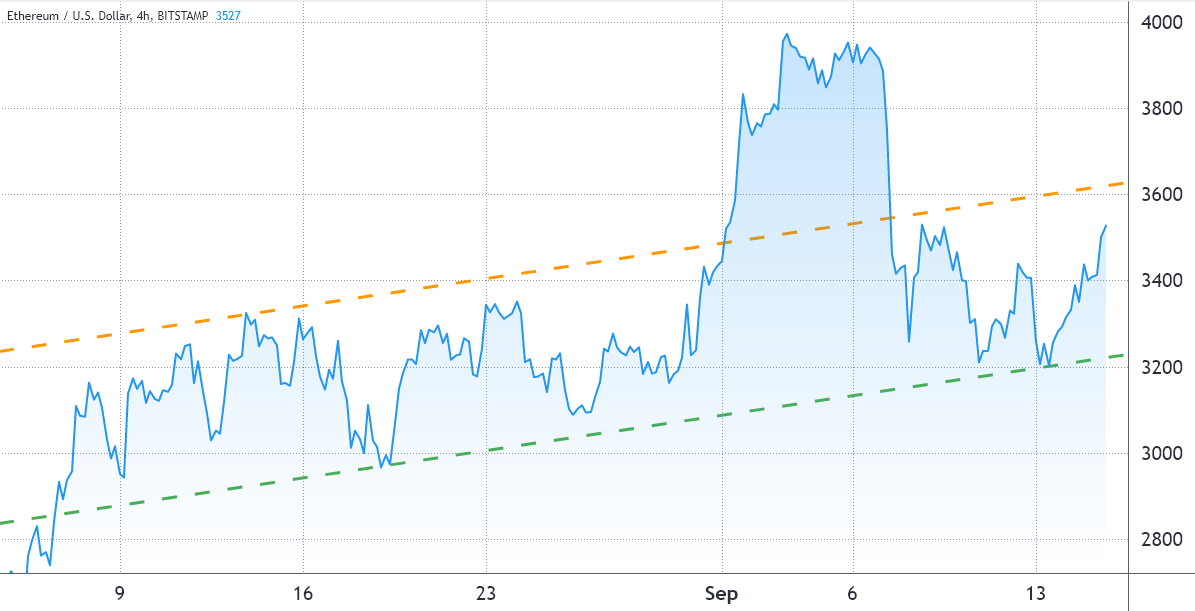

For the past 40 days, the price of Ether (ETH) has been trending marginally upward, largely staying within a narrow channel for the most part. After a brief rise that drove the price up to $4,000 in the first week of September, a subsequent drop sent it back into the ascending trend channel.

Transactions involving nonfungible tokens broke records in August, overloading the Ethereum network and driving average transaction costs to exceed $40 by the beginning of September. Despite the fact that NFT trading volume has continued to decline, new things are still being created every minute, regardless of whether or not they are being traded.

Cathie Wood, the CEO of Ark Invest, a $58 billion asset manager based in the United States, stated on September 13 that Ark hopes to have a 60 percent Bitcoin (BTC) and a 40 percent Ether allocation by the end of the year. Ark Invest owns significant interests in the stocks of Coinbase (COIN) and Grayscale Bitcoin Trust (GBTC), among other companies. Furthermore, Wood has been a proponent of Bitcoin for quite some time.

It is possible that ether investors got lucky when one of the coin’s major competitors, Solana (SOL), experienced a seven-hour shutdown on September 14.

The network was taken down as a result of a sudden increase in transaction traffic that swamped the transaction processing queue.

On the same day, another issue occurred when the Ethereum layer-two rollup network Arbitrum One went offline for 45 minutes, resulting in a total of three incidents. The interruption was attributed to a large number of transactions being sent to the Arbitrum sequencer in a short period of time, according to the team.

These occurrences highlight the significance of the ETH 2.0 upgrade, which will offer parallel processing and allow for a significant reduction in transaction fees. Interestingly, Ethereum was also subjected to a big invalid block series from a malevolent party, which was puzzling. The attack, however, was rejected by the vast majority of network customers, resulting in a resounding failure.

