It was April 11 when Ether (ETH) lost the psychological support level of $3,000 after a 16 percent drop in weekly performance.

On April 11, $104 million worth of leveraged long futures were sold. Bulls were shocked.

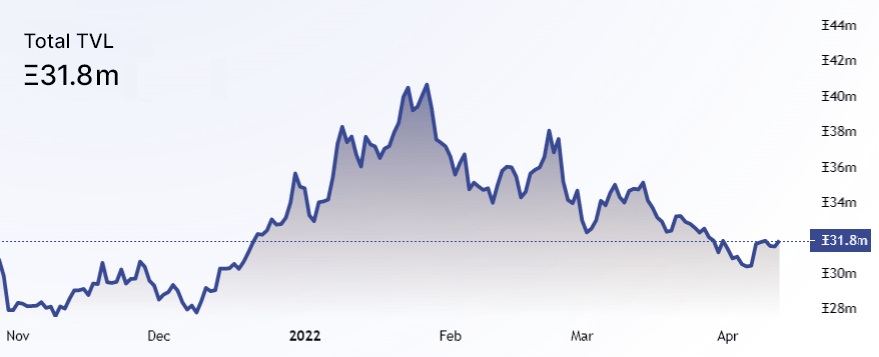

Ether’s downturn was also caused by a drop in the total value (TVL) of Ethereum smart contracts.

The metric hit a high of 40.6 million Ether on January 27, and has since dropped by 22%.

This could be part of the reason why Ether couldn’t handle the bad news that came with Bitcoin’s (BTC) 13 percent weekly decline.

Even so, the most popular altcoin has its own set of reasons why it’s on the rise. Ethereum developers made the first „shadow fork“ of the network on April 11.

People who work on Bitcoin can now stress-test their ideas about the complicated transition from proof of work to proof of stake on the testnet, which was updated.

As a result, one needs to look at how professional traders are putting their money. There’s no better way to figure this out than by looking at derivatives markets.

The futures premium is back to bearish levels

To figure out if the current bearish trend is based on the opinions of the most important traders, one should look at the price of Ether’s futures contracts, which is called the „basis.“

Unlike a perpetual contract, these fixed-calendar futures do not have a funding rate. This means that their prices will be very different from those of regular spot exchanges.

When a trader looks at how much it costs to buy and sell futures, they can get a sense of how people in the market are feeling.

As sellers ask for more money to hold off on paying, a neutral market should show a premium of between 5% and 12% each year.

The above chart shows that between March 25 and April 6, the futures premium for Ether was above the 5% neutral threshold. It then dropped to 3%.

Futures market traders don’t want to open leveraged long (buy) positions at this level because they don’t want to lose money.

