The price increase has been linked to a variety of factors, including the US consumer price index, the exchanges‘ reduced supply, and a bullish continuation chart shape known as a „cup and handle.“

Traders are unlikely to come up with a reason for the abrupt change, other than investors restoring confidence following the Sept. 19 slump attributable to contagion fears surrounding China-based property developer Evergrande.

The Ethereum network has come under fire for its $20 or more transaction fees associated with nonfungible token (NFT) sales and decentralized finance (DeFi) activity.

Cross-chain bridges connecting Ethereum to proof-of-stake (PoS) networks have been addressing this issue partially, and the debut of the Umbrella network oracle service on Friday demonstrates how quickly interoperability is progressing.

Additionally, China’s announcement of even harsher laws last week had a favorable effect on the volumes seen at decentralized exchanges (DEX).

Centralized cryptocurrency exchanges, including Huobi and Binance, suspended operations to Chinese residents, prompting a huge outflow of coins.

Simultaneously, this spurred activity on Uniswap and dYdX, a decentralized derivatives exchange.

Despite this volatility, there are still reasons for investors to be bullish on Ether at the end of the year.

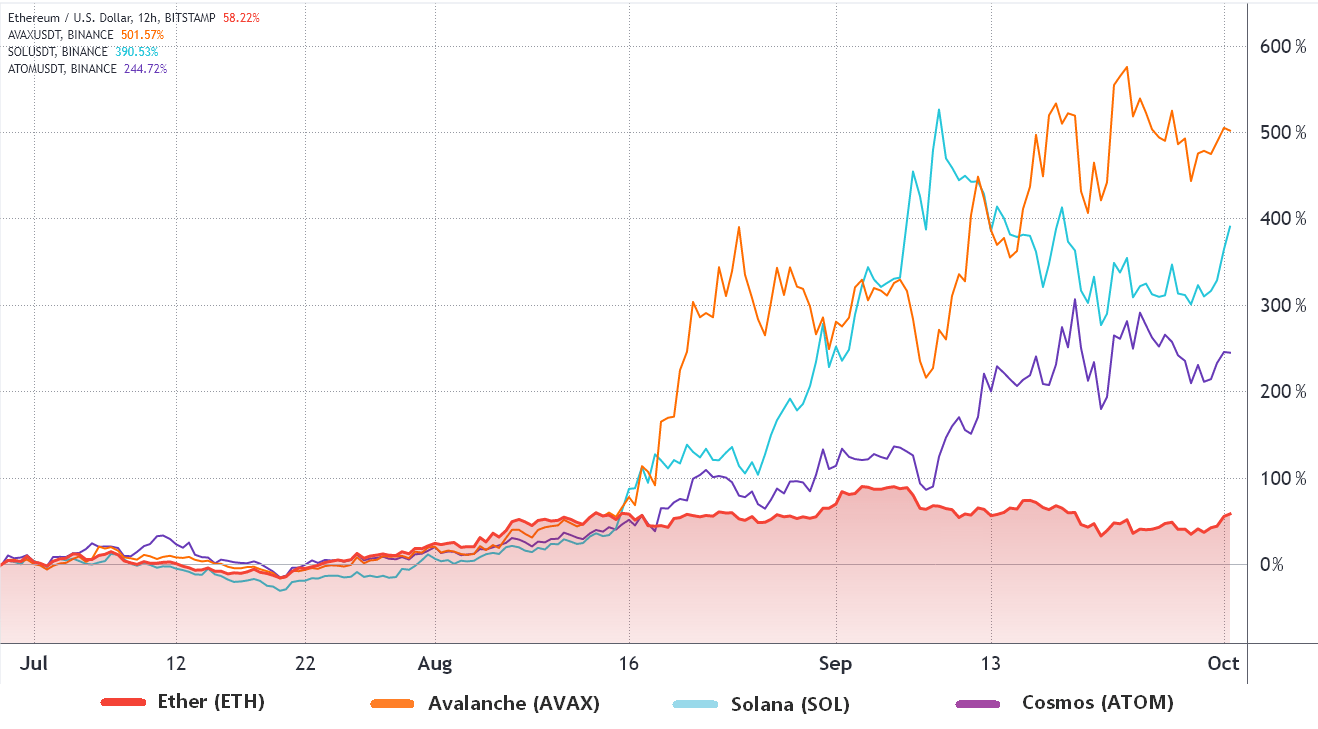

Simultaneously, the constraints imposed by Ethereum layer-1 scaling have resulted in some of its competitors posting strong improvements over the last few months.

