Right after a sharp pullback at the stop of last 7 days, Bitcoin would seem to be on the highway to recovery.

Wanting Forward to Conference You at iFX EXPO Dubai Could 2021 – Producing It Materialize!

The pullback began on Thursday, March 28th. The day prior, Bitcoin peaked just around $57K by the close of the day on Thursday, nonetheless, the price tag of Bitcoin had fallen to virtually $51K. A variety of analysts pointed out that the correction was specially astonishing simply because of the report amount of money of alternatives expiry that was owing on Friday, March 29th.

The selling price correction brought about many analysts to dilemma regardless of whether or not BTC was at the commencing of a much larger bear cycle. Nonetheless, soon after BTC’s selling price drop bottomed out last Thursday, Bitcoin has been on a path of steady gains. The rise seems to have been bolstered by news this week of both equally Visa and Paypal saying options to enmesh them selves additional into the crypto planet.

Now, the massive question on everyone’s head is what will occur in the coming month. Will Bitcoin manage to recapture $60K and further than? Or is a further pullback in the playing cards right before Bitcoin can get back regular floor?

Bitcoin has been bolstered by constructive information all through 2021

Doug Schwenk, chairman of Digital Assets Analysis (DAR) instructed Finance Magnates that he believes Bitcoin may possibly have more to go prior to a further pullback.

“BTC has just bounced back from $51k all-around selections expirations a 7 days ago to approach the $60k degree once more,” he explained to Finance Magnates. “There are plainly robust tailwinds on price provided the speed of restoration.”

What’s causing these tailwinds to blow so strongly? In addition to the current news about PayPal and Visa, Doug pointed out that “we continue on to see positive information in institutional adoption, such as Goldman Sachs ideas to give to prosperity clientele and ongoing ETF filings and approvals in Canada and Brazil, as nicely as filings in the US.”

“It’s effortless to picture BTC breaking the psychological $60k barrier and shifting increased if there continues to be mostly beneficial news,” he explained.

Beyond the world of institutional investors, markets could potentially be boosted by beneficial regulatory information in the United States. “The entire business is waiting around to hear what Gary Gensler as the new chair of the SEC and what other new regulators at the CFTC and OCC will say about clarity and help,” Doug pointed out.

Nevertheless, this anticipation could go equally means: “any remarks that show up destructive could effortlessly drag BTC back in the quick phrase, as could beneficial development on a Central Financial institution Digital Currency (CBDC).”

Substantial establishments are accumulating Bitcoin at document speed

Even if a pullback is probable in the quick-expression, Justin Hartzman, CEO and Co-Founder of CoinSmart, pointed out to Finance Magnates that “analysts [have been] calling for considerably greater price ranges this 12 months.”

“I feel as we see far more institutions enter the sector and inflation as a final result of printing of income throughout the planet, the a lot more the mass market place will enter the crypto room. From there, it is just a matter of supply and demand,” he reported.

In fact, as COVID stimulus reduction proceeds in the United States, the USD’s standing as the world’s default currency might be faltering. When there’s however some debate about no matter whether or not Bitcoin is a correct “hedge in opposition to inflation,” the simple fact that more investors–particularly those of the institutional stripe–are buying and hodling much more BTC than at any time right before.

Marcin Kolago, main govt and founder at Coinerro, informed Finance Magnates that ”a substantial sum of Bitcoins is consistently taken off from the industry.” In other text, a rising amount of traders appear to be acquiring Bitcoin and then going it into “cold storage,” producing it far more tricky to offer.

“Such accumulation is an argument we are much from a sector crash, as this kind of crashes are preceded by additional liquidity flowing into the market place from very long time period hodlers,” Kolago explained.

As extra institutions accumulate Bitcoin, how will its popular volatility be afflicted?

Kolago also pointed out that if the development of big-scale accumulation continues, there could be a fundamental change in the way that Bitcoin operates in crypto markets.

“It will be appealing to see if Bitcoin sustains its volatility in the future,” he said, referencing this “unprecedented corporate accumulation.”

“While previous peaks and crashes have been strongly pushed by retail operates and stress, it remains to be witnessed if corporate holders respond to sector developments in a much less emotional way,” he claimed. “Corporate Bitcoin possession has lessened the standard degree of current market leverage, consequently now raising security.”

Recommended article content

Orbs Blockchain to Pioneer One-Sided Liquidity for Generate FarmingGo to article >>

