United States Treasury Secretary Janet Yellen defended President Joe Biden’s most recent massive spending package while speaking to Bloomberg. Yellen said it’d be „a plus“ for society even if it led to a higher interest rate environment.

If rates inch higher, traders will research the best possible options to market their portfolios. While gold is down about 2.5% year-to-date, Bitcoin (BTC) is up 22% during the exact same time, even after the massive plunge in May.

Bitcoin’s outperformance might not go undetected and many institutional investors are likely to make it part of their portfolio together with gold.

London-based asset management company Ruffer booked a profit of more than $1 billion on a cost of $600 million in Bitcoin. Ruffer’s investment manager Hamish Baillie in a meeting with The Times said the company bought in November and sold its own“last tranche in April.“ Baillie said institutional investors, such as Ruffer, are likely to continue purchasing Bitcoin.

This implies that Bitcoin is likely to attract huge institutional interest at reduced levels, which might act as a strong flooring. The bigger the purchases by institutions at reduced prices, the higher the price is likely to rally throughout the next bull phase.

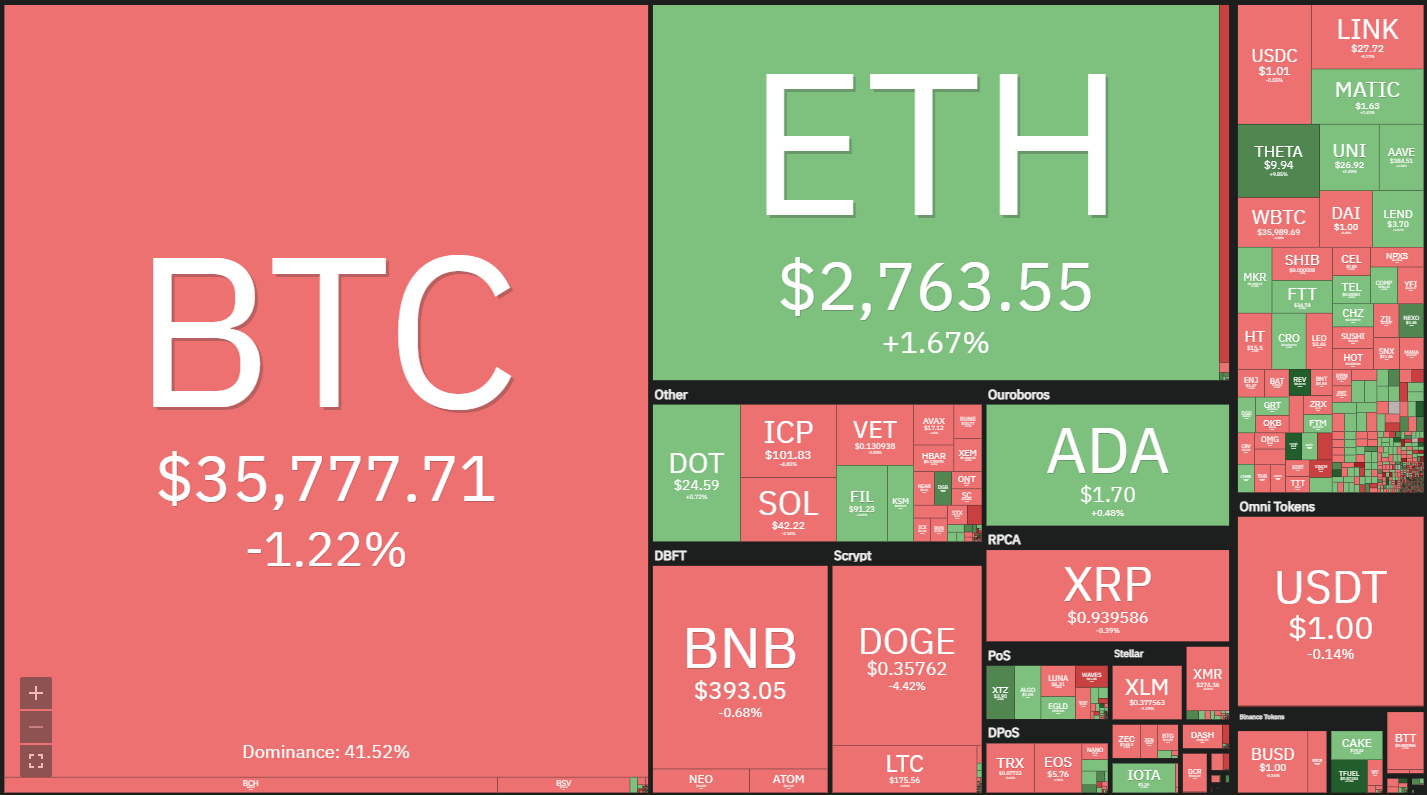

Let’s analyze the graphs of this top-10 cryptocurrencies to determine their next potential trending move.

BTC/USDT

Bitcoin dropped to the trendline of this symmetrical triangle on June 5 but the bears could not break this service. The bulls successfully defended the trendline for the past two days and are trying a rebound it off today.

The buyers will need to push the purchase price above the resistance line of the triangle to gain the upper hand. Should they have the capacity to do that, the BTC/USDT pair could extend the aid rally to the 50-day simple moving average ($46,784). A breakout and close above the 50-day SMA will be the first indication that the downtrend could be finishing.

On the other hand, the downsloping moving averages and also the relative strength index (RSI) from the negative land suggest advantage to the bears.

In the event the purchase price turns down in the current level or the overhead resistance and breaks beneath the triangle, the set could witness panic selling. That will pull the purchase price down to the crucial support zone at $30,000 to $28,000.

ETH/USDT

Ether (ETH) switched down in the resistance line of the symmetrical triangle on June 4 but the shallow correction indicates the bulls are buying on dips. The price has risen back above the 20-day exponential moving average ($2,743) and the bulls are hard the resistance line of the triangle.

