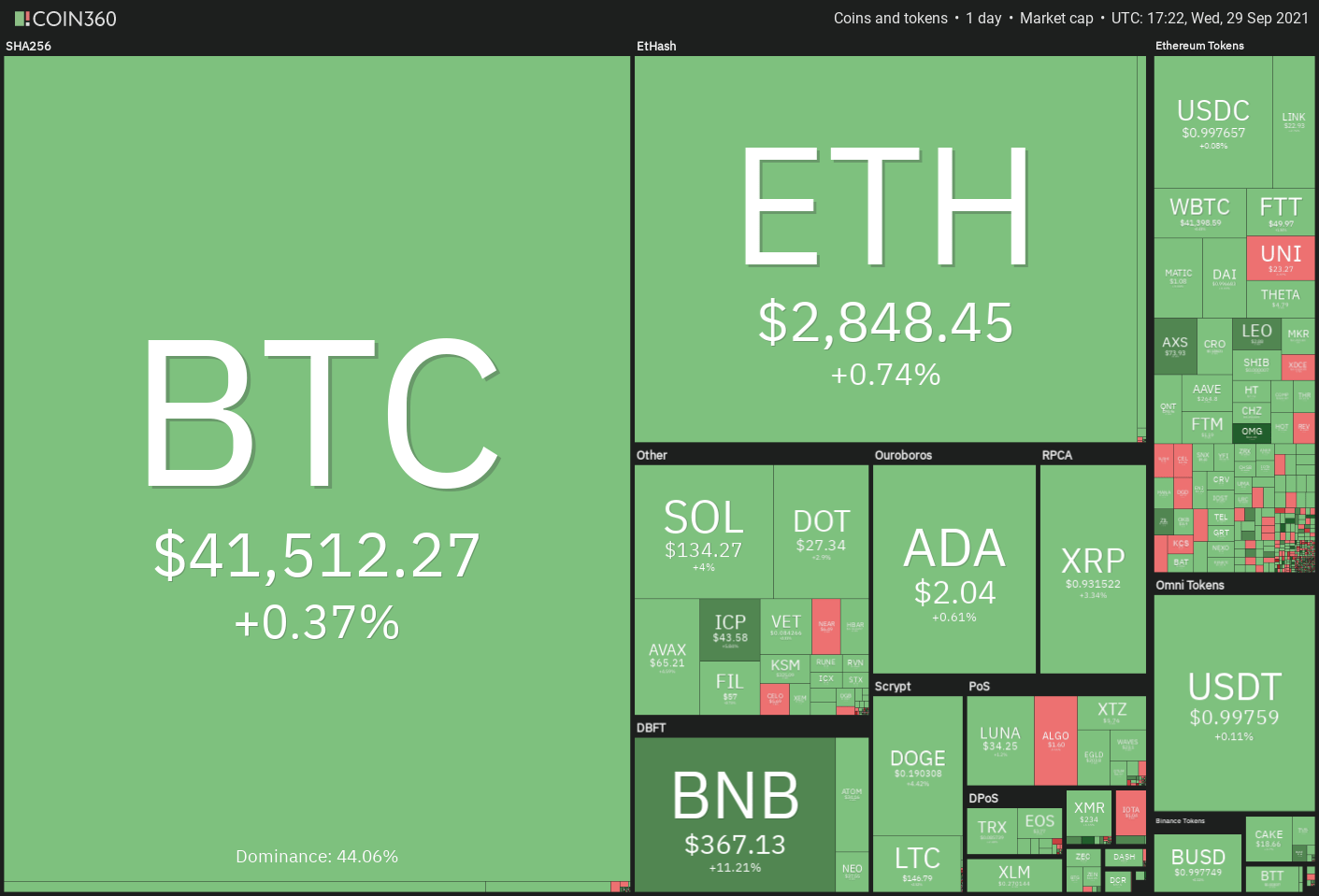

Bitcoin (BTC) and Ether (ETH) are seeking to bounce off important support levels as bulls attempt to stymie bears‘ attempts to extend the slump.

Elon Musk, CEO of Tesla, recently stated at the Code Conference in California that governments cannot „kill crypto“ owing to its decentralized nature, but they may „delay its growth.“

Whales have moved unprecedented sums of Bitcoin in the last two weeks, according to data.

