Every day, news stories are made about non-fungible tokens (NFTs).

As more and more NFT platforms are being built, champions like OpenSea are becoming more and more popular.

It’s a real platform economy, like the one where YouTube or Booking.com got a big chunk of the market.

But it’s still a very young economy, and it’s having a hard time understanding how the law works in its field.

Regulators are becoming more interested in the subject, and if the industry doesn’t act quickly, there could be a backlash.

When there are fights, they usually start in the East.

To start with, we’re going to talk about how the digital asset regime and financial law apply to NFTs in France.

Another time, we will talk about liability and copyright again.

A digital asset?

In France, digital assets are made up of two types of tokens.

You can think of them as utility tokens, which are all intangible assets that can be used to hold, store, or transfer one or more rights in digital form. They can be issued, stored, or transferred through a shared electronic recording device that allows the owner of the assets to be identified directly or indirectly.

NFTs are intangible assets that can be given, recorded, kept, or transferred through electronic records that other people can see.

Any digital representation of value that isn’t issued or guaranteed by a central bank or public authority, isn’t linked to a legal tender, and doesn’t have the legal status of money is called a payment token. These tokens can be used to transfer, store, or exchange money electronically.

Is an NFT a digital asset under French law?

An NFT can be bought to get a piece of property, but it can also be bought to get a piece of service related to that NFT.

An NFT can also be thought of as a digital representation of value that doesn’t come from a central bank or government, isn’t linked to a legal tender, and can be stored or exchanged by electronic means. This is why it’s important to know what an NFT is.

We can see that digital assets, like NFTs, are possible. They could be used, paid for, or both.

The consequence of classifying NFTs as digital assets would be twofold.

Registration as a virtual asset service provider

In addition to its main market, the platform that issues NFTs has a secondary market on which users can benefit from: 1) a digital asset storage service or access to digital assets for the benefit of a third party so that they can hold, store or transfer these digital assets, and/or 2) a service to buy or sell digital assets in legal tender, and/or 3) a service to exchange the digital assets for other digital assets, and/or 4) the operation of a platform that issues NFTs.

Clients must also be found through a „Know Your Customer“ process.

In our analysis, we take into account the fact that the proposed European regulation, „Markets in Crypto-assets,“ refers to NFTs as „crypto assets“ (MiCA).