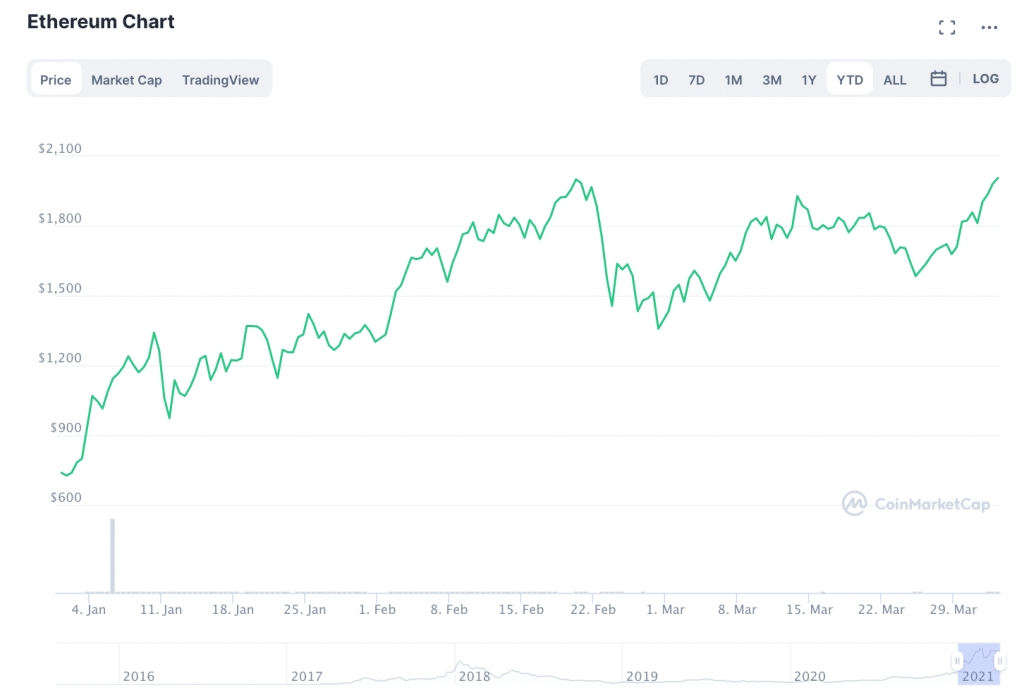

ETH approaches a new all-time superior

As Bitcoin carries on to stabilize stages previously mentioned $50K, other cryptocurrencies seem to be riding alongside a bullish development as effectively.

For instance, Ether (ETH), the indigenous token of the Ethereum blockchain, was closing in on its preceding all time large of $2,036 with a price tag of $1,998 at press time.

What’s driving the cost of Ether up?

Having said that, the Ethereum network is continue to struggling with some sizeable restrictions to how often it can be applied. Transaction fees on the community have been sky-significant for months, and really don’t clearly show signals of coming down whenever quickly.

The network is currently in the system of migrating to a Evidence-of-Stake (PoS) consensus algorithm, which builders say will decreased transaction fees and maximize the variety of transactions for each 2nd (TPS) on the network. However, the course of action of migrating to the new algorithm might not be done until 2022.

ETH hangs in the balance of the Ethereum network’s long run

Hence, Ethereum’s price tag may well be approaching a place of limitation in the small-time period. Doug Schwenk described that presently, “ETH is trapped involving the adoption of DeFi and higher transactions expenditures and restricted transaction bandwidth.”

“DeFi has been a incredibly hot place over the previous six months and has mainly been developed on Ethereum provided its brand name and smart deal abilities,” he said. On the other hand, “as fuel fees increase and maximum throughput constrains the community, Ethereum displays some fragility and pushes innovation to other blockchains.”

Even now, in spite of these attainable limitations, there is a path for ETH to make a lot more gains in the small-expression: “with a planned Canadian ETH ETF and the most effective identified wise deal brand, it is likely that ETH carries on typically upward until finally the community complications are solved or a very clear consensus substitution emerges,” Schwenk described.

In the meantime, Ethereum’s specialized holdups could have cleared a path for the rise of other smart contract-enabled blockchains (and their native belongings.)

Coinerro’s Marcin Kolago stated that “Ethereum is an asset with sizeable opportunity, presently hamstrung by higher gasoline service fees.”

“This has spurred opposition like the Binance Sensible Chain, which is centralized, but considerably much less expensive to use,” he stated. “Once a credible remedy to the Ethereum gasoline charge issue seems on the shut horizon, the sector will get started discounting it and we can expect selling price movement. Until that time there is area on the industry for competitors, it stays to be viewed if any of them establishes by itself as the new go-to solution.”

Regulators are turning their attentions towards the expanding DeFi ecosystem

In truth, the DeFi ecosystem is continuing to mature at an explosive rate–and will very likely keep on to do so, with or devoid of Ethereum.

CoinSmart’s Justin Hartzman stated that much of this growth has been spurred by amplified curiosity in “crypto fascination-earning products” in the DeFi room.

“Some of these solutions boast fascination charges among 8-25%,” he explained, adding that “investors need to be certain to just take note of the chance associated in these new and frequently ‘too superior to be true’ choices considering that DeFi products and solutions nevertheless have a sure amount of danger concerned.”

DeFi’s development is also remaining “amplified with the ever-developing extremely well-liked NFT sector,” he explained.

Even though there may possibly be “exciting times ahead” for DeFi, regulators are increasing their attentions on the DeFi space–a factor that may well trigger some hiccups in the progress of the space.

Specially, Marcin Kolago pointed to “the new FATF (Money Motion Undertaking Drive) draft assistance,” which appeared previous 7 days.

Kolago defined that the apperance of the steerage implies that “regulators are adjusting to rapid DeFi advancement and will generate more compliance and AML measures in the field.”

“While this kind of actions are really hard to put into practice in a decentralized network, they may guide long-phrase to market place consolidation and the escalating great importance of crypto regtech,” he explained. “While crypto crime may possibly be shrinking year to calendar year, as demonstrated in the Chainalysis crypto criminal offense studies, rest confident DeFi will be an location impacted by regulation in the coming yrs.”

None of the content of this report constitutes precise price tag predictions or financial commitment assistance. Just before investing in Bitcoin or any other crypto asset, carefully consider your appetite for possibility never commit additional than you can pay for to eliminate.

![naga review unveiling the platformac280c299s copytrading value proposition 1[1]](https://www.coinnewsdaily.com/wp-content/uploads/2022/04/naga-review-unveiling-the-platformac280c299s-copytrading-value-proposition-11-350x250.png)