The overall volume of transactions worth at least $10 million has surpassed the levels witnessed when Bitcoin was near $60,000.

Material Indicators, an on-chain analytics site, reports that “smaller” whales were sold and gigantic whales were added to their holdings.

Bobby Lee, the former CEO of the BTCC exchange, told Bloomberg on Sept. 29 that Bitcoin’s surge is projected to begin in 2021, when the price will not only reach an all-time high, but will also clear the psychological $100,000 level and possibly approach $200,000.

Are Bitcoin and altcoins preparing for a relief rally, or will bears continue to push prices below their respective support levels?

To determine this, let us examine the charts of the top ten cryptocurrencies.

BTC/USDT

Bitcoin continues to trade between the 100-day simple moving average ($41,221) and the 20-day exponential moving average ($44,229), with the 100-day simple moving average ($41,221) being the most recent. The price has recovered from the 100-day simple moving average (SMA) today, indicating that bulls are continuing to defend this level of support strongly.

The 20-day exponential moving average (EMA) is trending down, and the relative strength index (RSI) is in the negative zone, indicating that sentiment is still negative and that bears may sell on rallies in the near term. If the price falls below the 20-day exponential moving average, the tight range action may persist for a few more days.

A break and close below the 100-day simple moving average (SMA) could result in panic selling, which could drive the price down to $37,332.70 or below.

If this level is breached as well, the BTC/USDT pair might fall as low as $30,000.

Alternatively, a break and close above the 20-day exponential moving average (EMA) will be the first indication that selling pressure may be easing. The pair may next rise to the 50-day simple moving average ($46,580), after which it might go to $48,843.20.

ETH/USDT

Ether fell from the 20-day exponential moving average ($3,118) on September 27 to the 100-day simple moving average ($2,771) on September 28.

The bulls have regained control of the support and are seeking to push the market closer to the 20-day exponential moving average.

Bears maintain control of the market, as indicated by the downsloping 20-day exponential moving average and the RSI in the negative region. If the price falls below the current level or the 20-day exponential moving average, the bears will make one more effort to break the 100-day simple moving average support.

If this occurs, the ETH/USDT pair could fall as low as $2,400, and if this support is also breached, the slump might reach $1,972.12 in the short term. The bulls will need to lift the price over $3,174.50 and keep it there for a sustained period of time in order to suggest that the correction may be done. After there, the pair could move to the 50-day simple moving average ($3,291) and then to $3,676.28.

ADA/USDT

For the past few days, Cardano (ADA) has been trading between the 20-day exponential moving average ($2.27) and the $1.94 support level. The lengthy wick on today’s candlestick implies that bears are taking profits on relief rallies in the stock market today.

The downward-sloping 20-day exponential moving average (EMA) and the RSI reading below 40 signal that bears have the upper hand. The sellers may make one more try to bring the price below the zone between $1.94 and the 100-day simple moving average ($1.87) and keep it there.

If the price falls below this support zone, the selling might gain speed, and the ADA/USDT pair could fall as low as $1.60 and subsequently as low as $1.40, depending on the circumstances. If bulls are able to move and sustain the price over $2.47, this pessimistic outlook will be rendered worthless.

BNB/USDT

In the week of September 27, Binance Coin (BNB) closed below the $340 support level, but the bears were unable to capitalize on this move and drive the price below $320.

This demonstrates that selling becomes ineffective at lower levels.

The relative strength index (RSI) has developed a positive divergence, indicating that the negative momentum may be fading. The robust rise seen today signals aggressive buying at lower levels, as well as the possibility of bears covering their short positions.

If bulls are able to push the price over the 20-day exponential moving average ($381), it will indicate that the correction may be done. It is possible that the BNB/USDT pair will climb to $433.

If, on the other hand, the price continues to decline from the 20-day moving average, it will indicate that traders are selling on rallies. A further attempt to bring the market below $320 will be made by the bears after that.

XRP/USDT

On September 28, XRP fell below the 100-day simple moving average ($0.88) once more. Bullish retests of support levels tend to weaken them over time, but a tiny good indicator is that the bulls have successfully defended the level on a number of occasions in the last several days.