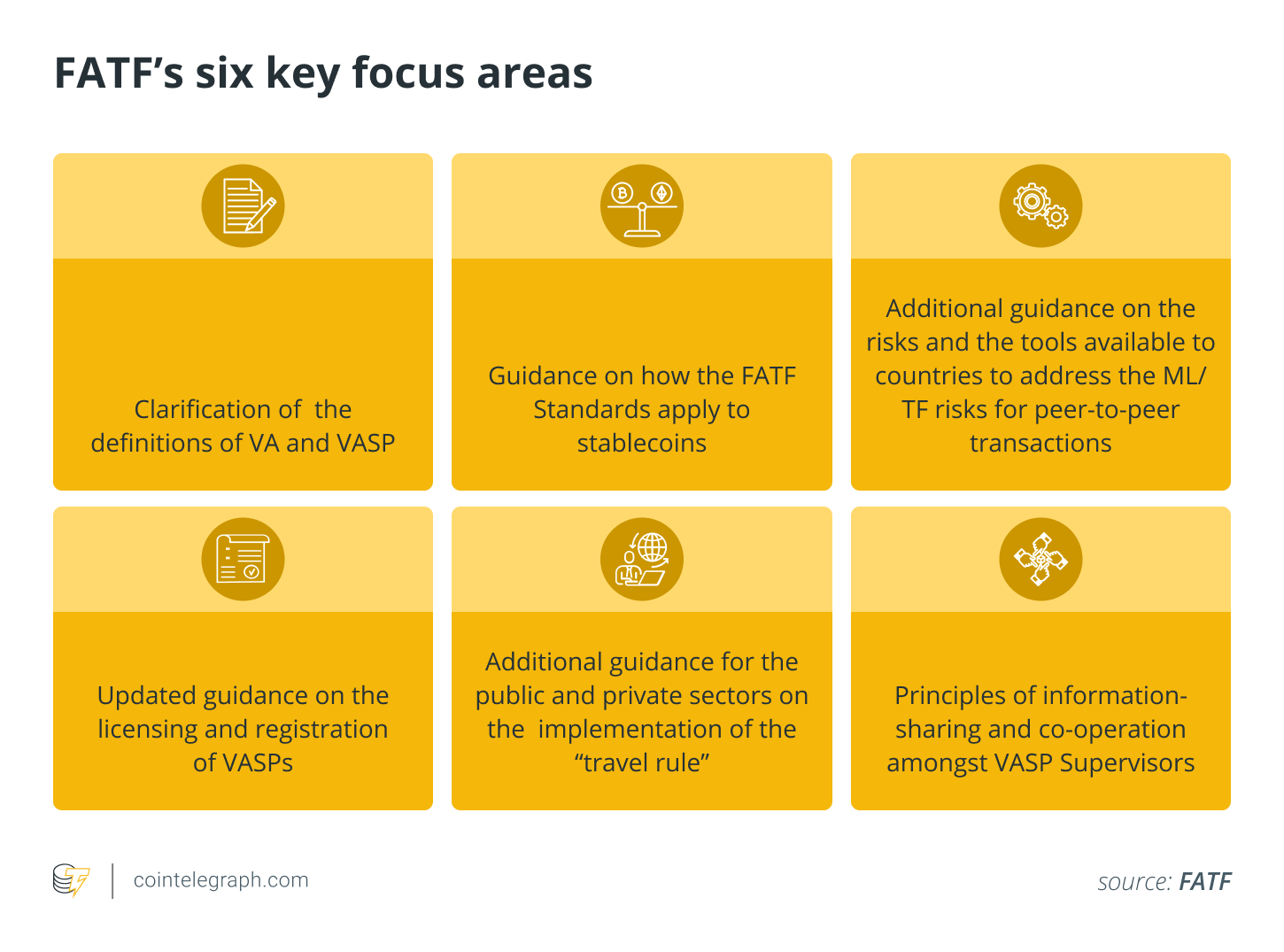

The Financial Action Task Force (FATF) has also made a statement about „digital assets“ and „non-financial transactions.“ This is one of the most well-known recommendations from October 2021.

People „generally don’t think of NFTs as virtual assets,“ it says.

FATF, on the other hand, says that regulators should look at the nature of the NFT and how it works in practice, not the terminology or marketing terms used.

FATF says that NFTs that „are used for payment or investment“ can be virtual assets.

The directive doesn’t say what „for investment purposes“ means, but the FATF likely wants to catch people who buy NFTs and plan to sell them later for a profit.