If buyers propel the purchase price above the triangle and the 50-day SMA ($2,918), it will suggest the beginning of a rally to the 61.8% Fibonacci retracement level at $3,362.72. This degree may behave as stiff opposition but if the bulls detain the next decline above the 20-day EMA, it will suggest the downtrend might be finished.Contrary to the assumption, if the purchase price turns down in the current level and slides under $2,550, the ETH/USDT pair could drop to the service line of the triangle. A bounce off this service can extend the stay of the set within the triangle.The first indication of weakness will be a break and close below the service line of the triangle. Such a move could clear the path for a decrease to $2,180.53 and $1,728.74.

BNB/USDT

Binance Coin (BNB) turned down from $433 on June 4 and the bears thwarted another effort from the bulls to clean the resistance on June 5. This implies the bears are aggressively defending the $433 level.

Even though the price traded under the 20-day EMA ($398) for the past two days, the bears could not sink the BNB/USDT set to the trendline. This implies that bulls might be regrouping to create another assault at the $433 level.If buyers succeed in driving the price above this resistance, the BNB/USDT pair could rally to the 50-day SMA ($492) and to the 78.6% retracement level at $589.04.Alternatively, if the purchase price turns down in the current level or the overhead resistance and falls under $365, the set may correct to the trendline. A break below this service will suggest the bears are back in the game.

ADA/USDT

Cardano (ADA) turned down from $1.88 on June 3 but the bulls haven’t allowed the price to sustain beneath the 20-day EMA (1.67). This implies the opinion is turning positive and the bulls are buying on dips to the 20-day EMA.

The buyers will finally have to push the purchase price above $1.94 to gain the upper hand. If that occurs, the ADA/UDST pair could muster to the all-time high at $2.47. A breakout and close above this resistance will suggest the beginning of the next leg of this uptrend.Contrary to the assumption, if the purchase price turns down in the overhead resistance, it will suggest competitive selling at higher levels. That could keep the set range-bound involving the 50-day SMA ($1.56) and $1.94 to get a couple of days.The first indication of weakness will be a break under $1.33. That could open the doors to get a further slide to $1.