The bulls were able to push the price up to the 20-day exponential moving average ($1.00) today, but the lengthy wick on the day’s candlestick implies that the bears are not about to give up.

If the price continues to decline from its current level, the bears will make one more effort to bring the price below the 100-day simple moving average (SMA).

If they are successful, the XRP/USDT pair may fall as low as $0.69.

In contrast to this premise, if bulls are able to push the price above the 20-day exponential moving average, the pair might rally to the 50-day simple moving average ($1.11).

SOL/USDT

Despite the fact that Solana (SOL) has broken out of the downtrend line, bulls are finding it difficult to keep the price above the 20-day exponential moving average ($141). This shows that bearish sentiment is still prevalent, and that bears are selling into rallies.

The first indicator that selling pressure may be easing will be a break and closing above the 20-day exponential moving average (EMA). SOL/USDT may subsequently advance to the 38.2 percent Fibonacci retracement level at $154.20, and then to the 50 percent retracement level at $166, depending on the direction of the trend.

Alternatively, if the market moves down from the 20-day exponential moving average (EMA) or the overhead resistance, the bears will attempt to push the pair below the 50-day simple moving average ($118). If the price of oil falls below $116 and remains there for an extended period of time, panic selling may ensue.

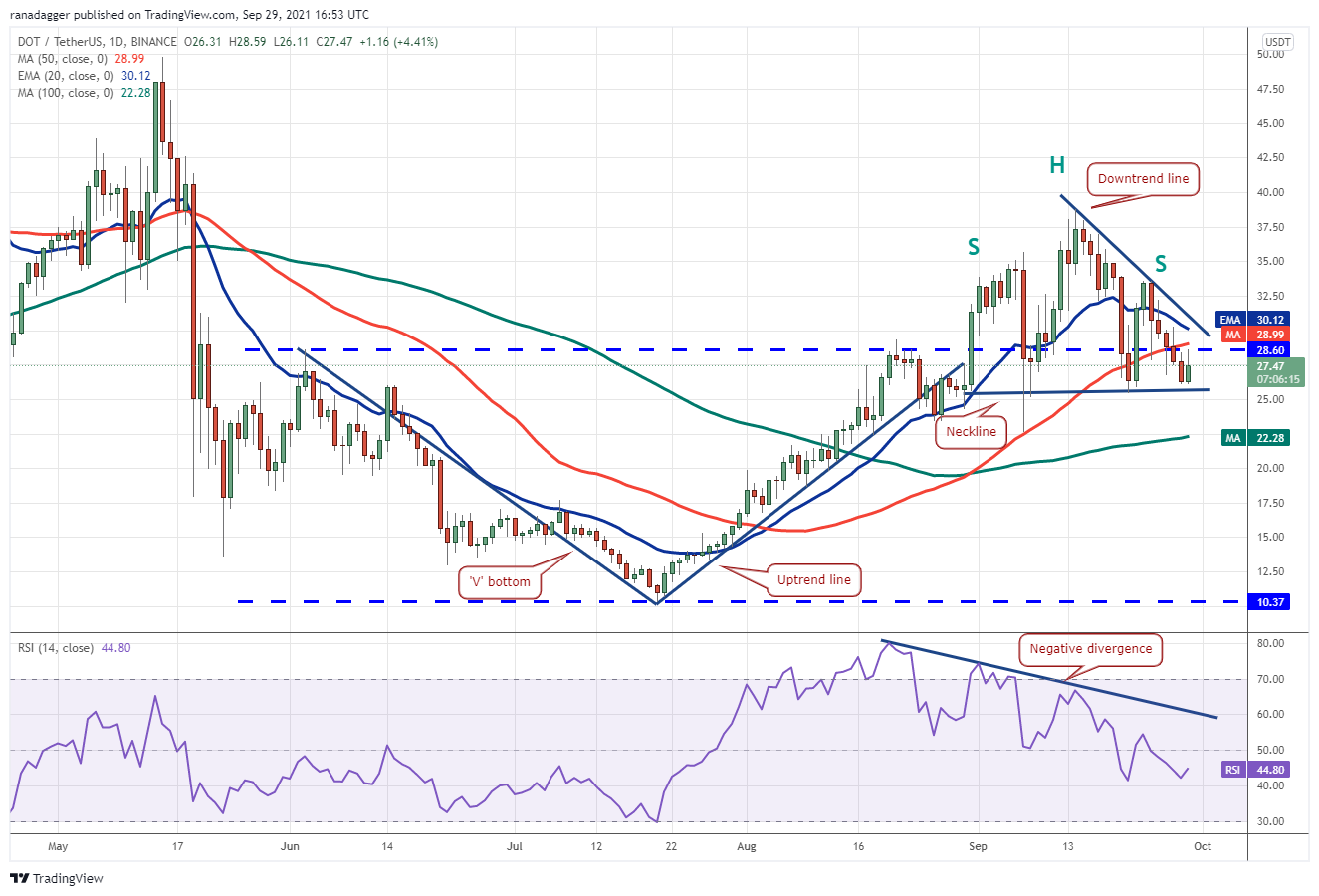

DOT/USDT

As the growing head and shoulders pattern takes shape, Polkadot (DOT) is striving to rebound off the neckline of the design. If the bulls fail to defend this level, the bearish setup will be complete. A break and closing below this level will complete the bearish setup.

It is possible that the selling may gain speed below the neckline, driving the price to the 100-day simple moving average ($22.28) and subsequently toward the pattern goal at $12.00 per share. The downward-sloping 20-day exponential moving average ($30.12) and the RSI, which is barely below the midway, indicating that bears have a minor advantage.Bears may be losing control of the market if bulls are able to push the price above the 20-day exponential moving average (EMA) and below the downtrend line. The pair could then rally to $33.60, where bears could once again present a significant obstacle. A break and closing above this resistance level could clear the way for a retest of $38.77 as the next target.

DOGE/USDT

Dogecoin (DOGE) is sandwiched between $0.19 and $0.21 for the past three days. This tight-range trading implies hesitation among the bulls and the bears over the next directional move.