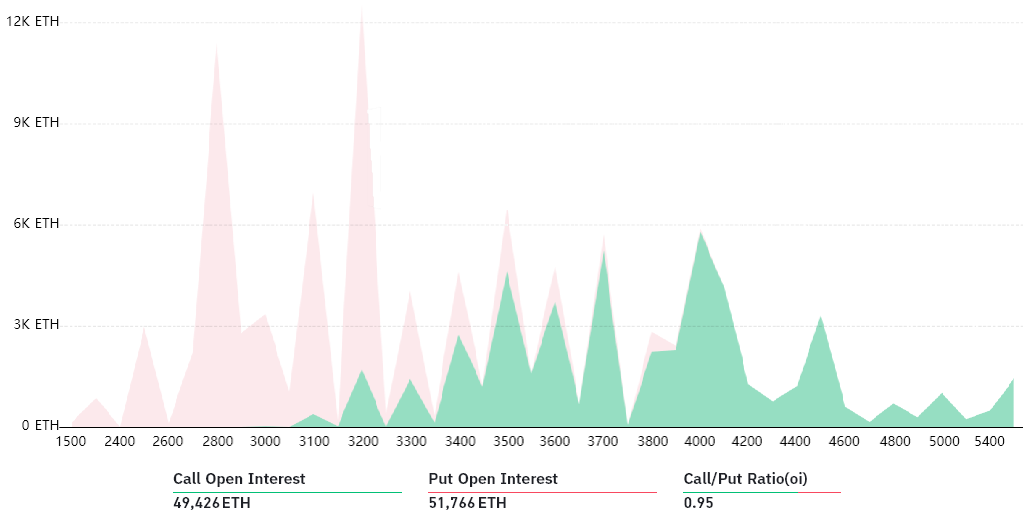

As previously said, bears were taken by surprise, and 95 percent of put (sell) instruments were placed at or below $3,500. Because of this, only $8 million worth of neutral-to-bearish put options will be executed at the expiration of the contract if ETH remains above that price on September 17.

A put option gives the holder the right to sell Bitcoin at a defined price on a specific date before the option expires. As a result, if the price of ETH remains over $3,000 at 8:00 a.m. UTC on September 17, a $3,000 put option becomes worthless.

The call-to-put ratio is balanced

The 0.95 call-to-put ratio reflects the modest difference between the $173 million in call (buy) options and the $181 million in put (sell) options in terms of value, respectively. This high-level picture necessitates a more in-depth examination that takes into account the fact that several of the bets are extremely unlikely given the present $3,500 level.

For example, if the expiry price of Ether on September 17 is $3,300, any call options that are purchased above that price become worthless. This means that the right to acquire ETH at $3,700 will be worthless in that situation.

The four most likely scenarios, based on the current price of Ether, are listed below. The notional benefit from the expiry of the contract is represented by the imbalance favoring either side. The following table illustrates how many contracts will be triggered on Friday, based on the expiry price, as shown by the data:

- Between $3,100 and $3,300: 2,100 calls vs. 20,300 puts. The net result is $58 million favoring the protective put (bear) instruments.

- Between $3,300 and $3,500: The net result is balanced between bears and bulls.

- Between $3,500 and $3,700: 17,600 calls vs. 2,300 puts. The net result is $55 million favoring the call (bull) options.

- Above $3,700: 17,600 calls vs. 2,300 puts. The net result favors the call options by $85 million.

This raw estimate takes into account call options being utilized only in bullish strategies and put options being used exclusively in neutral-to-bearish trades. Investors, on the other hand, may have employed more intricate techniques, which often entail a variety of expiration dates.

This week should see very little volatility

Because of a fluctuating Ether price, buyers and sellers will see minor profits in order to increase their returns on the weekly options expiry. It will be intriguing to see whether it can reach the $3,500 goal or not – anything might happen.

To put things in context, the open interest in the ETH monthly options that expire on September 24 now stands at $1.6 billion. As a result, it is expected that both sides will concentrate their efforts over the next week.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of CoinNewsDaily. Every investment and trading move involves risk. You should conduct your own research when making a decision.