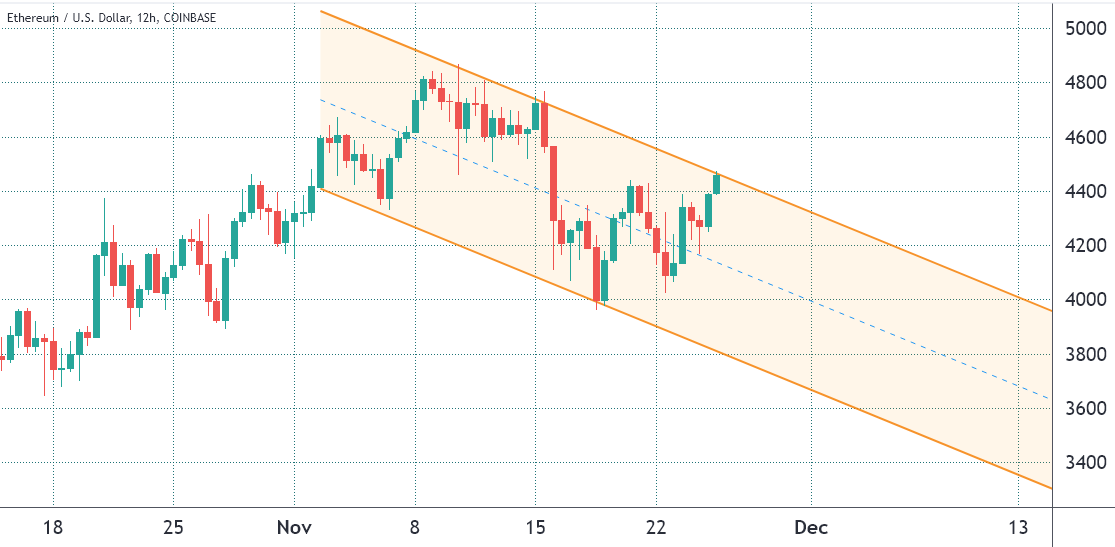

Investors in Ether (ETH) have nothing to complain about following the 344 percent gains recorded in 2021 through November 24. Analysts, on the other hand, are concerned that the $4,000 resistance test on Nov. 19 is building a falling channel with a target price of $3,600 by mid-December, representing an 18 percent drop from the current $4,400 price.

It appears that, despite having outperformed Bitcoin (BTC) by 16 percent in just one month, and the ETH/BTC pair reaching 10-week highs, Ether is having difficulty dealing with the consequences of its own success.

Users have continued to express dissatisfaction with Ethereum gas fees, which have averaged more than $45 over the past three weeks. Regardless of how difficult this can be, there is no doubt that Ethereum continues to be the platform of choice for the major decentralized finance (DeFi) and nonfungible tokens (NFT) markets.

Tried to buy something for $5 using eth.

The gas fees are $480.45.

How certain are we that an Airbnb product manager isn’t the creator of Ethereum? pic.twitter.com/G35F0o6keO

— Chris Bakke (@ChrisJBakke) November 17, 2021

Increasing regulatory uncertainty in the United States continues to be a significant impediment to the surge in Ether’s price. The Securities and Exchange Commission, or SEC, reiterated on Nov. 24 that the crypto panel at the public meeting set for Dec. 2 would be primarily concerned with the regulatory framework for cryptocurrency.

Even the one million ETH that has been burned since the introduction of EIP-1559 in August has not been enough to keep the price of Ether at all-time highs. Because the network generates approximately 5.4 million ETH every year, Ether continues to be a deflationary asset. Despite this, the price of Ether has climbed by 16 percent when compared to the price of Bitcoin since October 25, largely reflecting the impact of the Bitcoin price decline.