The RSI is attempting to form a bullish divergence, which suggests that the selling pressure may be lessening in the short term. If bulls are able to push the price over $0.21, the DOGE/USDT pair might advance to the 20-day exponential moving average ($0.22), which could act as a strong resistance once more.

A break and closure above the 20-day exponential moving average (EMA) will be the first indication of strength, and it might pave the way for a likely up-move to the downtrend line in the near future. Alternatively, if the price declines from its current level or breaks through overhead resistance and falls below $0.19, the pair might fall as low as $0.15 per dollar.

AVAX/USDT

The lengthy wick on Avalanche’s (AVAX) candlestick from September 27 indicates that bears were active in selling on rallies. On September 28, the selling persisted, and the bears were able to push the price below the support line of the ascending channel.

The extended wick on the day’s candlestick implies that bears are selling on any tiny recovery in the price, despite the fact that bulls have driven the price back into the channel today. The 20-day exponential moving average ($62.12) has flattened down, and the relative strength index (RSI) is barely above the midpoint, indicating that bulls may be losing their grip on the market.

If the price of AVAX/USDT fails to maintain its position within the channel, the pair might fall to the next support level at $52. On the other hand, if bulls are able to keep the price within the channel, the pair may advance to $72, and if this level is crossed, a retest of the all-time high at $79.80 is a distinct possibility.

UNI/USDT

After pushing Uniswap (UNI) above the downtrend line of its declining channel for two days, bulls were unable to keep the stock at the higher levels. Bulls, on the other hand, have not given up much ground and are attempting to scale the overhead barrier again today, which is a slight positive.

The bears‘ hold on the market appears to be slipping as the 20-day exponential moving average ($23) and the relative strength index (RSI) approach the midpoint. If the price of the UNI/USDT pair continues to rise above the channel, it might reach the 50-day simple moving average ($25.88) and then $27.62.

A break and close above $27.62 might result in a retest of the hard overhead hurdle at $31.41, which now stands at $31.41. In contrast, if the price continues to fall from its current level, it will signal that bears are fighting the barrier with vigor and determination. The next possible stop for the pair is $17.73 if it falls below $21.84 per dollar.

The author’s thoughts and opinions are entirely his or her own and do not necessarily reflect those of CoinNewsDaily.

Each investing and trading action entails risk; before making a decision, you should conduct your own research.

Market data is provided by HitBTC exchange.