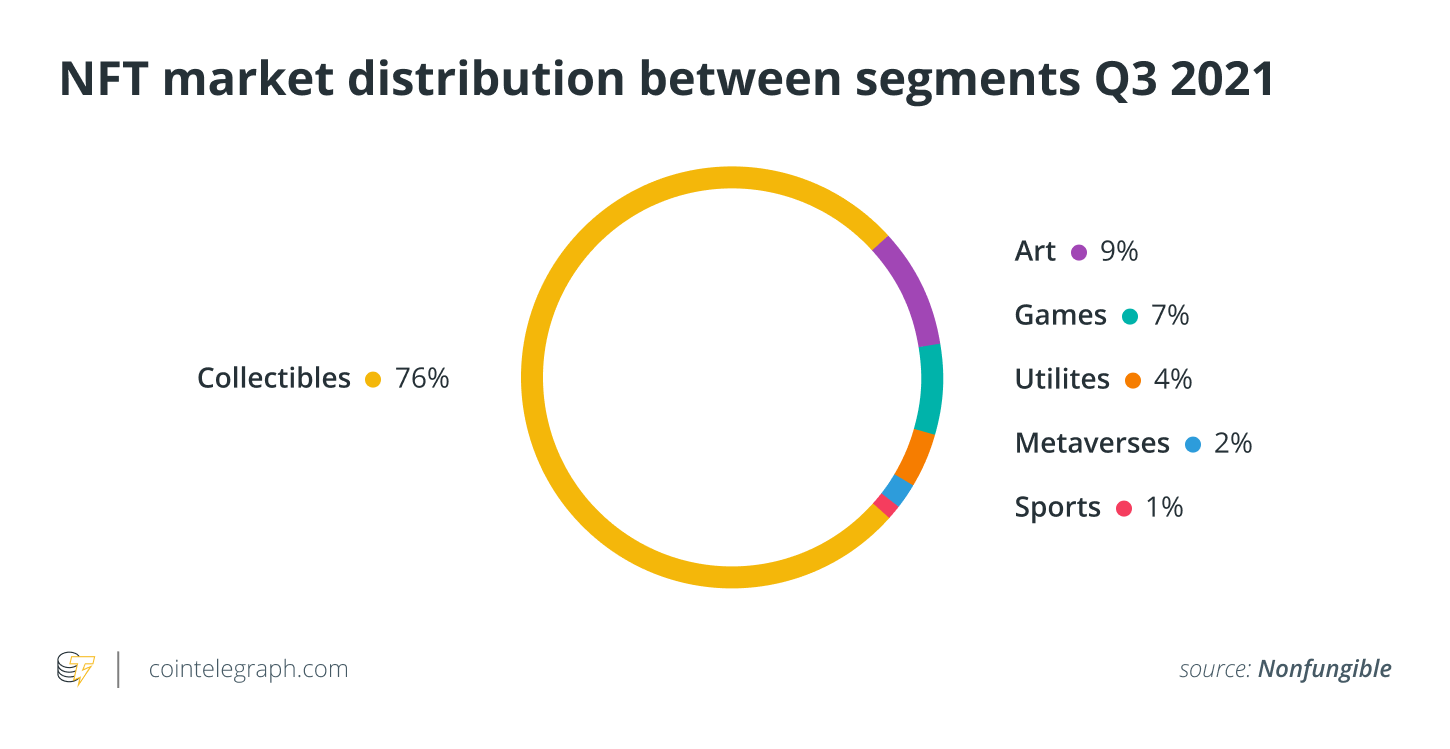

Many people buy NFTs because they have a connection to the artist or work. A lot of the industry buys them because they have the potential to go up in value.

A lot of NFTs could be called digital assets if this interpretation is correct!

Application of the ICO regime?

As soon as there is a public sale of digital assets (to more than 150 people) in France, the French ICO law comes into play.

When the issuer does this, they have to follow these rules:

The „simple“ advertising of the token sale is allowed, but any canvassing or „quasi canvassing“ is not allowed, unless the issuer has a visa from the AMF.

This is a very important point because the NFT issuer can’t invite people from France to sign up on its site without breaking the law.

Then, it would be illegal to target groups or communities that are „French,“ so it would have to be very careful.

It’s not that we don’t think the ICO regime should be used for NFTs. This is because this regime is meant to regulate fundraising and protect investors.

Some parts of the law don’t work well with an NFT offer (i.e., offer limited to 6 months, sequestration of funds during the ICO, etc.).

The proposed MiCA regulation thinks of NFTs as digital assets by default, but doesn’t make them subject to some of the rules that ICOs have to follow (publication and notification of a white paper).

Anti-money laundering obligations and KYC?

We have already talked about the risk of becoming a virtual asset service provider (VASP), which would require us to do a background check (from 1 euro of transaction).

In addition, people who act as intermediaries in the art trade, even when it is done through art galleries, when the value of the transaction is more than 10,000 euros, they must take steps to prevent money laundering and terrorist financing, based on their risk assessment.

Even though digital works of art don’t qualify as digital assets, all NFT platforms that are linked to them should go through KYC checks even if they don’t qualify as digital assets, which isn’t the case now.

In the United States?

In Europe, tokens are called digital assets, but in the United States, they are called securities because the US Securities and Exchange Commission uses the „Howey Test“ to classify them as securities.

The chances of the SEC classifying tokens as „securities“ are very high.

People have already said that some NFTs could qualify as securities, especially when they are sold in fractions. The SEC hasn’t yet made a decision on the matter.