DOGE/USDT

Dogecoin (DOGE) had shaped a Doji candlestick pattern on June 6 and 5 near the 20-day EMA ($0.37), signaling indecision one of the bulls and the bears.

If bears sink the purchase price under $0.35, the DOGE/USDT pair could drop to the neckline of a large head and shoulders pattern. A breakdown and close under the neckline will be a huge negative as that could increase the prospect of a drop to $0.10.

On the other hand, the moving averages are flat and the RSI is only below the midpoint, signaling a couple of days of range-bound action. In the event the purchase price turns out in the neckline, the set could grow to $0.47 and remain stuck between those levels for a couple of days.

A breakout and close above $0.47 will be the first sign of strength. It will clear the path for a northward march toward $0.59.

XRP/USDT

XRP’s price is becoming squeezed between the 20-day EMA ($1.03) and $0.88 for the past couple of days. The downsloping moving averages and the RSI under 44 signify advantage to the bears.

In the event the purchase price turns down in the current level or the 20-day EMA and breaks under $0.88, the XRP/USDT pair could drop to $0.79 then to the May 23 low at $0.65.

This negative opinion will probably invalidate if the bulls propel the purchase price above $1.10. If that occurs, the pair could rally to the 50-day SMA ($1.23) then to the downtrend line.

This is a significant resistance to be on the lookout for as a break above it will suggest the downtrend is finished.

DOT/USDT

Polkadot (DOT) was trading within an ascending channel for the last couple of days. The altcoin is trying to bounce off the trendline of this station and rise above the overhead resistance at $26.50.

If that occurs, the DOT/USDT pair could climb to the 50-day SMA ($31.68) then to the opposition line of the station. In the event the purchase price turns down in the resistance line, then the set will continue to exchange within the station.

However, if the bulls push the price above the station, the momentum can select up. That will also suggest an end to this downtrend.

Conversely, if the purchase price turns down in the 20-day EMA or the 50-day SMA, it will suggest that dealers are selling on rallies to the moving averages. A break below the trendline of this station will increase the prospect of a drop to $18.41 and then to $15.

UNI/USDT

Uniswap (UNI) switched down in the 20-day EMA ($27.64) on June 4 but the bulls didn’t allow the price to drop below $25. This implies a positive opinion because traders are not waiting to get a deeper correction to purchase.

This degree might again function as a stiff resistance.

However, if the bulls detain the next decline in the 20-day EMA, it will suggest the opinion has turned positive. This will enhance the prospects of a rally to the 78.6% retracement level at $38.15.

This bullish perspective will invalidate if the purchase price turns down and plummets under $21.50. This type of move will suggest the bears have overpowered the bulls.

ICP/USDT

Internet Computer (ICP) is struggling to rebound off the 103.71 service for the past two days, which suggests a lack of buyers even at those levels. This increases the likelihood of a break under the support.

If that occurs, the ICP/USDT pair could drop to the all time low in $86.01. This is a significant support to be on the lookout for because if this degree cracks, the set could extend its decrease to $60.The negative opinion will invalidate if the purchase price turns out in the current level and rises above $120. That will indicate powerful purchasing at lower prices. A break above $136.60 will open the door to get a rally for $168.

BCH/USDT

Bitcoin Cash (BCH) is currently trading involving the downtrend line and the service in $616.04. The downsloping 20-day EMA ($747) and the RSI from the negative zone suggest bears have the top hand.

In the event the price falls under the $616.04 service, the bears will try to pull the purchase price down to the May 23 service at $468.13. This is a significant support to be on the lookout for because if it cracks, the decrease could extend to $400.Conversely, if the purchase price turns out in the current level and breaks above the 20-day EMA, it will suggest buyers are trying to make a comeback. The BCH/USDT pair could then muster to the 50-day SMA ($930).

The views and opinions expressed here are only those of the author and do not necessarily reflect the views of Cointelegraph. Every single investment and trading movement involves danger. You should conduct your own research after making a determination.

Market data is provided by HitBTC exchange.