Take note of how Ether’s 58 percent positive performance over the last three months is much lower than that of new Proof-of-Stake (PoS) solutions that support smart contracts and interoperability.

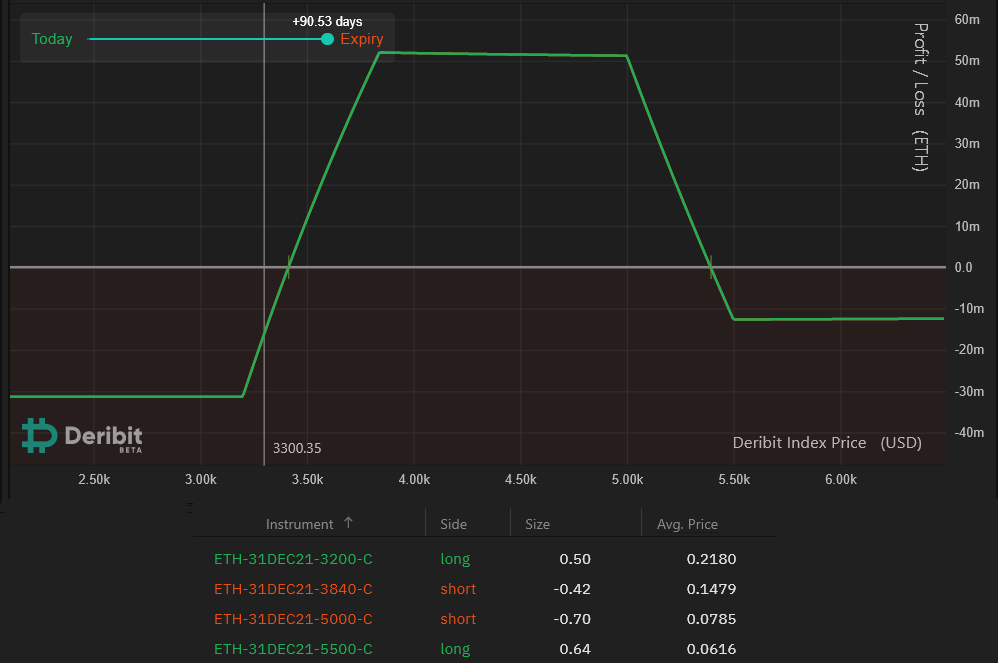

Bullish traders who believe Ether’s price will break to the upside but are unwilling to take on the liquidation risks associated with futures contracts may find the „long condor with call options“ approach to be more advantageous.

Consider the strategy in greater detail.

Options are a safer bet for avoiding liquidations

Options markets offer greater freedom for developing unique strategies, and there are two available instruments.

The call option protects the buyer from price increases, whereas the protective put option protects the buyer from price decreases.

Additionally, traders can sell derivatives to generate infinite negative exposure, similar to a futures contract.

This long condor strategy is due to expire on Dec. 31 and employs a slightly bullish range.

The same basic structure can be used for other time periods or price ranges, with some adjustments to the contract amounts.

While Ether was trading at $3,300 at the time of the pricing, a similar outcome can be obtained starting with any price level.

The first trade entails the purchase of 0.50 contracts of $3,200 call options in order to establish positive exposure over this price level.

The trader must next sell 0.42 ETH call option contracts to cap gains above $3,840.

Additional 0.70 call option contracts should be sold to further limit gains above $5,000.

To complete the strategy, the trader must purchase 0.64 call option contracts that provide upside protection above $5,500 in the event that the price of Ether skyrockets.

The 1.65 to 1 risk-reward ratio is moderately bullish

While the approach may appear complicated to execute, the needed margin is simply 0.0314 ETH, which also serves as the maximum loss.

If Ether trades between $3,420 (up 3.6 percent) and $5,390, a net profit is possible (up 63.3 percent ).

Traders should keep in mind that if there is sufficient liquidity, it is also feasible to close the trade prior to the Dec. 31 expiry.

At 0.0513 ETH, the maximum net gain is between $3,840 and $5,000, which is 65 percent greater than the maximum loss.

With more than 90 days until the expiration date, this method provides the holder with piece of mind, as it does not involve the danger of liquidation associated with futures trading.

The author’s thoughts and opinions are entirely his or her own and do not necessarily reflect those of CoinNewsDaily. Each investing and trading decision entails some level of risk. When making a decision, you should perform your own research.