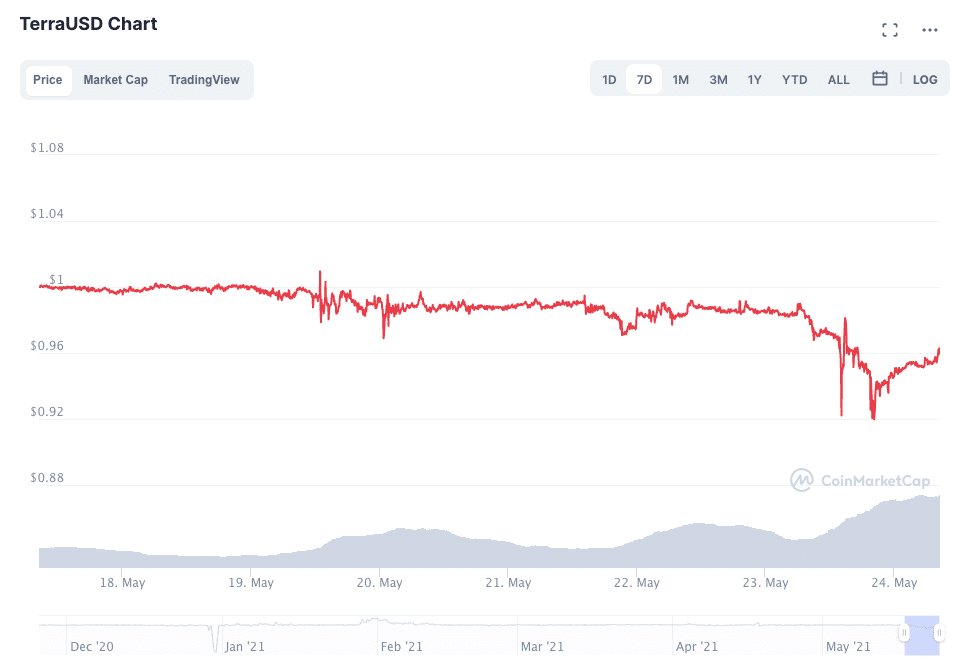

For instance, TerraUSD (UST), which is tied to the LUNA coin, was sitting about $.95 at press time, acquiring fallen as very low as $.92 on Sunday, May perhaps 23rd. The Twitter account associated with decentralized liquidity protocol, THORChain claimed that the asset was staying ‘stress-tested’, and urged followers to ‘Back the builders’.

Terra founder Do Kwon and “team/backers have their fingers on the pulse and are transferring rapidly,” THORChain wrote.

Do Kwon reported in a tweet on May 23rd that when the Terra financial state was suffering from tension “none of the fundamentals in [the Terra ecosystem] have improved. asserting the venture has been. “The ecosystem is considerably de-risked for obtaining survived a person of the worst industry crashes in crypto,” he wrote.

17/ In my see, none of the fundamentals in this ecosystem have changed:

1) the same applications are becoming formulated

2) the exact same robust neighborhood exists

3) the ecosystem is significantly de-risked for acquiring survived one of the worst marketplace crashes in cryptoProposed posts

Leicester Metropolis and FBS Announce Report New Principal Club PartnershipGo to report >>

— Do Kwon ? (@d0h0k1) May 23, 2021

“Building pure, impartial and decentralized revenue is the prolonged video game,” Kwon mentioned.

The Terra Twitter account wrote that: ”Our group will arise more powerful from this ephemeral market turmoil. This much too shall go.”

I suggest I’m assuming it is mainly because it’s an algorithmic stablecoin, it has to frequently burn/mint UST/LUNA to preserve its peg. I have normally noticed it occur again to a greenback tho, so not fearful.

— Kunal ? (@expl0sev) Might 21, 2021

Nonetheless, not everyone is persuaded. A single Terra follower wrote that: “What is scaring me is that $UST has not retained its peg to the greenback. It keeps peaking below a greenback and falling again down. Any explanations?? (sic)”

Nevertheless, yet another consumer stated that: “it’s since it’s an algorithmic stablecoin, it has to regularly burn up/mint UST/LUNA to retain its peg. I have usually seen it arrive back to a greenback tho, so not worried. (sic)”

Other algorithmic stablecoins are even more away from their $1 concentrate on pegs. CoinTelegraph described that Ampleforth (AMPL) fell to $.48 on Could 23rd, its most affordable level in an whole year. On the other hand, the Ether-backed RAI algorithmic stablecoin has managed to remain comparatively near to its focus on peg of $3 during the current market crash.

![naga review unveiling the platformac280c299s copytrading value proposition 1[1]](https://www.coinnewsdaily.com/wp-content/uploads/2022/04/naga-review-unveiling-the-platformac280c299s-copytrading-value-proposition-11-350x250.png)