Bullish calls dominate Nov. 26’s ETH options expiry

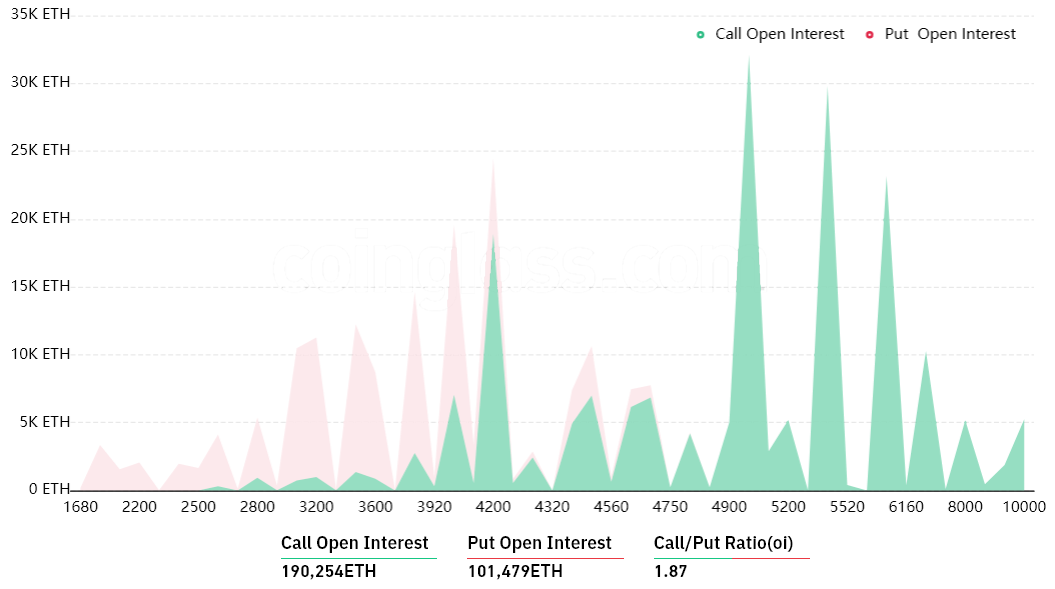

Despite the 10% correction to $4,400 since the $4,850 all-time high on Nov. 10, the Ether call (buy) options vastly dominate Nov. 26’s expiry.

The green region represents the call (purchase) options worth $820 million, which is the majority of the options expiring on November 26. If we compare it to the $440 million in put (sell) instruments, the difference is an astounding 87 percent.

Nonetheless, the 1.87 call-to-put ratio should not be taken literally, since the recent collapse in ETH is expected to wipe away 77 percent of the bullish bets on the cryptocurrency. When those call (purchase) options expire on November 26 at 8:00 am UTC, for example, only $165 million worth of Ether will be accessible at the expiration if the price of Ether remains below $4,400 at that time.

In other words, what is the use of having the option to purchase Ether at $4,400 or $4,600 if the cryptocurrency is now trading below those prices?

Bears need sub-$4,200 ETH to balance the scales

Based on the present price activity, the following are the three most likely possibilities. 1. According to the expiry price of ETH, the number of option contracts available on November 26 for bulls (call) and bears (put) instruments varies depending on the expiry date. It is the theoretical profit that is created by the imbalance that favors either side:

- Below $4,100: 15,400 calls vs. 15,200 puts. The result is balanced.

- Between $4,200 and $4,500: 38,400 calls vs. 8,800 puts. The net result is $130 million favoring the call (buy) instruments.

- Above $4,500: 50,200 calls vs. 2,300 puts. The net result favors the call (bull) instruments by $215 million.

This rough estimate takes into account call options being used only in bullish wagers and put options being utilized exclusively in neutral-to-bearish trades while making this calculation. Nonetheless, this simplicity fails to take into account more complex investment techniques.

Example: A trader could have sold a put option to earn positive exposure to Ether above a specified price, essentially increasing his or her exposure to the cryptocurrency. Unfortunately, there is no simple way to evaluate the magnitude of this effect.

Both sides have incentives to move price

The Bears require a 7.5 percent decline in the price of gold from $4,400 to below $4,100 in order to balance the scales and prevent a $130 million loss.

Bulls, on the other hand, require a 2.3 percent increase in price to $4,500 in order to improve their earnings by $85 million.

Traders must keep in mind that the amount of work required by a seller to pressure the price is enormous, and that this effort is usually fruitless during positive situations.

Options market incentives are currently balanced, favoring the $4,200- to $4,500 price range, entitling bulls to a $130 million profit on Friday, November 26. The price range of $4,200-to-$4,500 is currently the most favorable.

The author’s thoughts and opinions are entirely his or her own and do not necessarily reflect those of CoinNewsDaily. Each investing and trading action entails risk; before making a decision, you should conduct your own research.