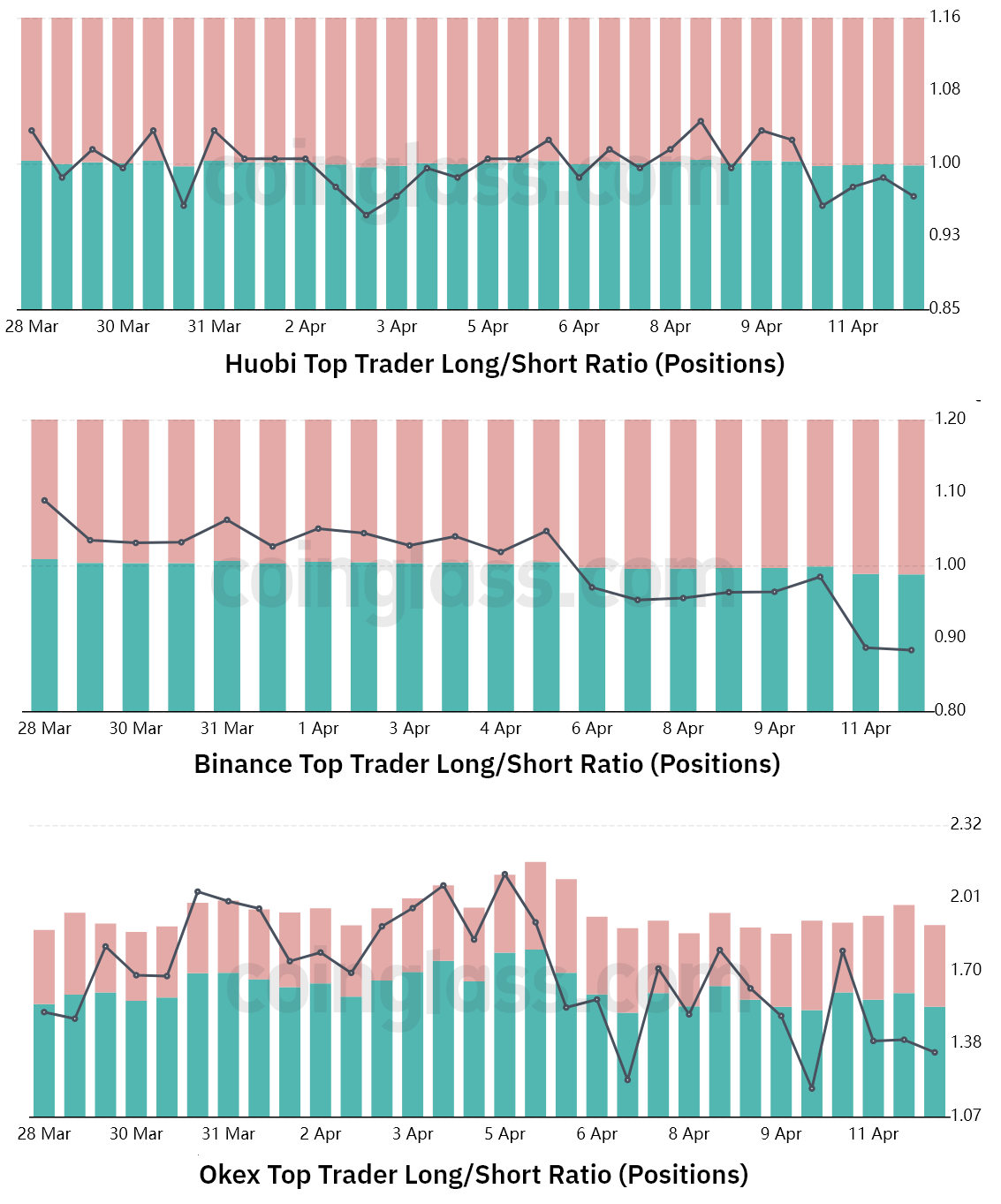

Long-to-short data confirms worsening conditions

The long-to-short net ratio of the top traders doesn’t take into account any outside factors that might have affected the longer-term futures instruments.

When you look at these whale positions on the spot, long-term, and futures contracts, you can figure out if professionals are actually going to be bearish.

There are a lot of methodological differences between different exchanges, so the absolute numbers don’t mean as much as they used to.

There has also been a big drop in the long to short ratio of every major derivatives exchange since April 5.

People who make a lot of money are betting more money on the stock market going down.

There was a 1.05 long-to-short ratio on April 5, but by the end of the month, that ratio had dropped to 0.88.

Also, the top traders on the OKX changed their position from 2.11 to 1.35.

Are investors and users abandoning the network?

According to the metrics above, there might not be a sign of extreme bearishness. However, the futures basis rate and the long-to-short ratio of the top traders both got worse over the last week.

TVL in Ethereum smart contracts also shows that people aren’t making smart contracts anymore.

Investors may be paying less attention to the proof-of-stake migration because of all the delays. Decentralized finance (DeFi), gaming, and nonfungible (NFT) projects may be moving to other networks because of this.

To make things even worse for Ether, traders have been paying more attention to altcoins that have a better chance of making money than Ether.

The author’s thoughts and opinions are entirely his or her own and do not necessarily reflect those of CoinNewsDaily. Each investing and trading action entails risk; before making a decision, you should conduct your own research.